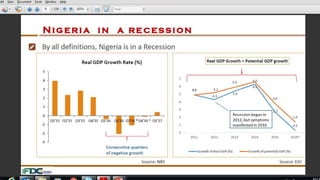

Nigeria is currently in a recession due to several factors:

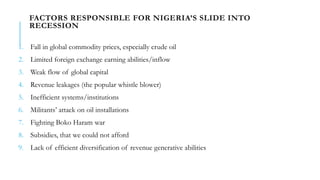

1. Falling global commodity prices, especially for oil which is Nigeria's main export.

2. Limited foreign exchange earnings and inflows as oil revenues have declined.

3. Weak global capital flows.

4. Issues like revenue leakages, inefficient systems, militant attacks on oil installations, and the costs of fighting Boko Haram have exacerbated the recession.

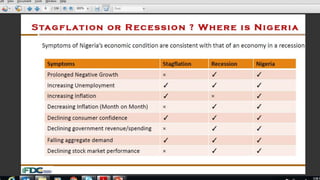

The document then discusses the symptoms of recession Nigeria is experiencing like currency devaluation, low foreign reserves, rising unemployment and companies folding. It provides recommendations on how Nigeria can exit the recession such as expansionary economic policies, institution building, and promoting exports.