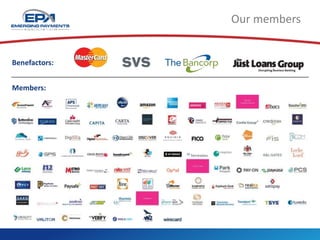

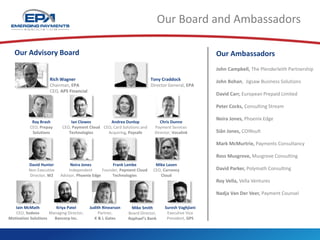

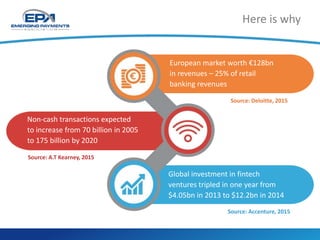

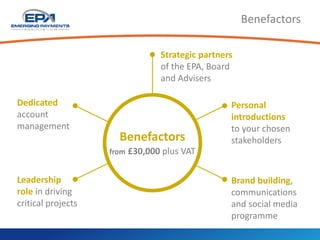

The document summarizes an organization called the Emerging Payments Association (EPA) which aims to connect, collaborate and educate members of the payments industry. The EPA offers different membership levels - Benefactors, Patrons, and Members - with each providing various benefits like marketing support, event access, and introductions to stakeholders. The payments industry is undergoing disruption due to factors like changing consumer preferences, regulatory intervention, and technological innovation.