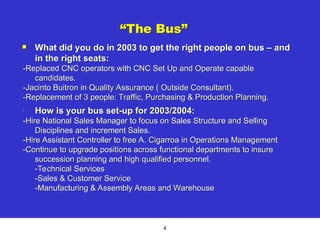

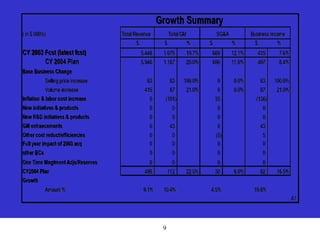

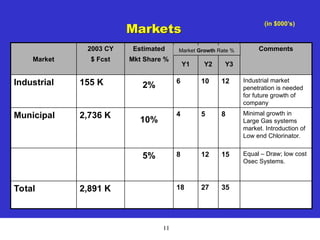

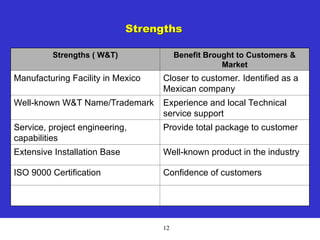

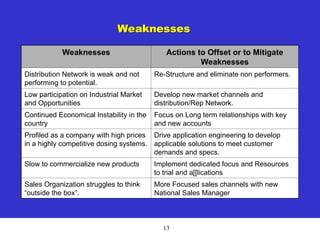

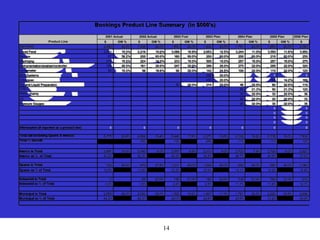

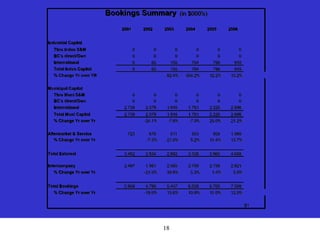

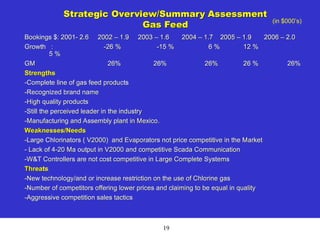

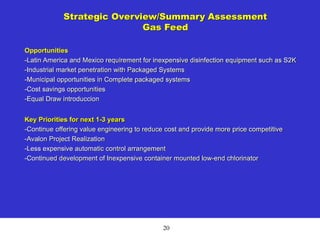

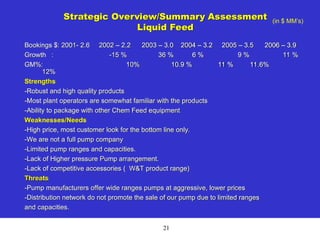

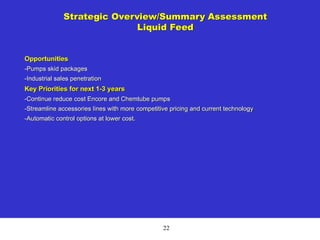

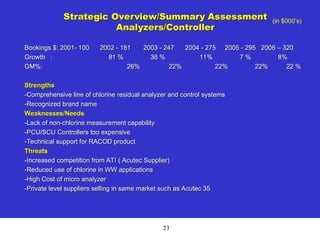

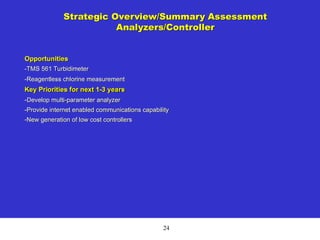

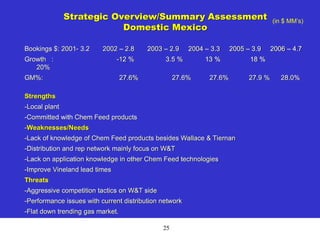

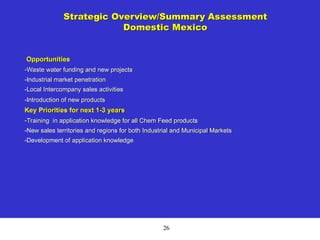

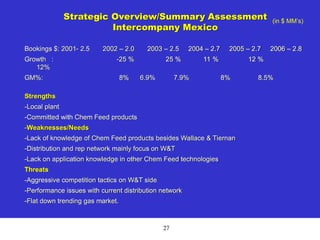

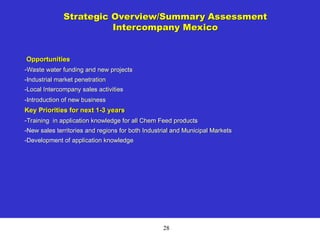

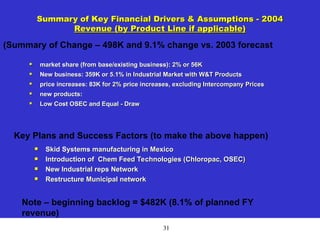

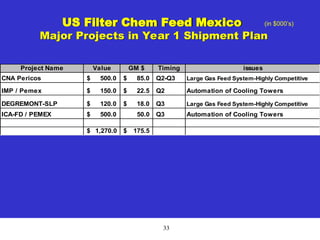

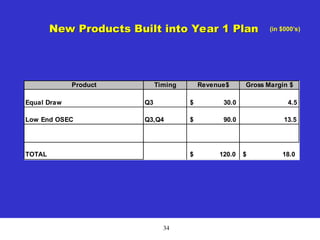

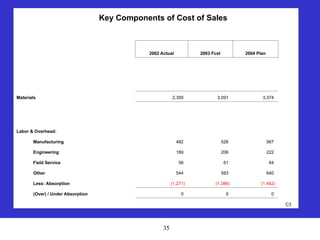

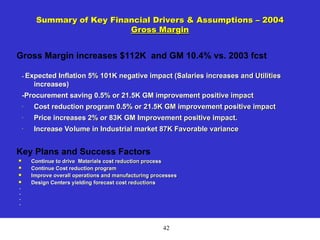

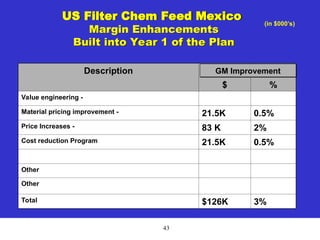

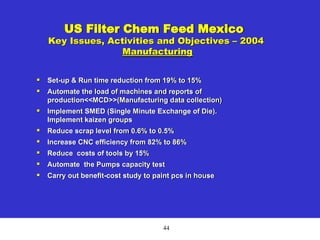

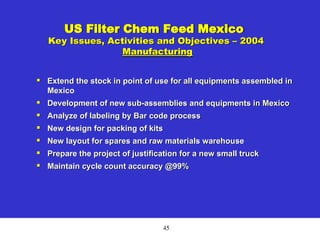

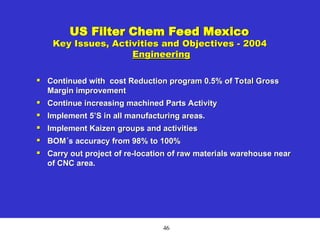

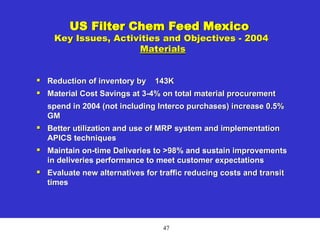

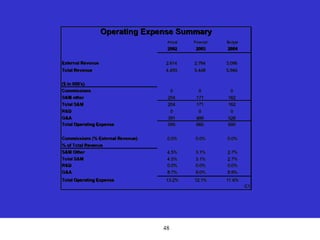

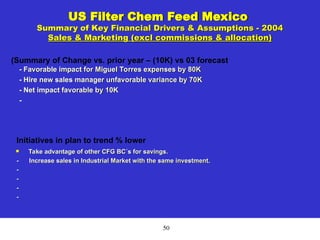

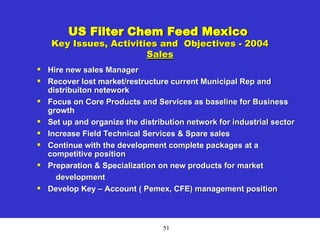

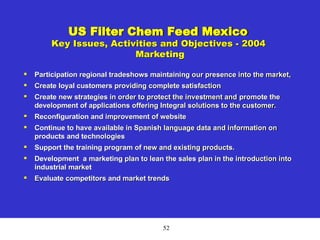

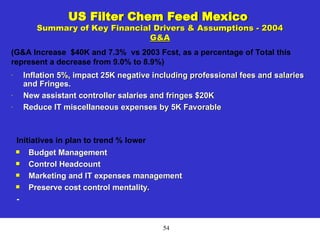

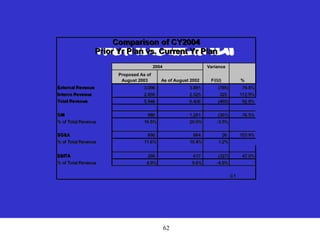

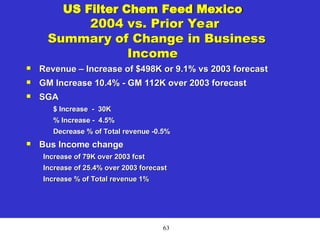

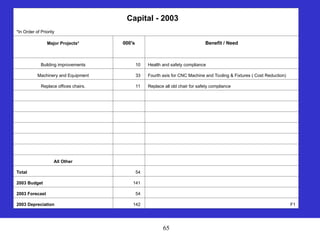

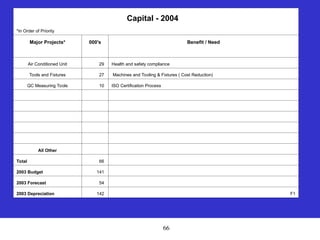

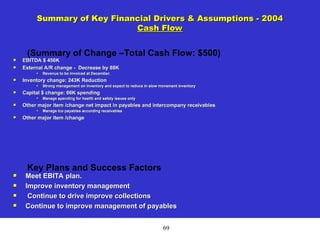

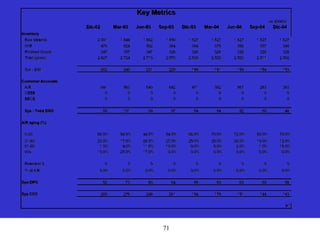

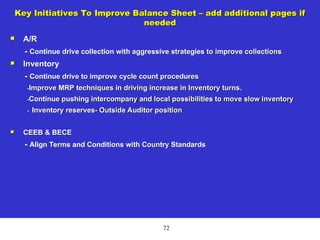

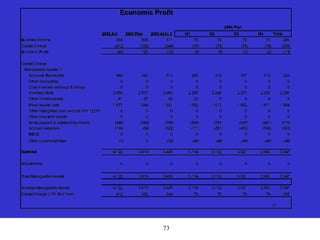

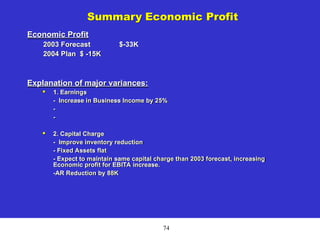

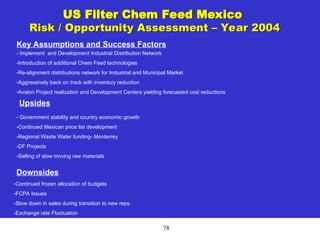

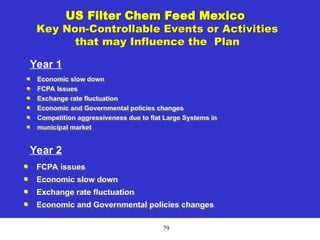

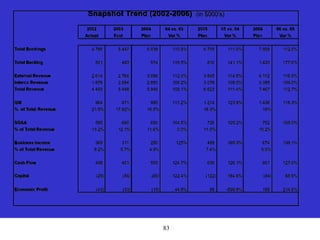

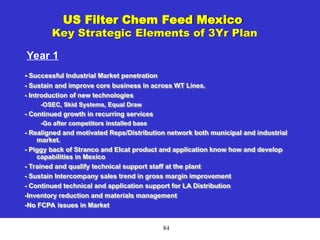

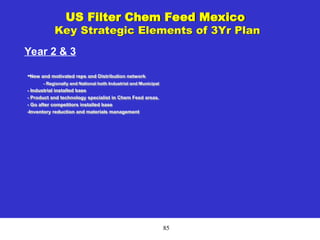

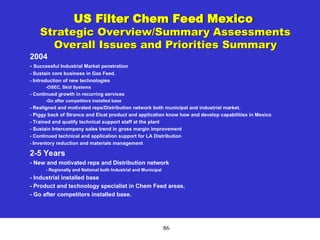

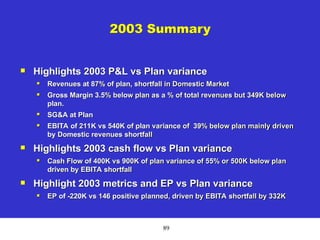

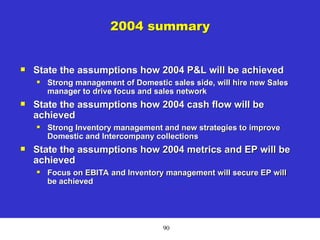

The document outlines a strategic plan for USFilter Chem Feed Mexico for the years 2004-2006, detailing growth summary, business strategies, and financial forecasts. It highlights challenges such as market competition and organizational changes aimed at enhancing operational efficiency and improving customer satisfaction. Key metrics for measuring success include revenue, economic profit, and customer satisfaction rates.