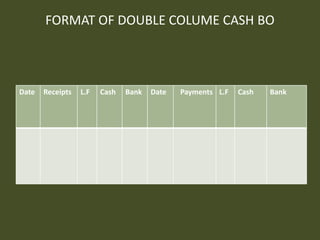

This document discusses a double column cash book, which contains two columns of amounts on each side to record bank transactions. It describes how pay-in slips are used to deposit cash or checks into a bank account and how checks can be used to withdraw money, including crossed and order checks. Endorsements involve writing instructions to pay a check to someone and signing the back. Contra entries record the transactions in the cash book. The conclusion restates that a double column cash book contains two amount columns on each side to record the large number of bank transactions common in many organizations.