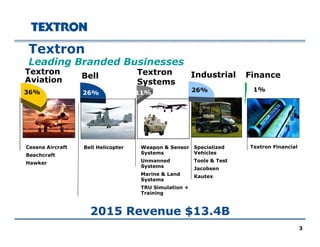

Doug Wilburne provided an overview of Textron Inc. for investors. Key points included:

- Textron has five main business segments that accounted for $13.4 billion in revenue in 2015.

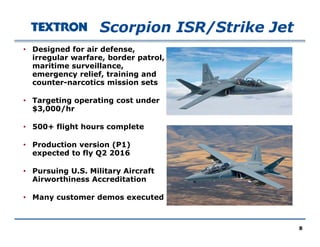

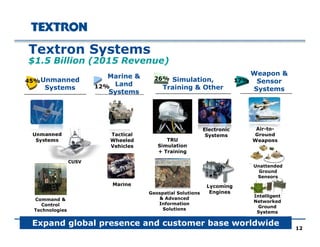

- The company is investing in new products and acquisitions to drive future organic growth.

- Recent acquisitions and new product developments across business segments were highlighted.

- Textron Aviation is expanding its aircraft product line to include new Citation models.

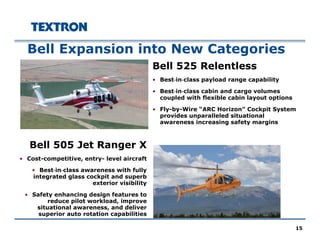

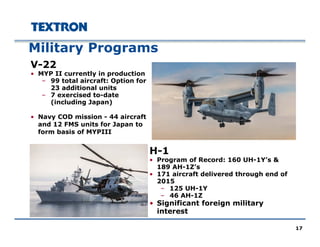

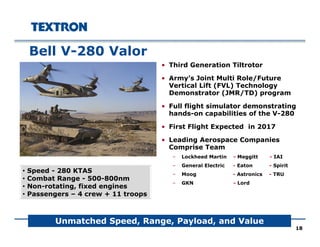

- Bell Helicopter continues to see growth from military programs like the V-22 and new commercial models.

- The presentation concluded with an overview of Textron's finance segment and comments on future strategies.