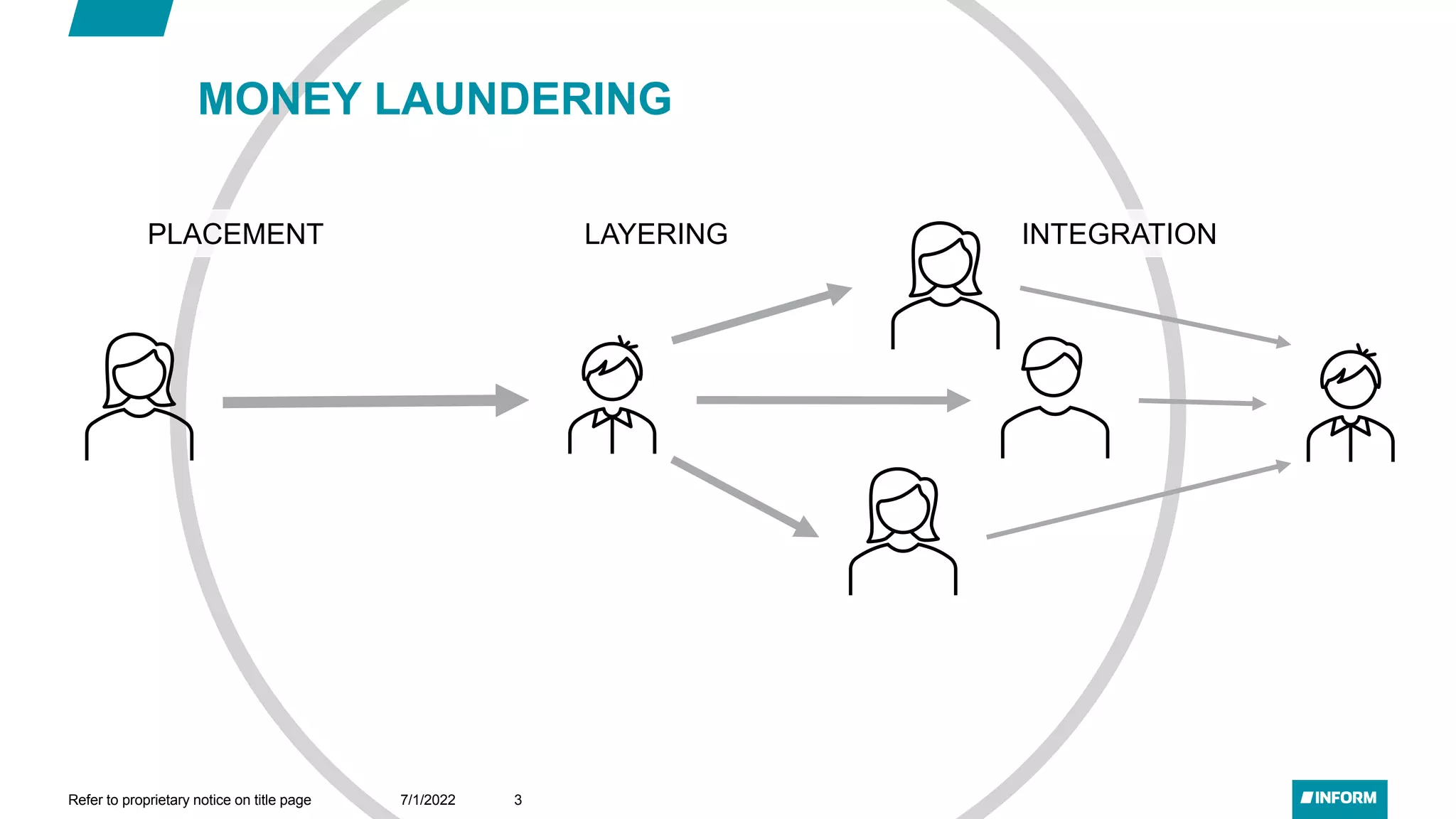

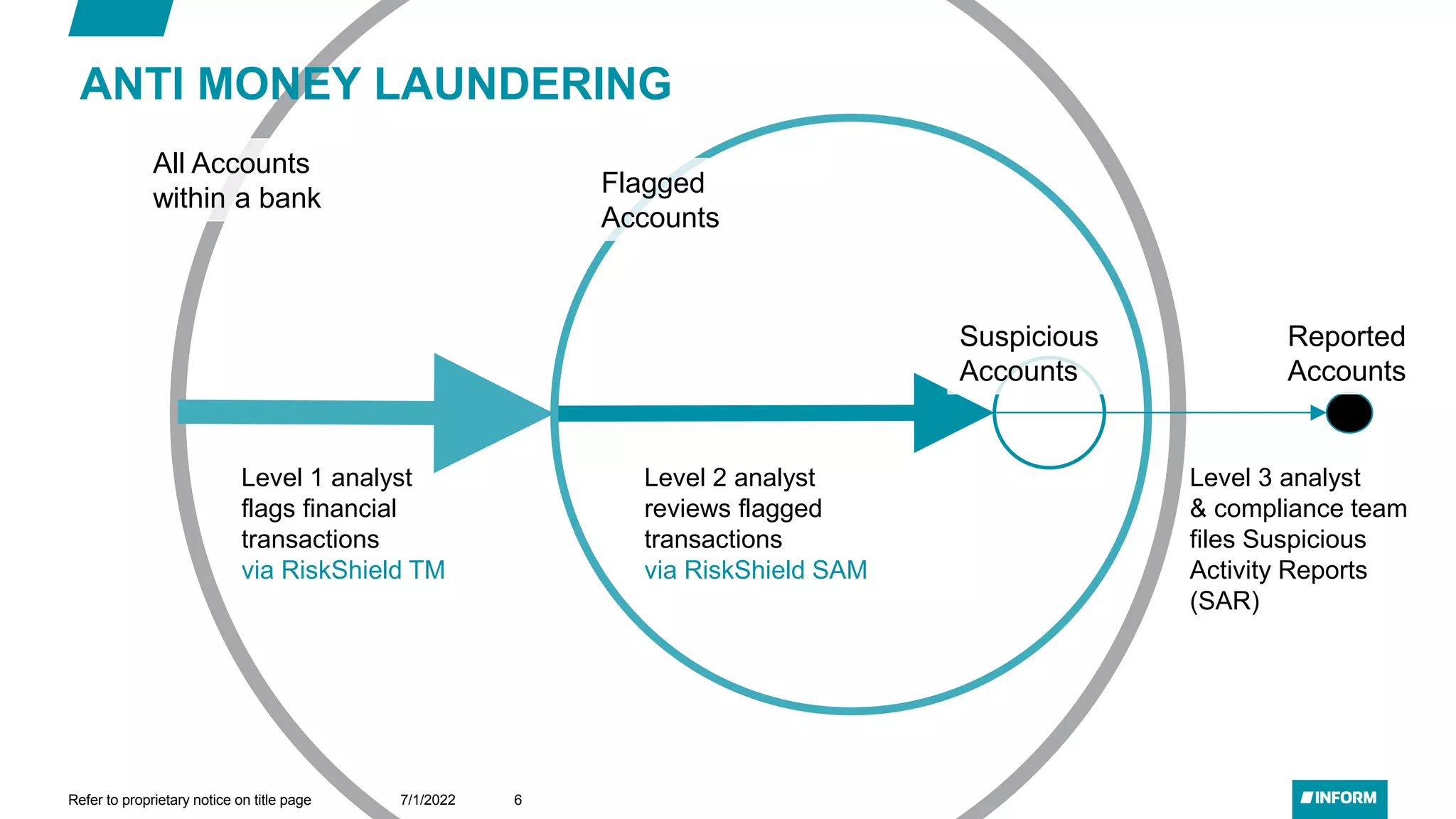

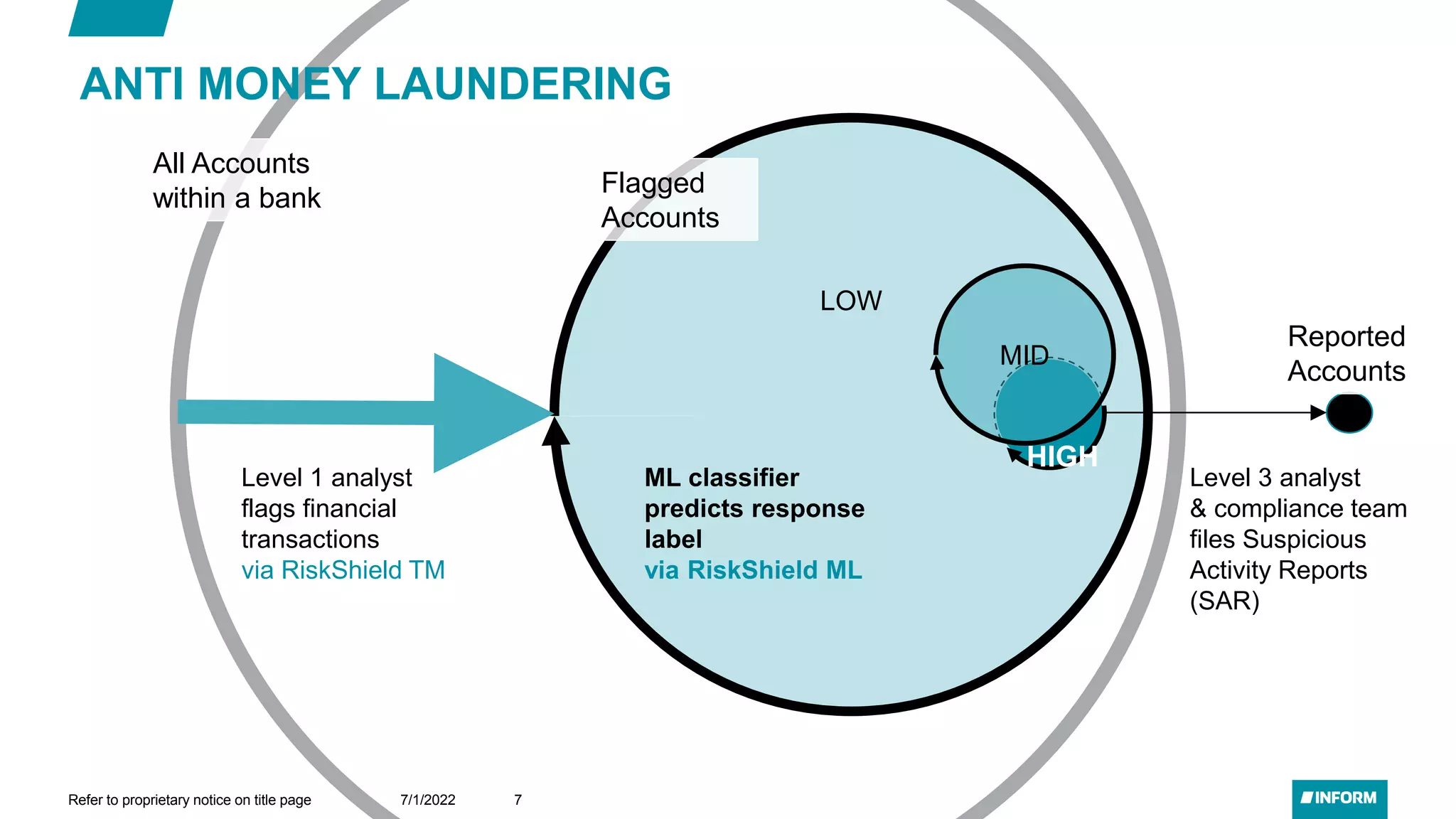

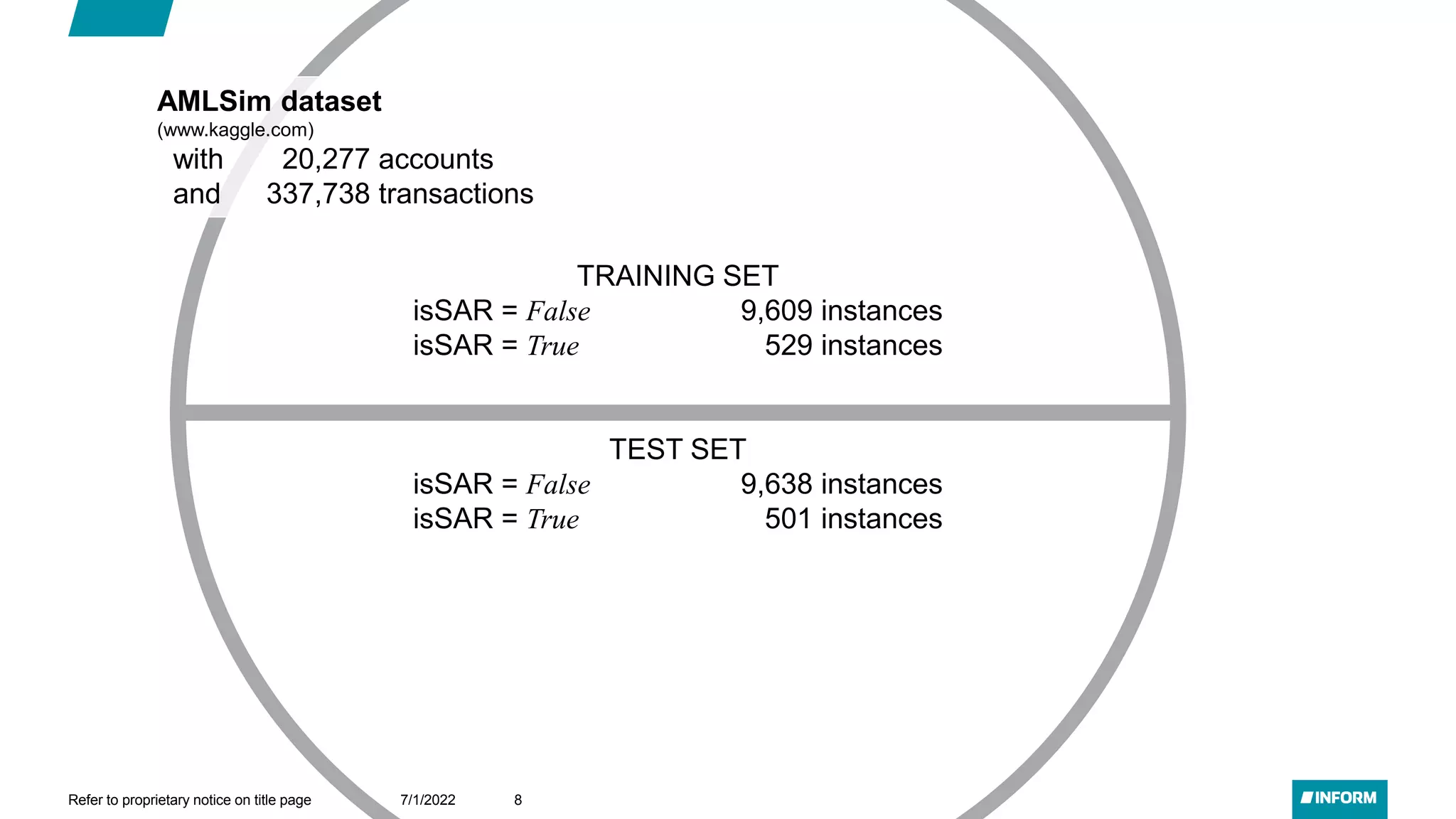

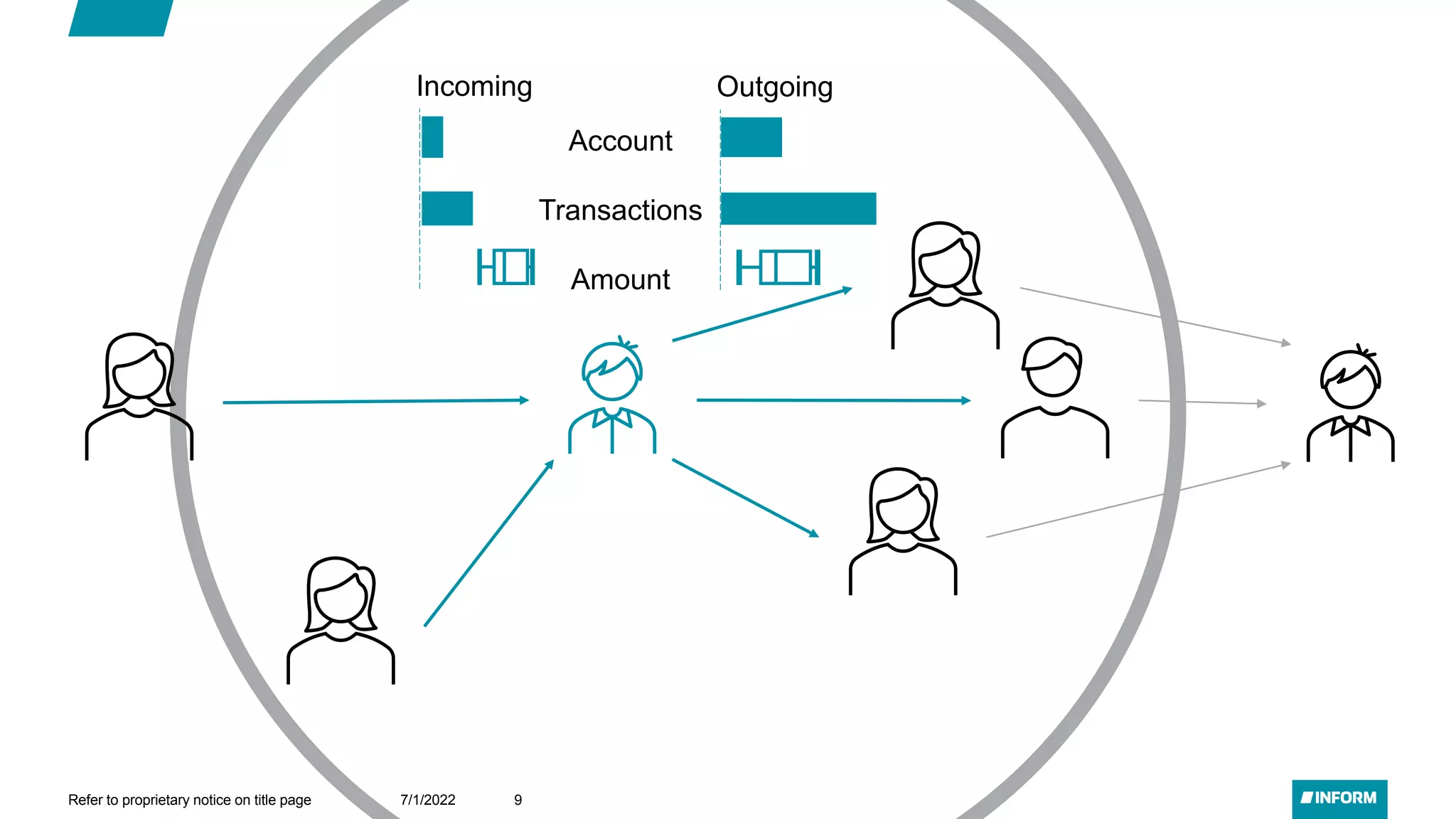

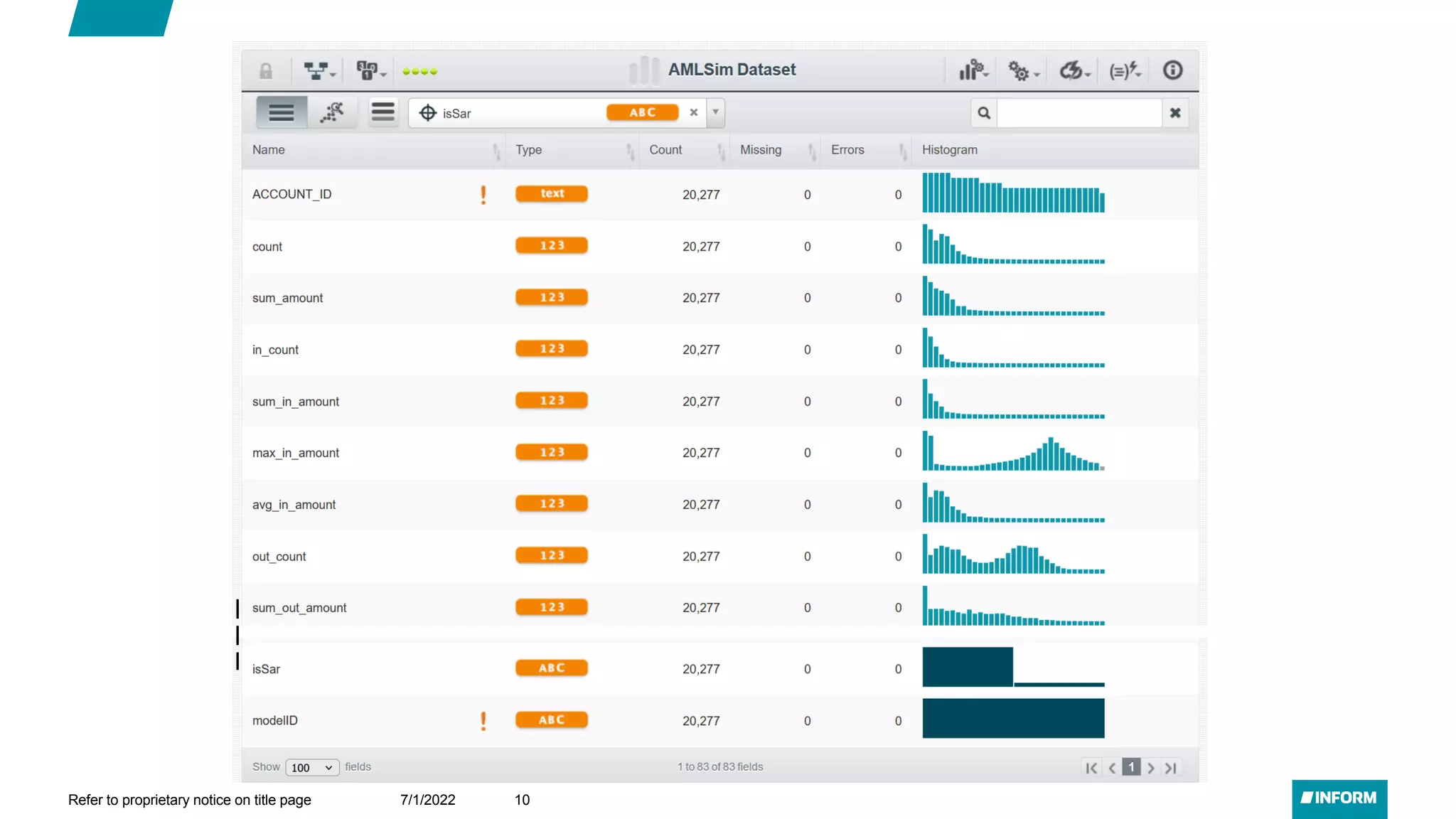

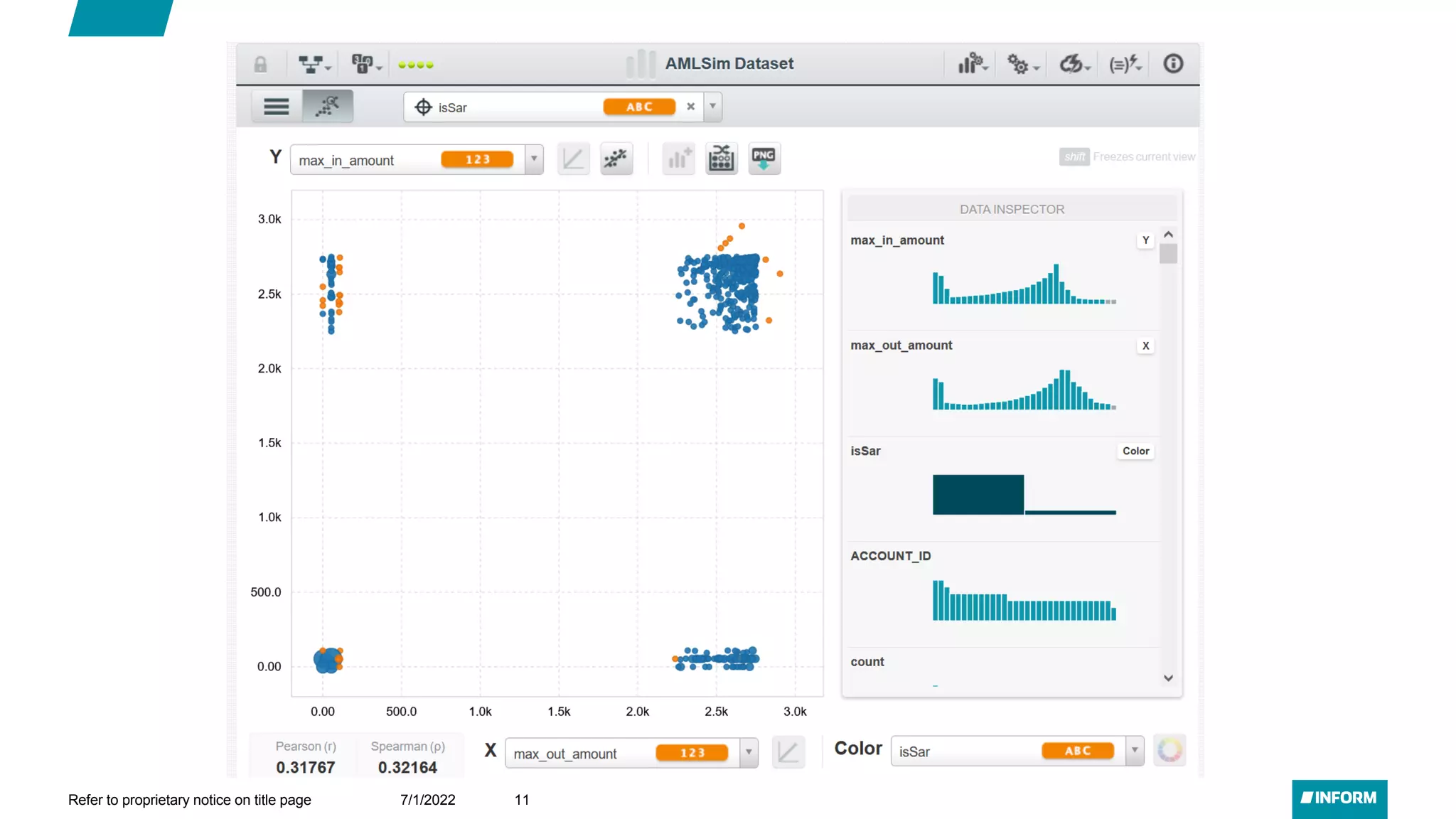

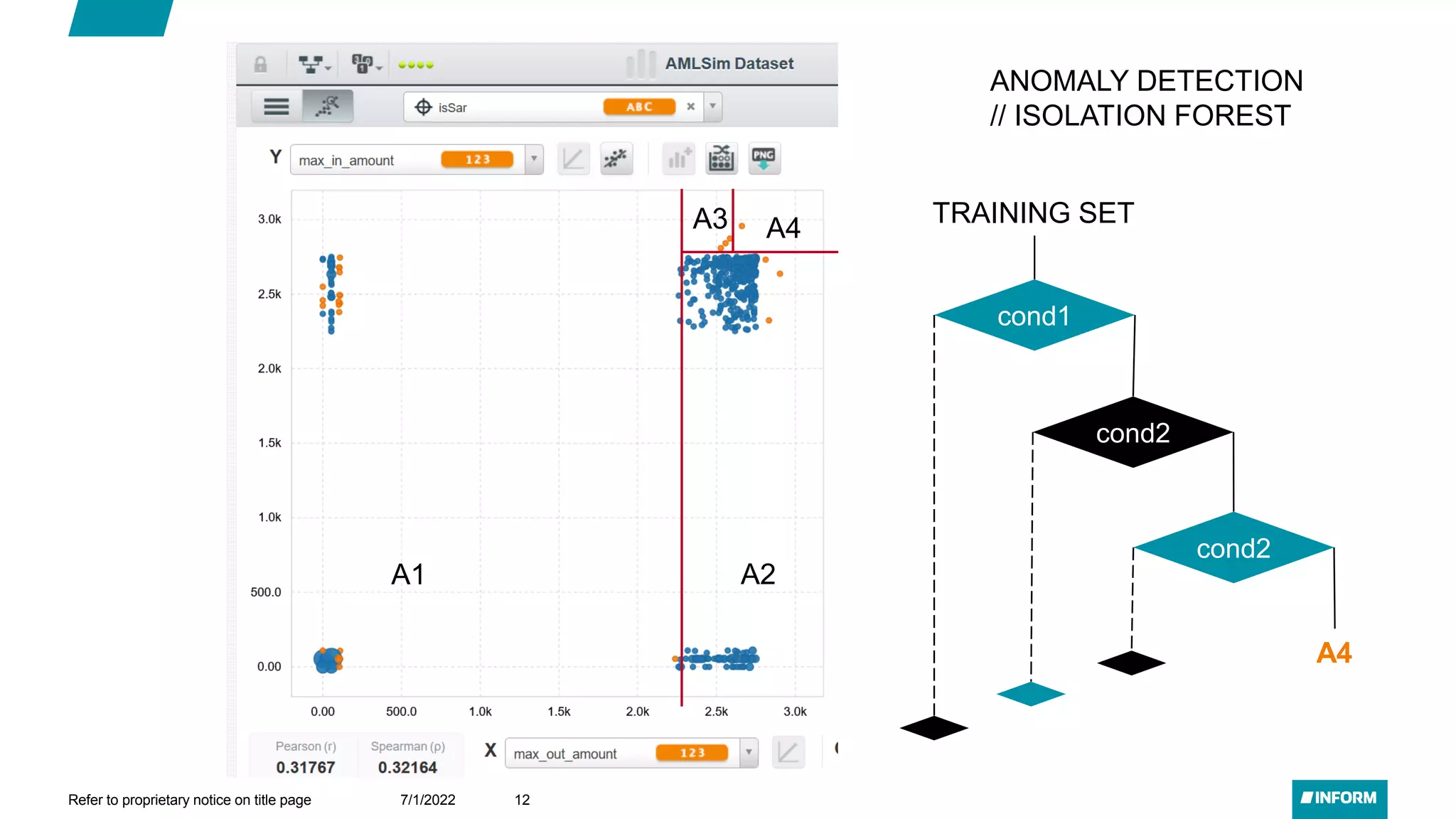

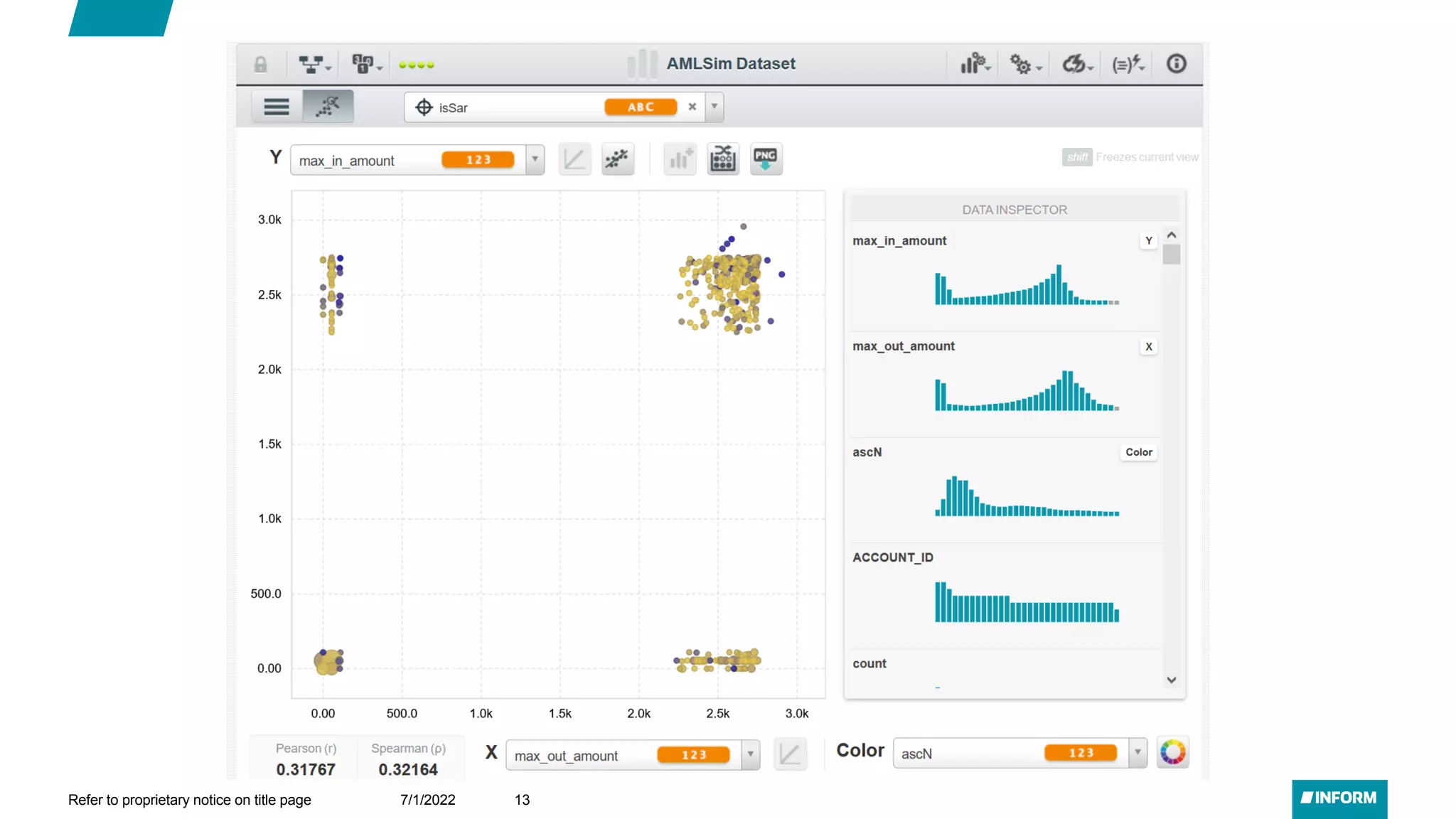

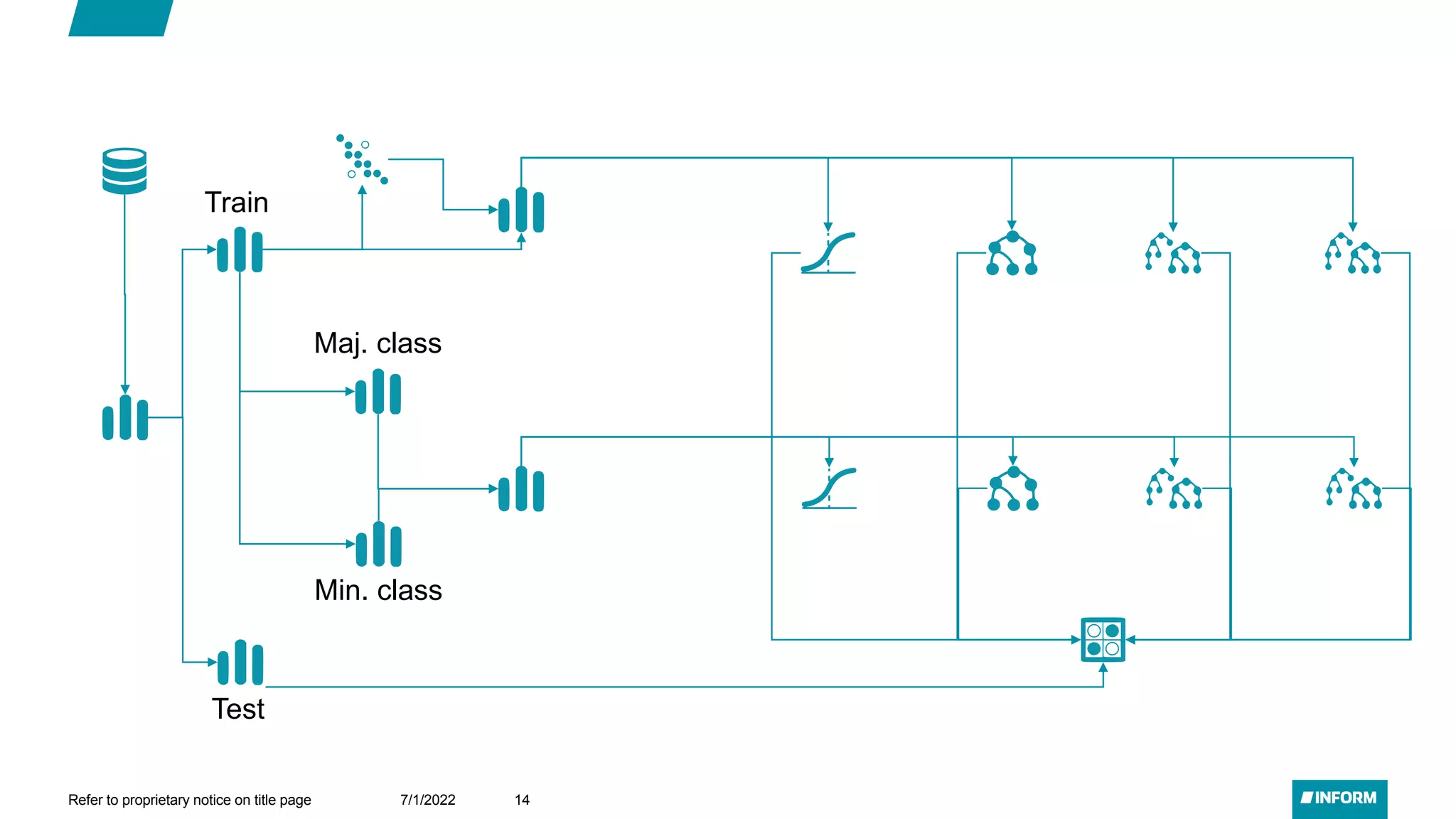

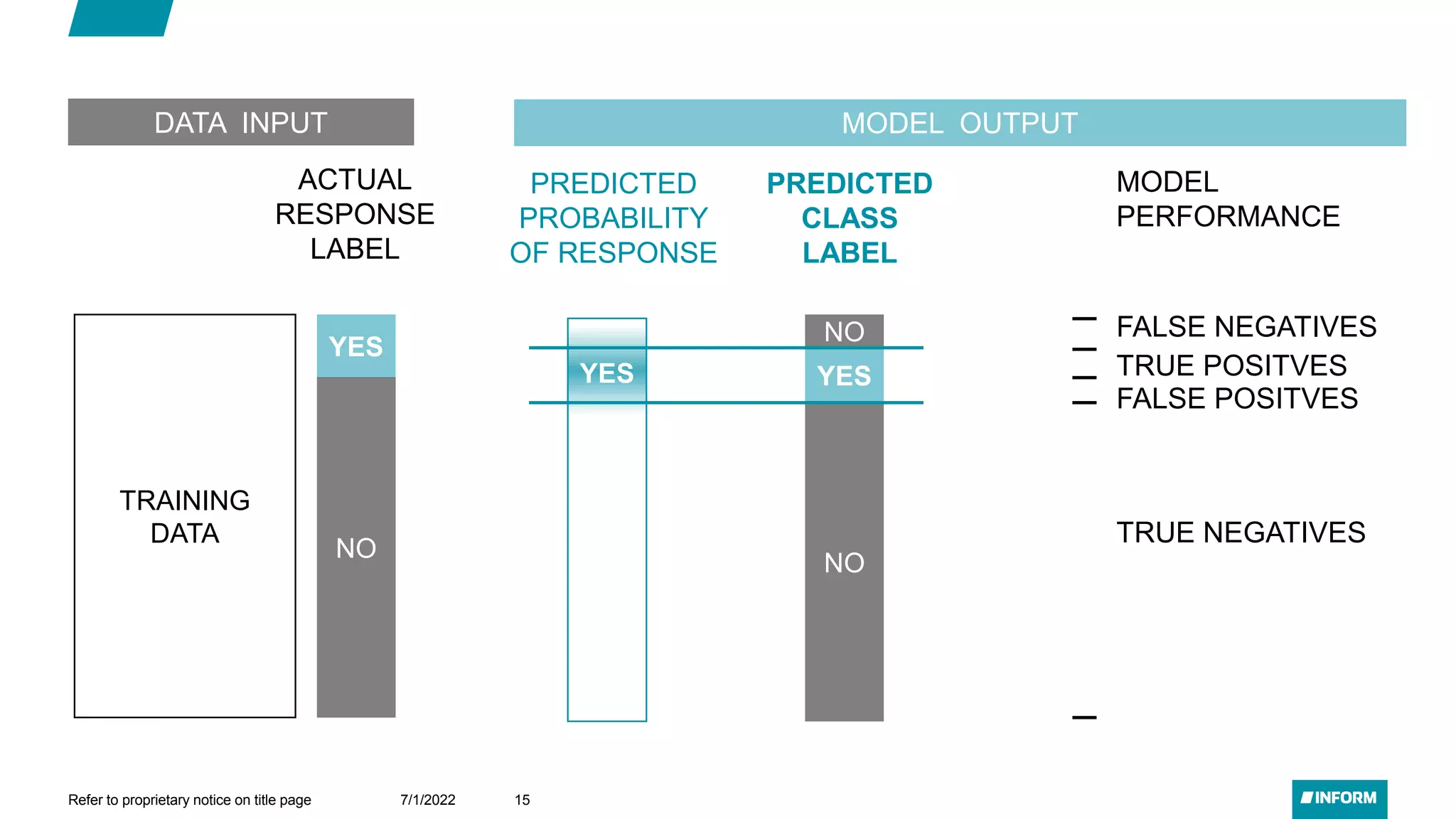

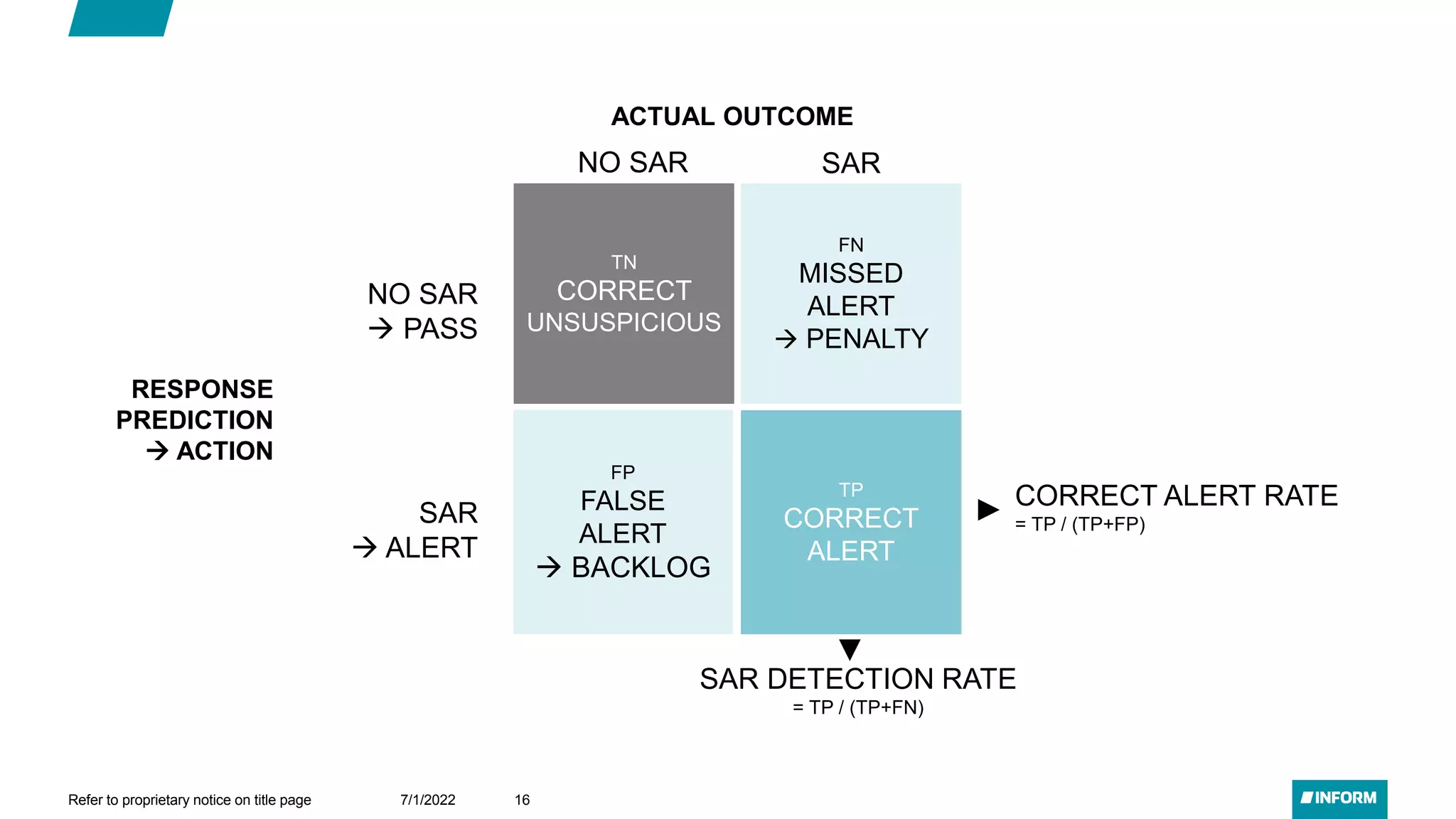

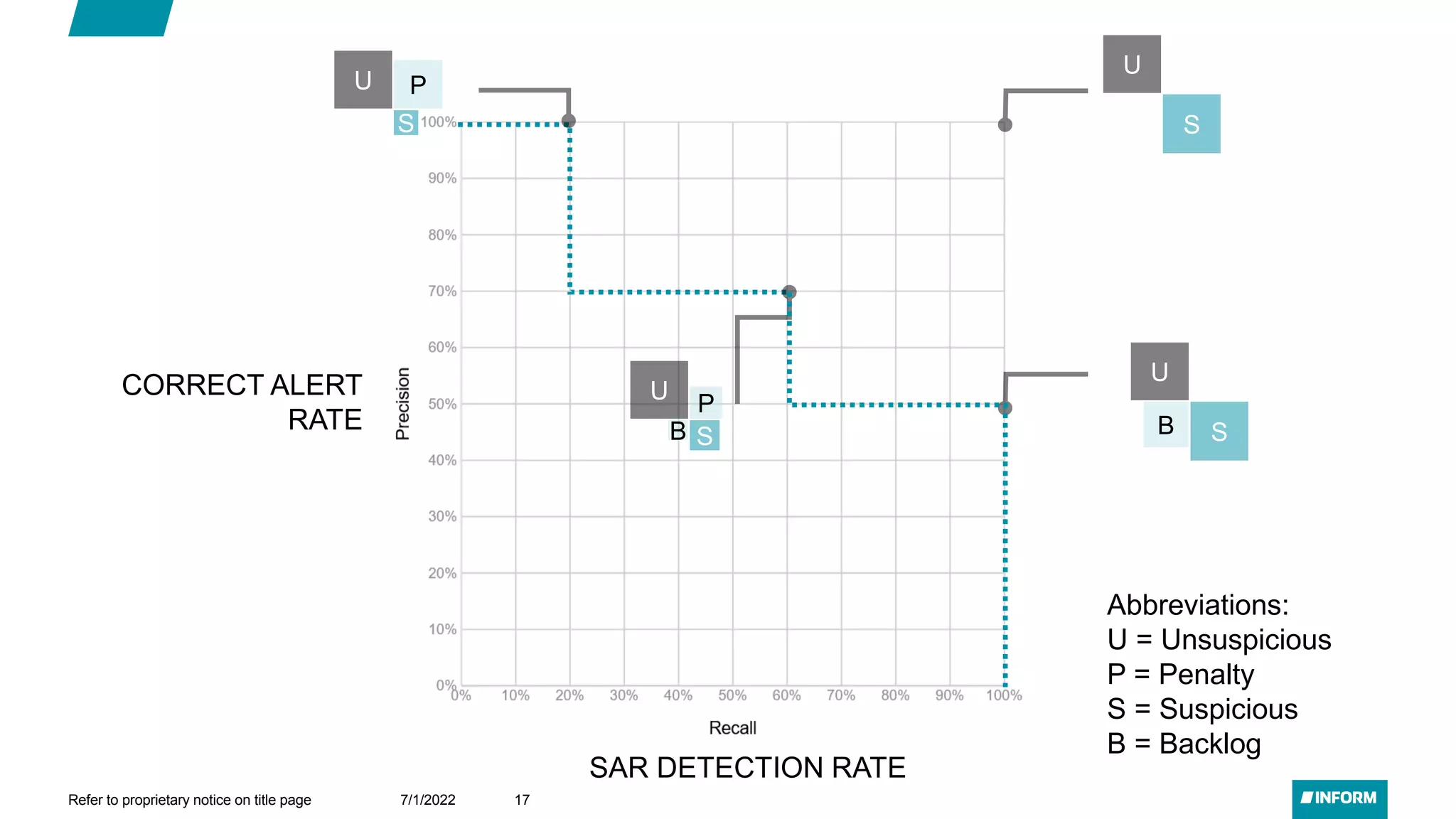

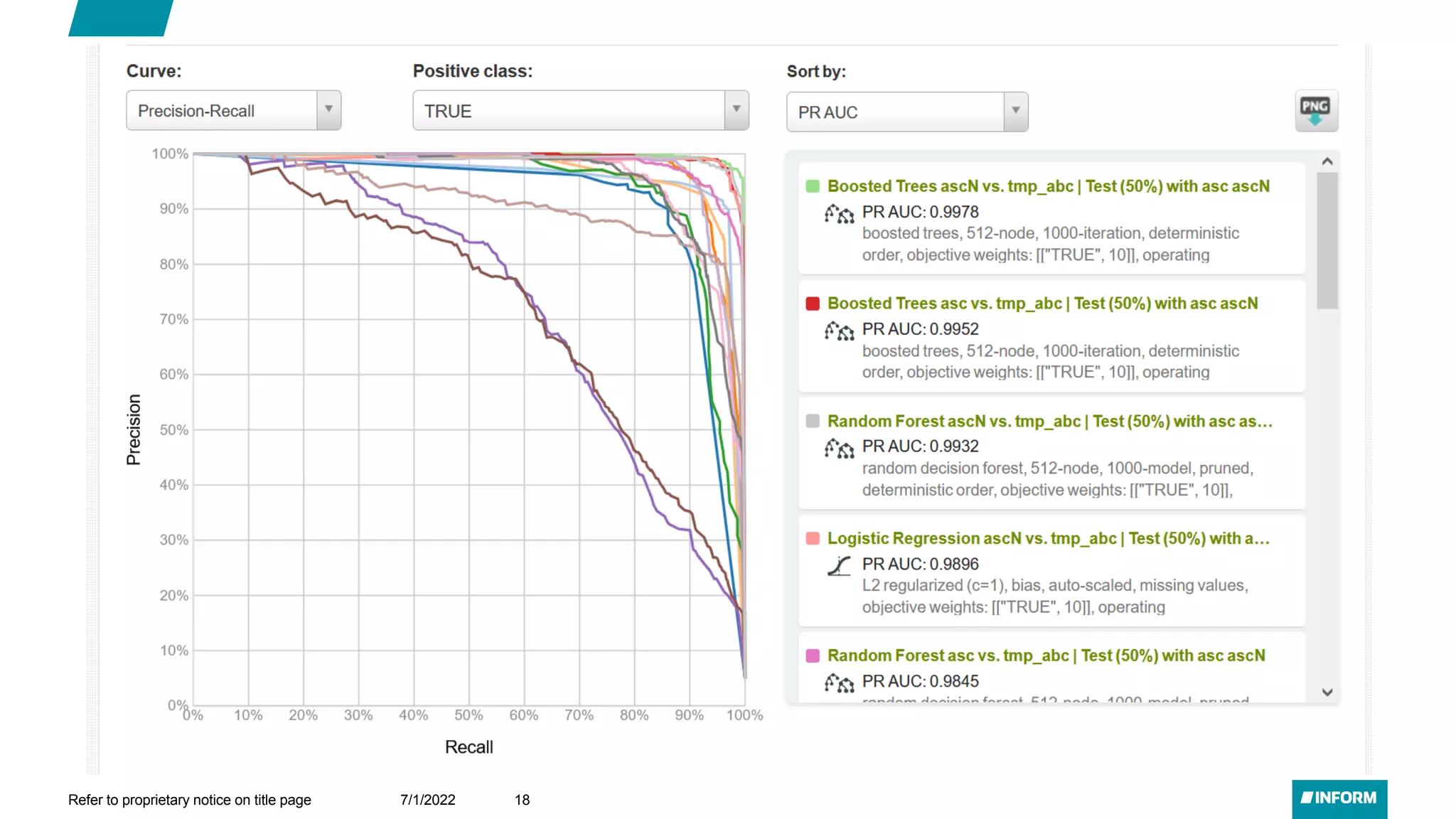

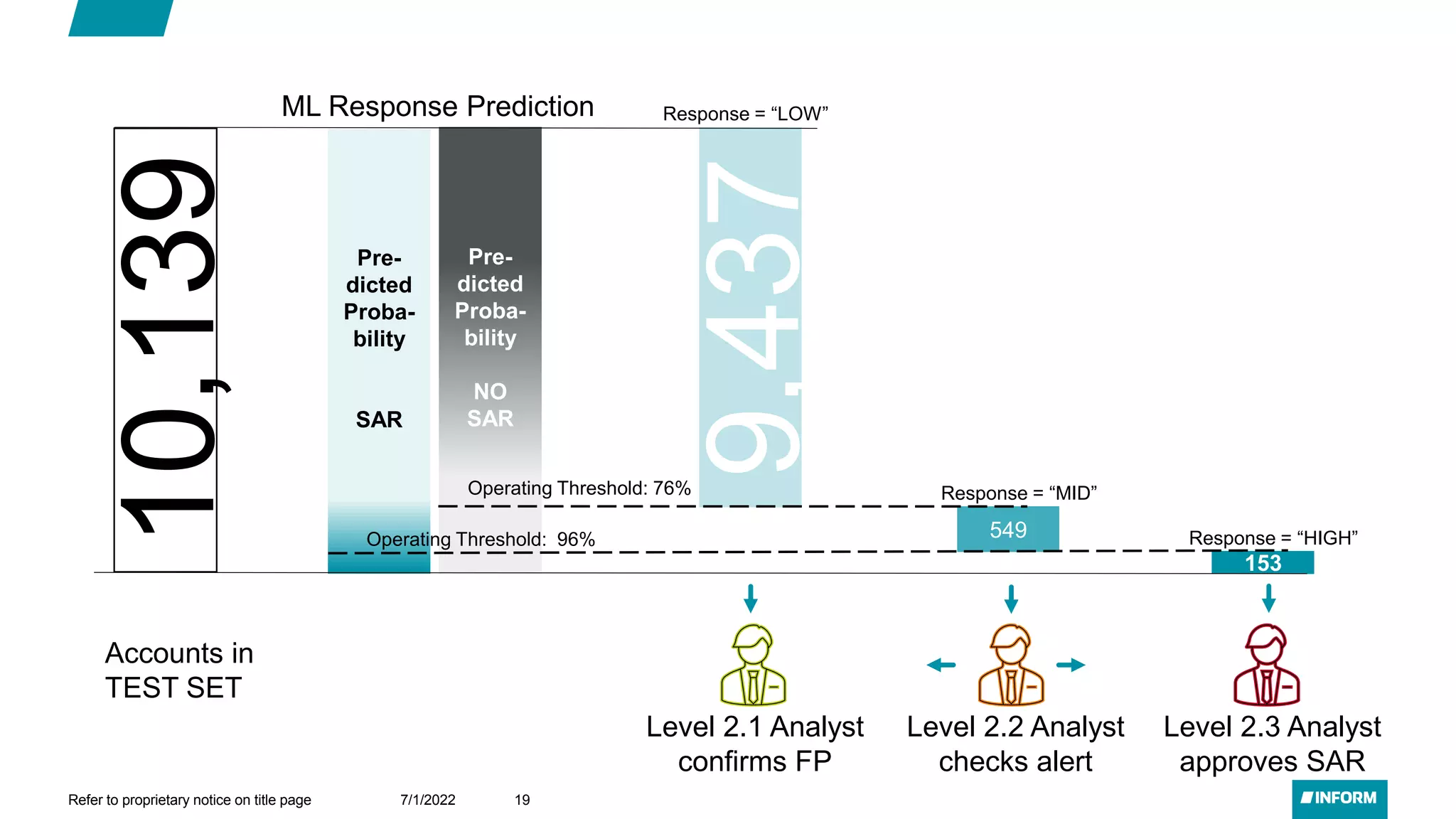

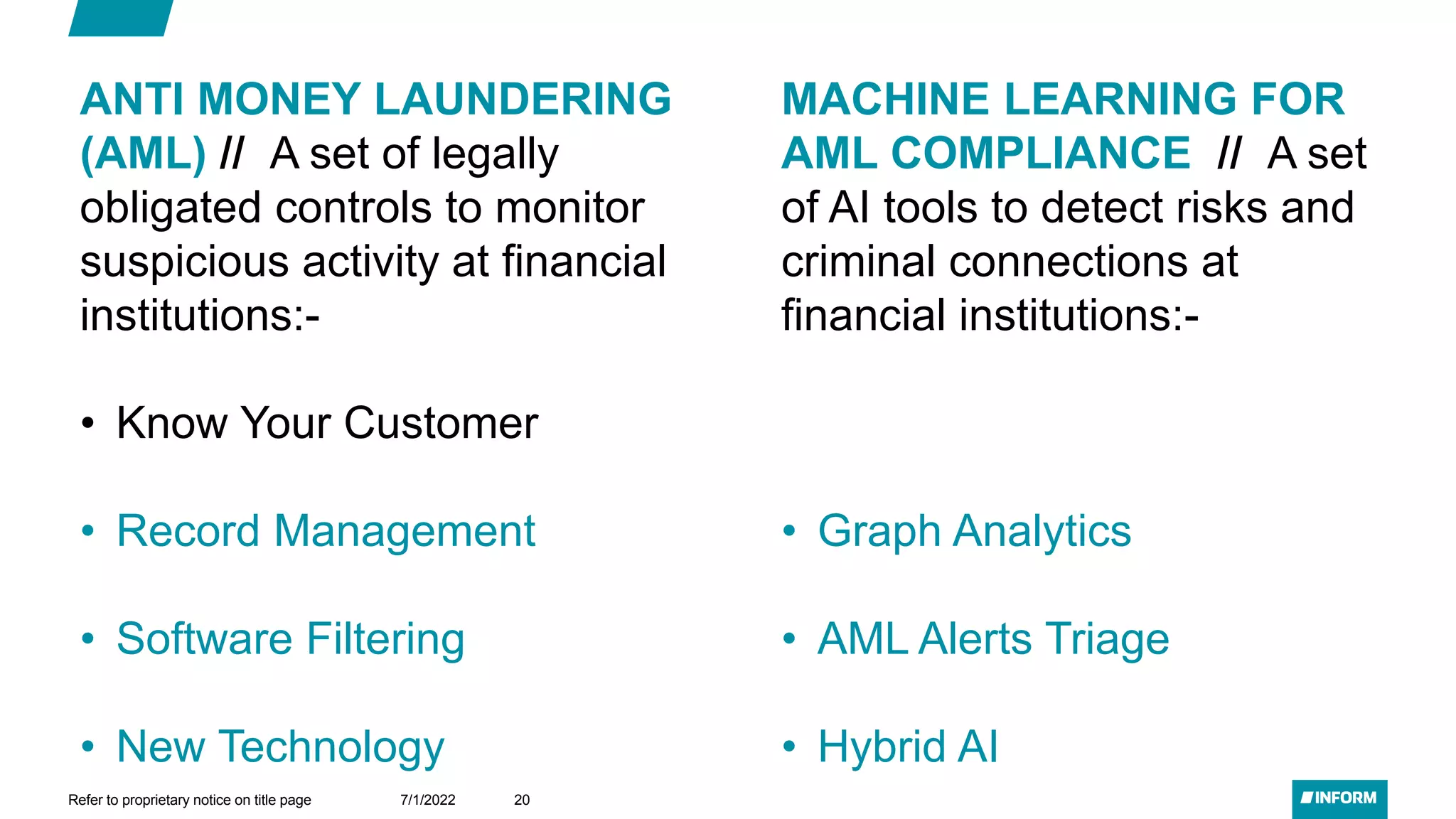

The document discusses the application of machine learning in anti-money laundering (AML) compliance, detailing legally mandated controls for monitoring suspicious activities in financial institutions. It highlights the use of AI tools such as graph analytics and machine learning classifiers for detecting risks and managing alerts. The text also describes the multi-level analyst workflow in reviewing suspicious transactions and filing reports.