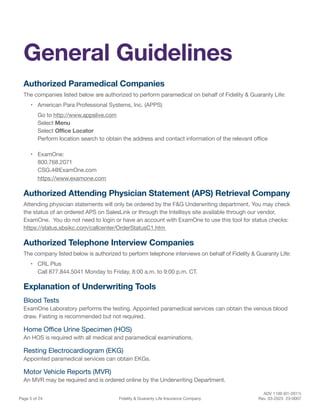

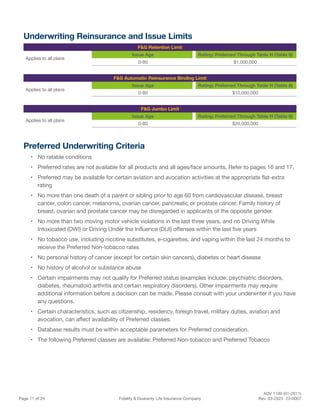

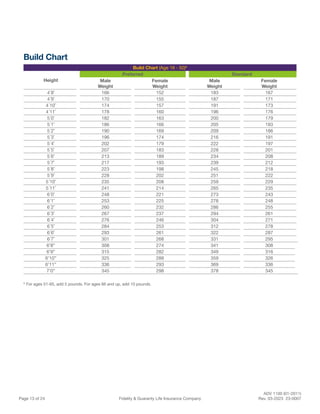

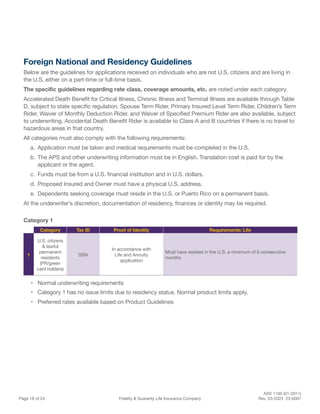

This document provides F&G's general underwriting guidelines. It outlines the authorized medical exam and inspection companies, underwriting tools used like medical exams and reports, requirements that vary by age and amount of coverage, and special considerations for spouses, juveniles, and foreign nationals. The guidelines establish standards and procedures for the risk assessment process to determine an applicant's insurability and appropriate rates.