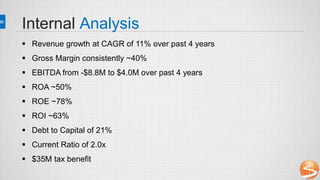

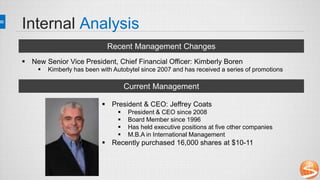

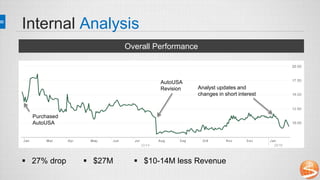

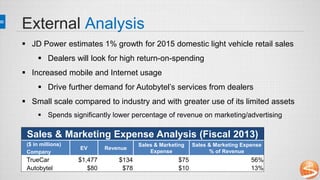

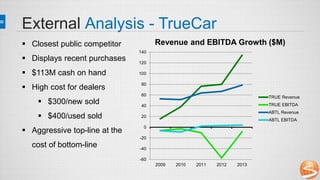

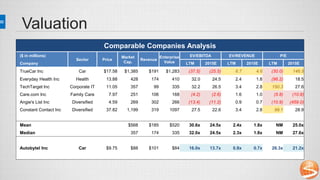

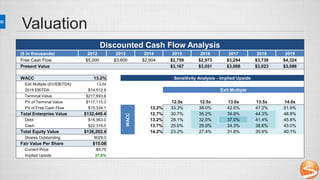

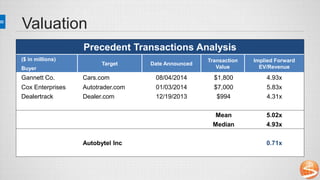

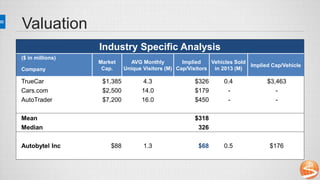

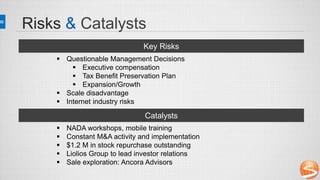

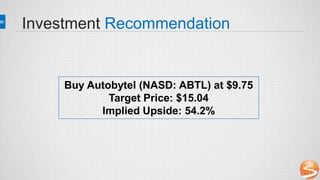

Autobytel Inc operates as a digital automotive marketing services company in the United States. It provides new and used vehicle leads, finance and insurance leads, and dealer analytics and marketing solutions. The company has a market cap of $88 million and trades on the NASDAQ under the ticker ABTL. The analysts recommend buying Autobytel at the current price of $9.75 per share, with a target price of $15.04 based on discounted cash flow and comparable company analyses, implying upside of over 50%. Key risks include management decisions and scale disadvantages versus competitors.