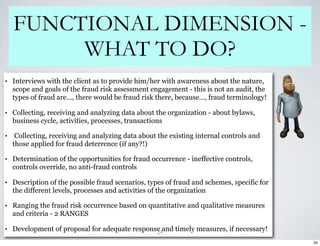

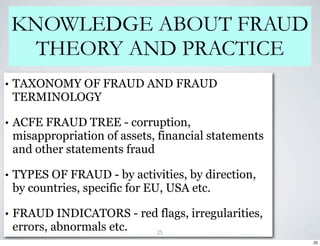

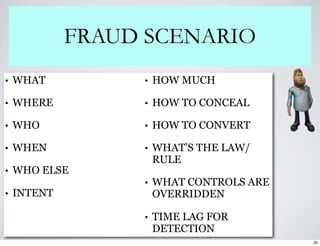

The document presents insights from the 10th International Congress on Internal Control, Audit, and Anti-Fraud, focusing on a 3D model for fraud risk assessment developed by Dr. Dimiter Dinev. This model emphasizes systematic data analysis for assessing fraud risk, involving various stakeholders such as internal auditors and compliance officers to enhance fraud deterrence. The document outlines the functional, methodological, and timing dimensions of the assessment process, detailing potential fraud scenarios and the necessary responses for organizations.