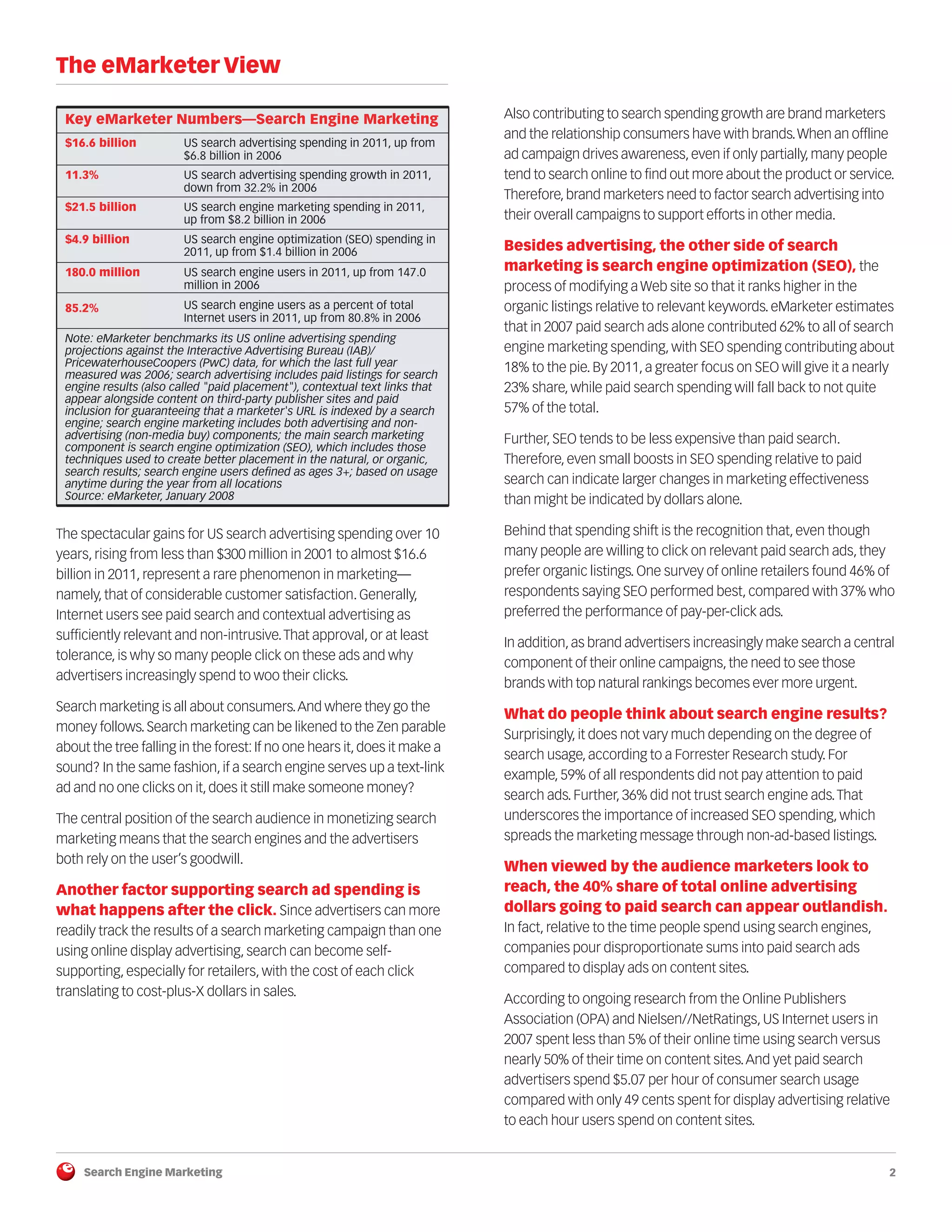

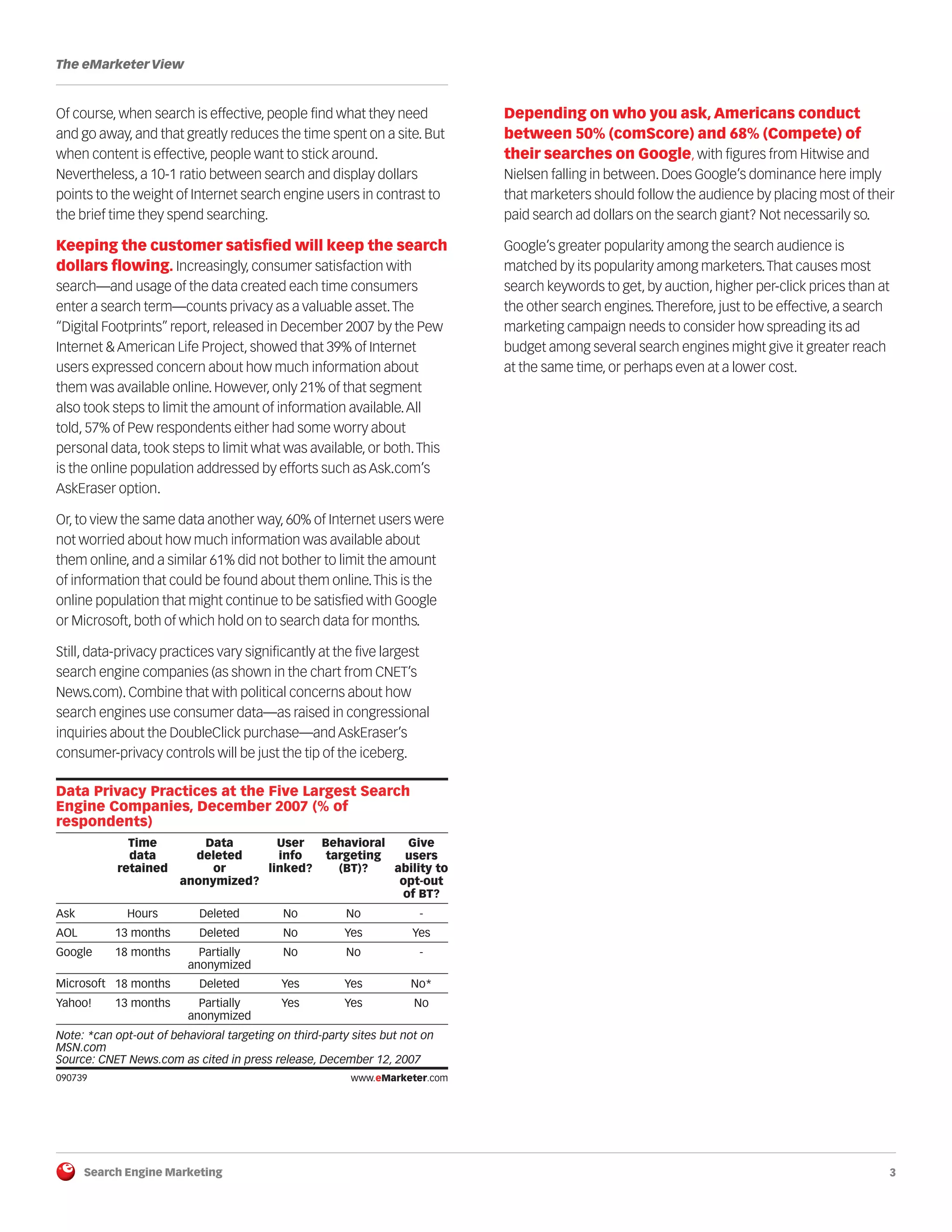

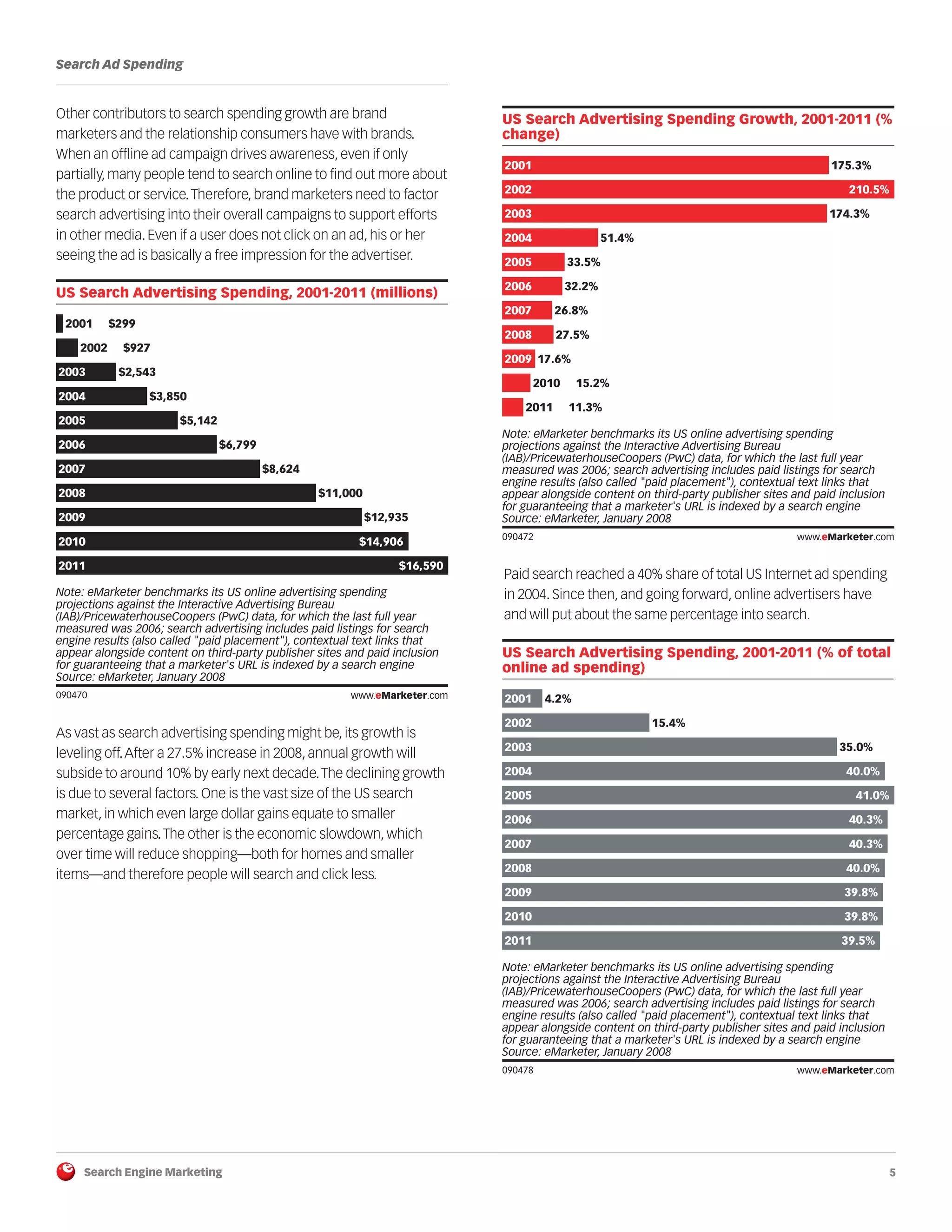

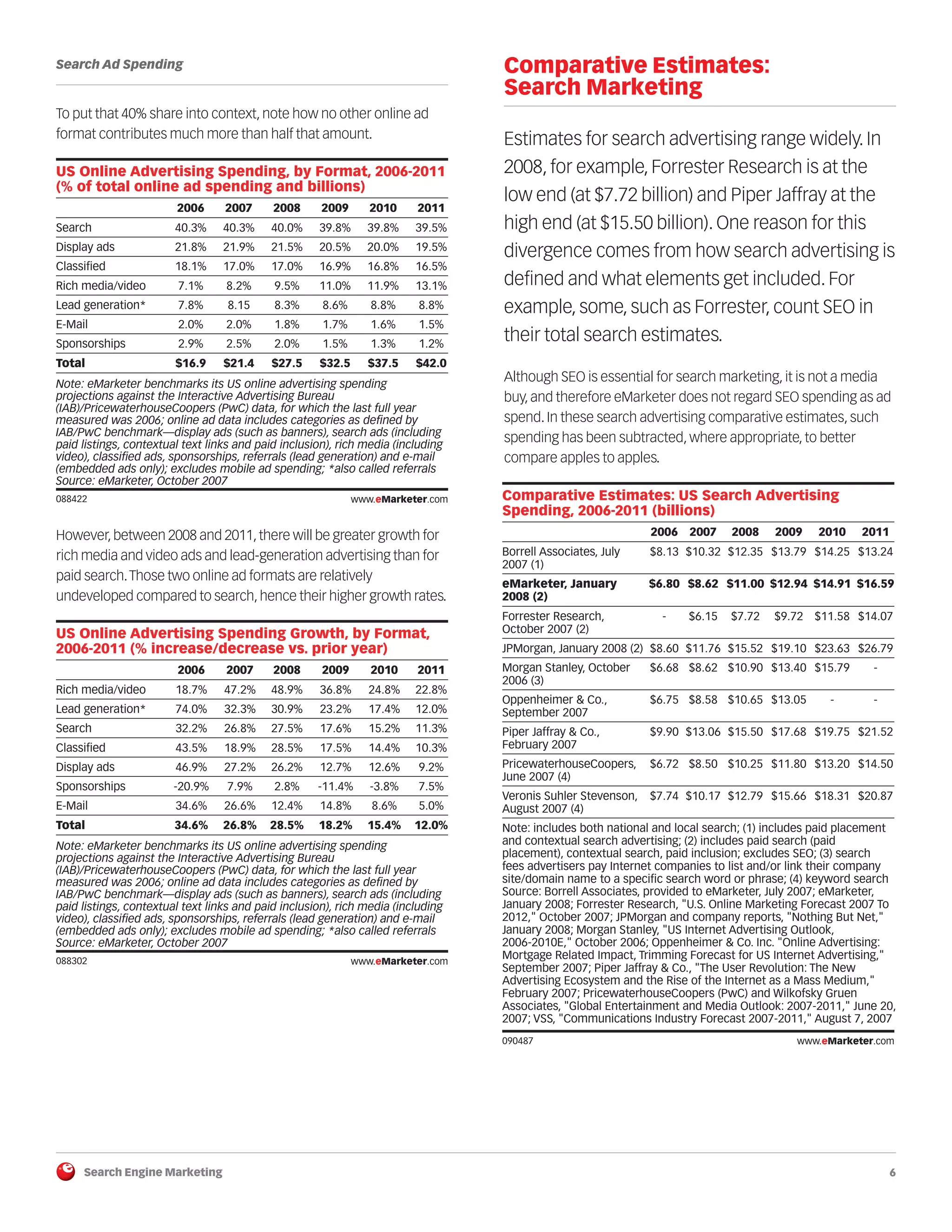

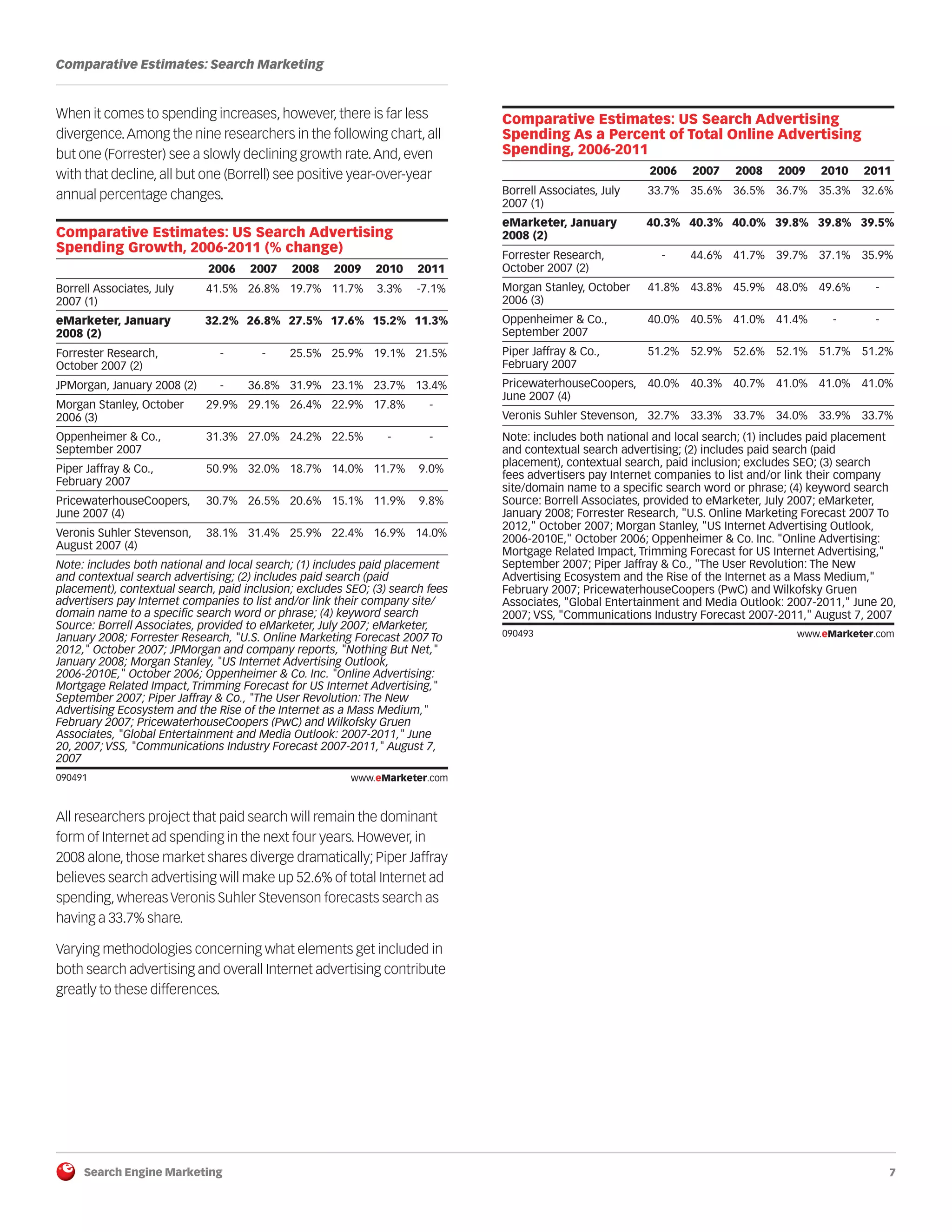

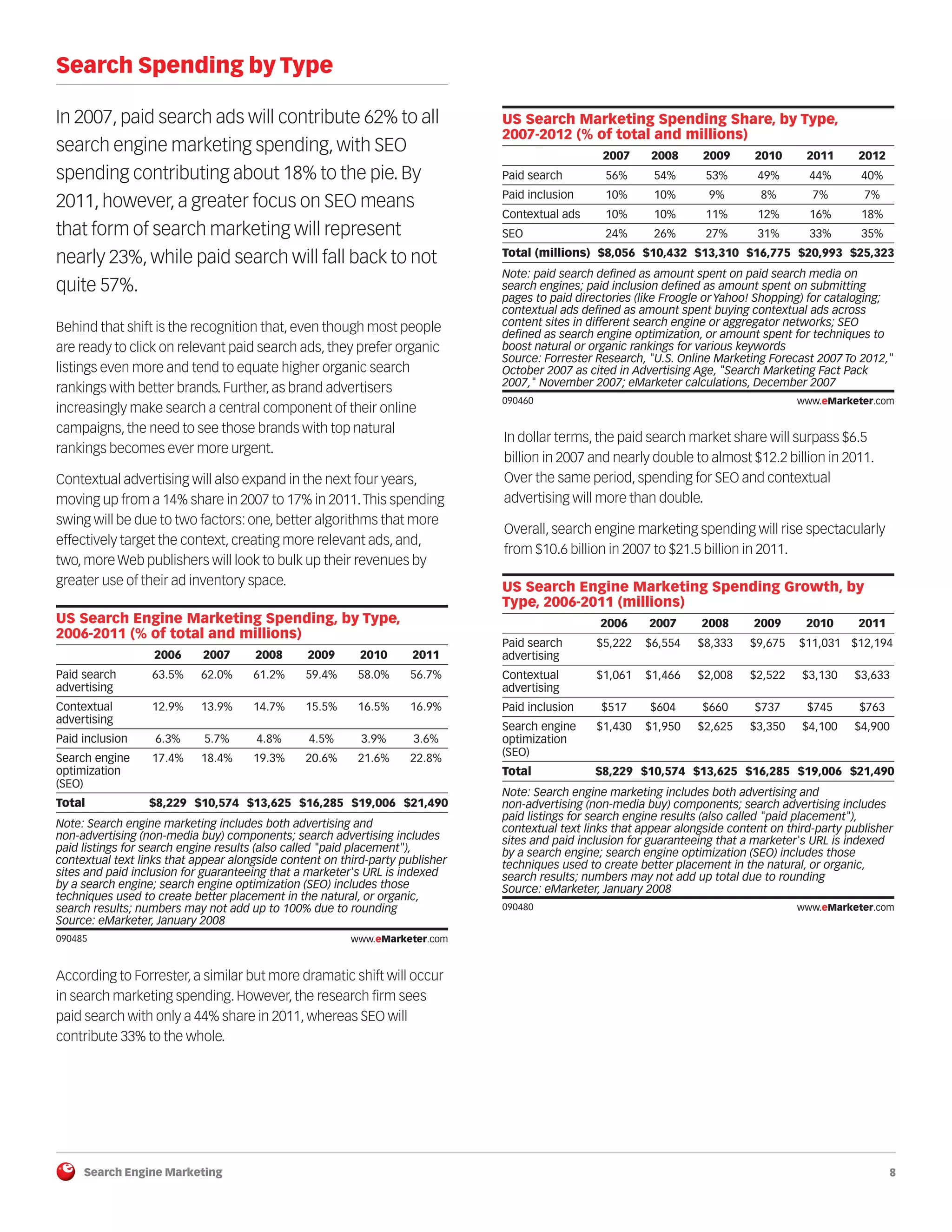

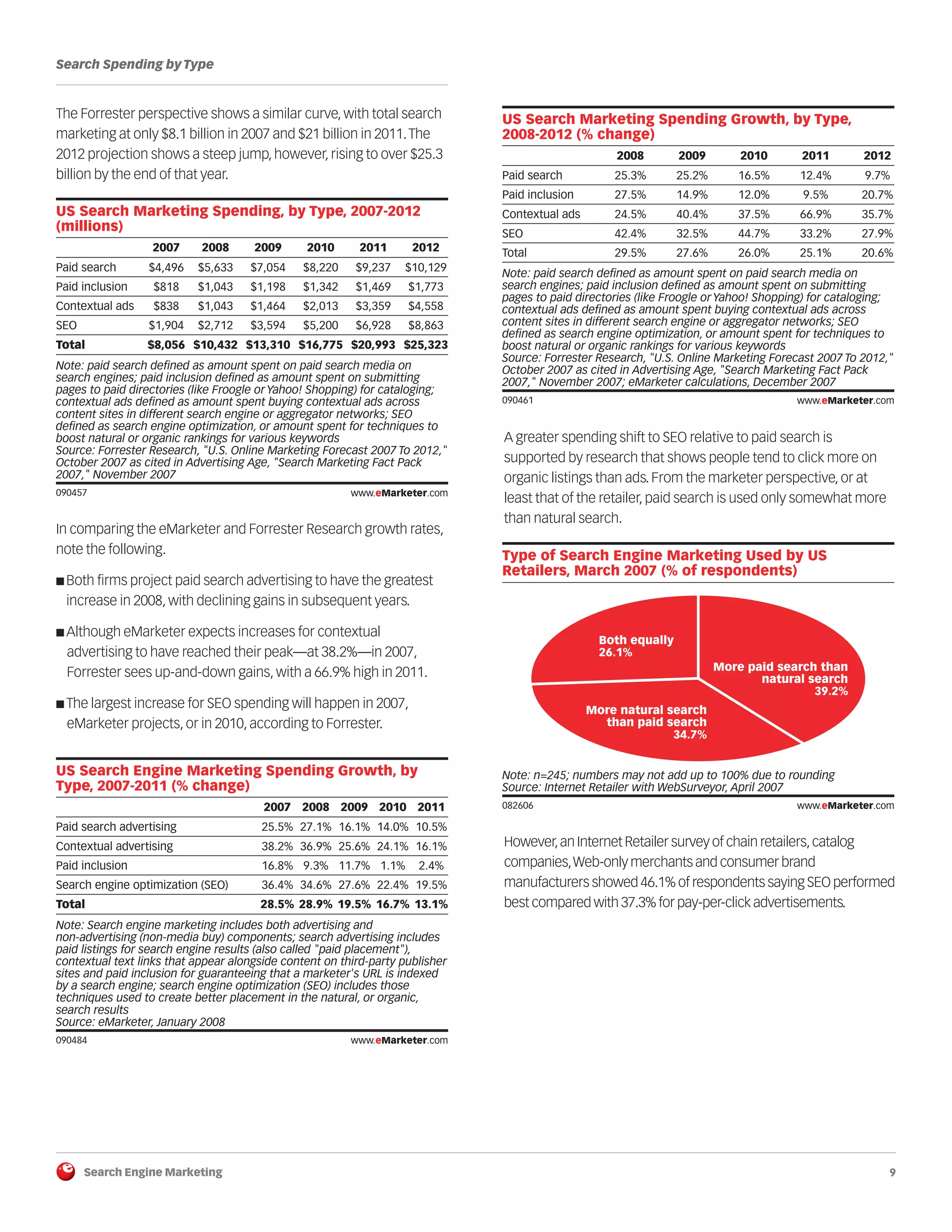

Search engine marketing spending has grown tremendously over the past decade, rising from $299 million in 2001 to an estimated $16.6 billion in 2011 in the US alone. This growth is driven by high customer satisfaction with paid search and contextual ads, which are seen as relevant and non-intrusive. Advertisers are also able to track results effectively. While growth is leveling off, search advertising will continue to make up about 40% of total US online advertising spending going forward.