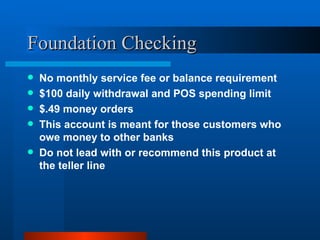

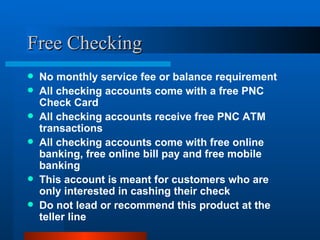

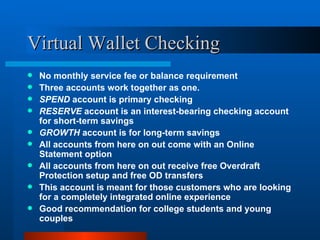

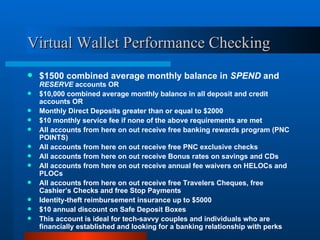

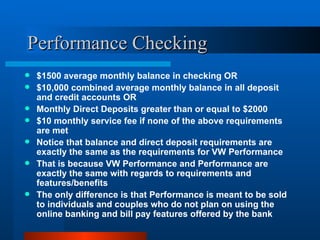

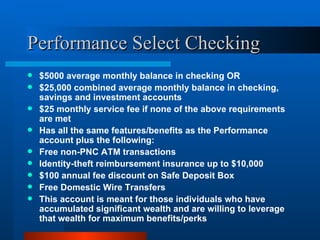

PNC has several checking account options at different price points to meet different customer needs. Foundation and Free checking accounts have basic features but carry restrictions and are not to be led with or recommended by tellers. Virtual Wallet Checking is for customers looking for an integrated online experience, while Performance and Performance Select have higher balance requirements but provide more perks and benefits. Tellers should have basic knowledge of accounts to answer questions and make recommendations, but do not need to know all details. The goal is a positive customer experience.