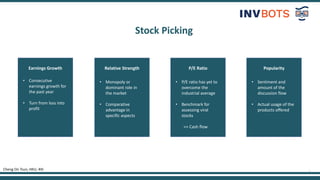

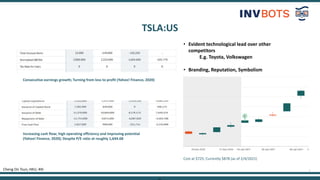

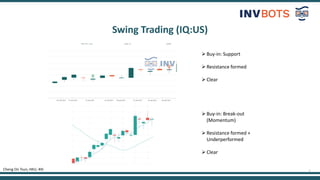

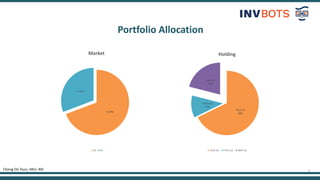

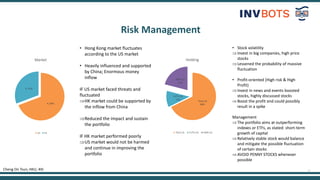

Cheng On Tsun from HKU had the 4th highest trading score. His portfolio consisted of 3 US stocks - Tesla (TSLA), Futu Holdings (FUTU), and GameStop (GME). He employed swing trading and momentum trading strategies, rebalancing his portfolio weekly. While his portfolio emphasized short-term growth, he aimed to mitigate risks through diversification across industries and markets.