Energy Outlook.

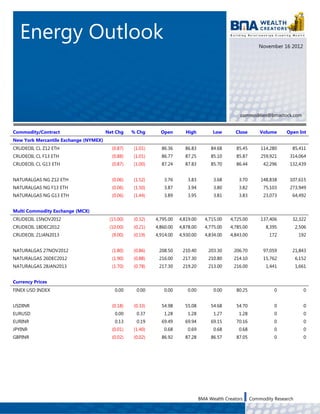

- 1. Energy Outlook November 16 2012 cvdc commodities@bmastock.com Commodity/Contract Net Chg % Chg Open High Low Close Volume Open Int New York Mercantile Exchange (NYMEX) CRUDEOIL CL Z12 ETH (0.87) (1.01) 86.36 86.83 84.68 85.45 114,280 85,411 CRUDEOIL CL F13 ETH (0.88) (1.01) 86.77 87.25 85.10 85.87 259,921 314,064 CRUDEOIL CL G13 ETH (0.87) (1.00) 87.24 87.83 85.70 86.44 42,296 132,439 NATURALGAS NG Z12 ETH (0.06) (1.52) 3.76 3.83 3.68 3.70 148,838 107,615 NATURALGAS NG F13 ETH (0.06) (1.50) 3.87 3.94 3.80 3.82 75,103 273,949 NATURALGAS NG G13 ETH (0.06) (1.44) 3.89 3.95 3.81 3.83 23,073 64,492 Multi Commodity Exchange (MCX) CRUDEOIL 15NOV2012 (15.00) (0.32) 4,795.00 4,819.00 4,715.00 4,725.00 137,406 32,322 CRUDEOIL 18DEC2012 (10.00) (0.21) 4,860.00 4,878.00 4,775.00 4,785.00 8,395 2,506 CRUDEOIL 21JAN2013 (9.00) (0.19) 4,914.00 4,930.00 4,834.00 4,843.00 172 192 NATURALGAS 27NOV2012 (1.80) (0.86) 208.50 210.40 203.30 206.70 97,059 21,843 NATURALGAS 26DEC2012 (1.90) (0.88) 216.00 217.30 210.80 214.10 15,762 6,152 NATURALGAS 28JAN2013 (1.70) (0.78) 217.30 219.20 213.00 216.00 1,441 1,661 Currency Prices FINEX USD INDEX 0.00 0.00 0.00 0.00 0.00 80.25 0 0 USDINR (0.18) (0.33) 54.98 55.08 54.68 54.70 0 0 EURUSD 0.00 0.37 1.28 1.28 1.27 1.28 0 0 EURINR 0.13 0.19 69.49 69.94 69.15 70.16 0 0 JPYINR (0.01) (1.40) 0.68 0.69 0.68 0.68 0 0 GBPINR (0.02) (0.02) 86.92 87.28 86.57 87.05 0 0 BMA Wealth Creators Commodity Research

- 2. Energy Outlook Correlation Matrix Commodity Gold Spot Silver Spot Dow Jones Indus. Avg WTI Crude Oil Dollar Index Spot Gold Spot 1.000 0.761 0.064 0.284 (0.328) Silver Spot 0.761 1.000 0.245 0.458 (0.408) Dow Jones Indus. Avg 0.064 0.245 1.000 0.517 (0.562) WTI Crude Oil 0.284 0.458 0.517 1.000 (0.471) Dollar Index Spot (0.328) (0.408) (0.562) (0.471) 1.000 Commodity WTI Crude Oil Natural Gas Future Dollar Index Dow Jones Indus. AVG WTI Crude Oil 1.000 0.179 (0.471) 0.517 Natural Gas Future 0.179 1.000 (0.045) 0.056 Dollar Index (0.471) (0.045) 1.000 (0.562) Dow Jones Indus. AVG 0.517 0.056 (0.562) 1.000 Fundamental Outlook US Crude Oil futures eased on Thursday, on concern over a growing stockpile surplus and weaker economic data from the world top consumer of oil. The most actively traded Crude Oil contract tested a low of $84.68 before settling at $85.45, fell more than a percent or 87 cents per barrel on New York Mercantile Exchange while domestic Oil prices declined marginal despite a stronger rupee against the dollar which appreciated 0.33% or 18 paise to close at Rs 54.70. MCX Crude Oil futures moved down 15 points or 0.32% to close at Rs 4725.00 after having tested a high of Rs 4819.00. NYMEX Oil prices were trading lower in the earlier session on the hopes of increase in inventory and greater number of US Jobless Claims. US Department of Labor showed that Initial Jobless Claims climbed 78,000 to 439,000 numbers, much weaker than the expectation of 372,000 numbers. US DOE showed that Crude Oil Inventories rose for the second week by 1.1 million barrels. Data from the Energy Information Administration showed Crude Oil stocks rose but little lesser than the market expectation of +2.5 million barrels in the week ended November 09. US Crude Oil stocks also hit a three years high last week and 13.4% above the five year average. It also seen that market is overlooked the Middle East tension on last day but still on track as the traders are looking the situation nervously. Front month Natural Gas futures closed lower and reversed a three days rally despite a decline in Natural Gas Storage which was the first withdrawal in US Gas Storage since March 15, 2012. NYMEX Natural Gas closed lower by 1.52% or 6 cents to $3.70 after having a tested a high of $3.83 per mmBtu while MCX Natural Gas prices tested a high of Rs 210.40 before settling at Rs 206.70. In the earlier session Natural Gas prices were trading lower on the back of cooler weather but after the release of US Natural Gas Storage prices moved lower and closed in negative territory. EIA Natural Gas storage decreased 18 billion cubic feet against -13 billion cubic feet of market forecast. BMA Wealth Creators Commodity Research

- 3. Energy Outlook www.facebook.com/bmawealth | www.twitter.com/bmawealth Disclaimer: This document is for private circulation only. Neither the information nor any opinion expressed constitutes an offer, or any invitation to make an offer, to buy or sell any securities or any options, future or other derivatives related to such securities. BMA Wealth Creators Ltd. Or any of its associates or employees doesn’t except any liability whatsoever direct or indirect that may arise from the use of the information herein. BMA Wealth Creators Ltd. and its affiliates may trade for their own accounts as market maker, block positional, specialist and/or arbitrageur in any securities of this issuer (s) or in related investments, may be on the opposite side of public orders. BMA Wealth Creators Ltd. and its affiliates, directors, officers, employees, employee benefit programs may have a long or short position in any securities of this issuer (s) or in related investments no matter content herein may be reproduced without prior consent of BMA Wealth Creators Ltd. While there report has been prepared on the basis of published/other publicly available information considered reliable, we are unable to accept any liability for the accuracy of its contents. BMA Wealth Creators Limited Vishwakarma II, 29-5A, Dr.Ambedkar Sarani, Topsia Road, Kolkata - 700 046 Tel: 033-40110099, www.bmawc.com BMA Wealth Creators Commodity Research