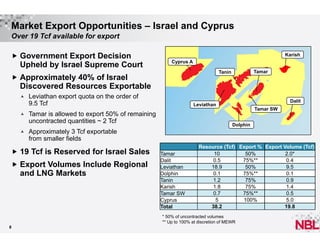

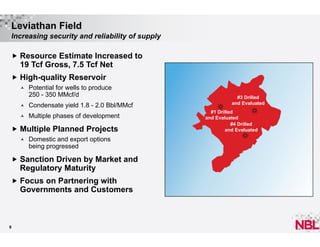

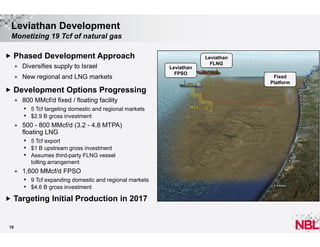

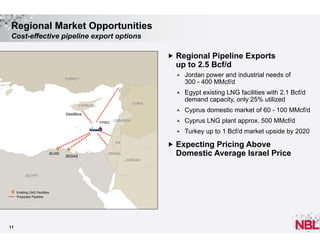

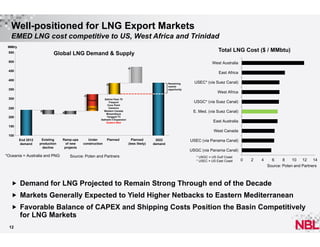

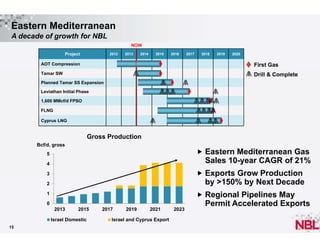

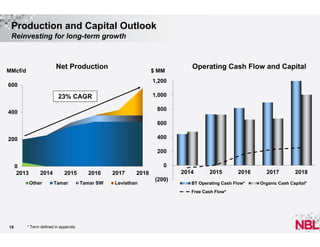

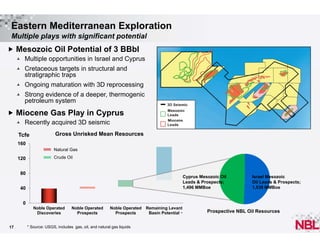

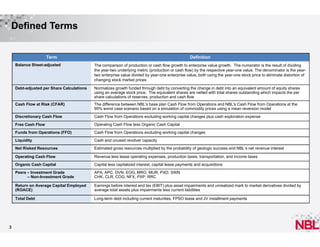

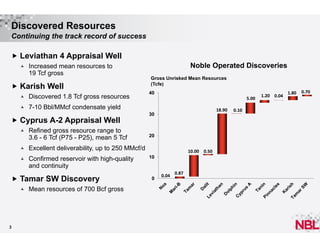

The document discusses Noble Energy's operations and discoveries in the Eastern Mediterranean region, including Israel and Cyprus. It provides resource estimates for fields such as Leviathan (19 Tcf), Tamar (10 Tcf), and Cyprus A-2 (5 Tcf). Demand for natural gas in Israel is growing at 17% annually to 2020 due to power generation, industry, and potential coal plant conversions. Noble is progressing development plans for fields like Leviathan and export opportunities to serve growing regional and LNG markets utilizing over 19 Tcf of identified export volumes.

![Israel Natural Gas Demand Growth

17% CAGR for 2013 - 2018

Israel Natural Gas Consumption

MMcf/d, gross

Historic

2,000

Demand Forecast

1,500

Unmet Demand

Extra Fuel Oil Burned

1,000

500

0

2004

2006

Power

2008

Other

2010

Industry

2012

2014

Coal Conversion [Hadera]

2016

2018

2020

2022

Potential Coal Conversion

Source: Poten and Partners, Israel Electric Corporation, Ministry of Energy and Water Resources, Noble Energy

Additional Domestic Market Opportunities

New desalination plant

Conversion to electric railroad system

7

Compressed Natural Gas for transportation

Methanol production](https://image.slidesharecdn.com/noble-131217124645-phpapp02/85/East-Med-Noble-pdf-9-320.jpg)