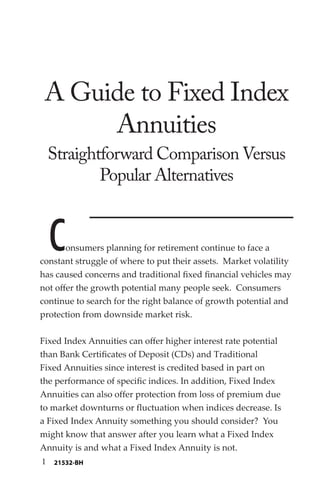

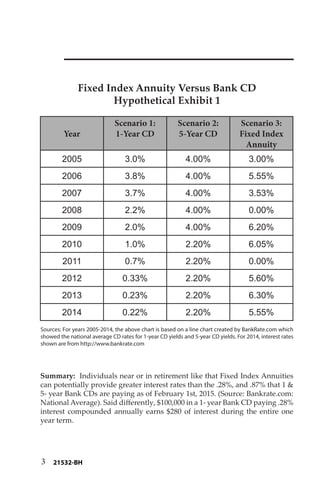

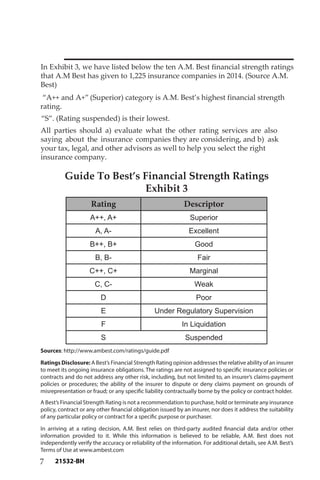

This document provides a summary and comparison of fixed index annuities versus popular alternatives like bank CDs and direct stock market investments. It contains three exhibits that hypothetically demonstrate how fixed index annuities can provide higher growth potential than CDs while also protecting against losses during market downturns. The summary explains that fixed index annuities offer upside potential linked to market indexes while providing downside protections and avoiding risk of losing premiums due to market fluctuations.