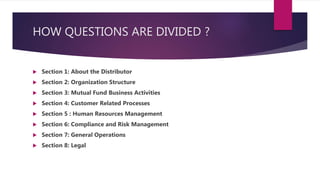

The document outlines the due diligence requirements for mutual fund distributors as mandated by SEBI in a circular dated August 22, 2011. It details the responsibilities of AMCs, AMFI, and intermediaries to ensure investor protection, maintain ethical practices, and adhere to compliance and risk management processes. The document also specifies sections for evaluating distributor operations, organizational structure, and customer-related processes to enhance service quality in the mutual fund industry.