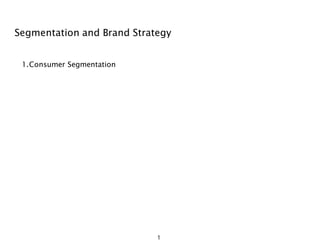

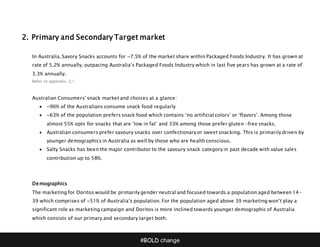

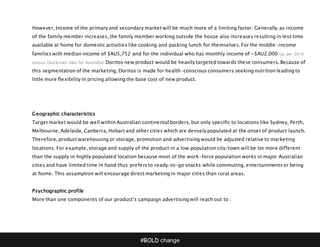

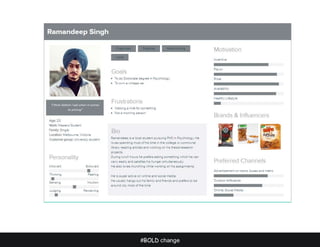

The document outlines a marketing proposal and plan for a new bold Doritos product aimed at health-conscious consumers in Australia. It details consumer segmentation, marketing strategies, pricing, and distribution plans, emphasizing a shift towards healthier snack options while maintaining brand identity. The plan includes a budget of AUD 6 million for advertising and promotions to effectively introduce the product in major Australian cities by June 2018.

![#BOLD change

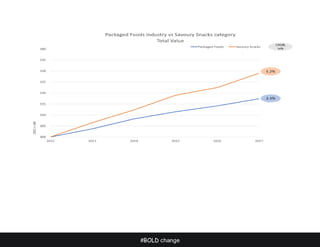

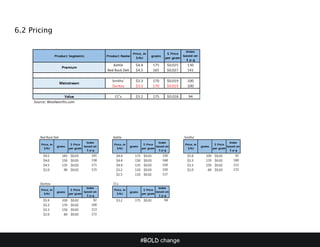

[Euromonitor, Key Trends and development in Australia] As consumer demand for products that promote health

and wellbeing has remained strong in 2017. Therefore, Doritos will be initially priced low to penetrate the targeted

market quickly attracting large number of buyers and at the same time capitalizing quickly to gain market share

and lately will allow Doritos to increase the price as demand increases, it will also create a goodwill for the early

adopters and rapid adoption & diffusion will help taking up with competition by surprise.

As per the exercise performed, appendix 6.2. we can say that there is elasticity in demand suggesting that with the

change in price of the product consumer tends to switch to a substitute product.

Therefore, the price would be set at a moderate range. The price range would be $2.0 for 90gms, $3.3 for 150gms

-170gms, $5.5 for 330gms (family pack). To compete with the peers, Doritos new product must keep the pricing

somewhat in a similar range of Doritos’ established products, appendix 6.2

6.3 Distribution plan](https://image.slidesharecdn.com/05-190327032901/85/Doritos-Marketing-Strategy-29-320.jpg)

![#BOLD change

References

I ) Service age groups | North Western Melbourne Primary Health Network | Community profile:

Profile.id.com.au. (2018). Service age groups | North Western Primary Health Network | Community profile. [online]

Available at: https://profile.id.com.au/nwmphn/service-age-group?BMID=50 [Accessed 6 May 2018]

2) Sweet or Salty Snacks? Australian Consumer Preferences Revealed! – Unique Health Products. [online]

Available at: https://uhp.com.au/blog/snacks-australian-consumer-preferences-revealed/ [Accessed 6 May 2018]

3) Snack Food Manufacturing – Australian Industry report | IBISWorld. [online]

Available at: https://www.ibisworld.com.au/industry-trends/market-research-reports/manufacturing/food-

product/snack-food- manufacturing.html [Accessed on 11 May 2018]

4) Writer, S. (2015). Snack Food Manufacturing in Australia – Food & Beverage. [online] Food & Beverage.

Available at: https://foodmag.com.au/snack-food-manufacturing-in-australia/ [Accessed on 11 May 2018]

5) Three Australian trends to watch in 2018 – Food & Drink Business

Foodanddrinkbusiness.com.au. (2018) – Food & Drink Business. [Online]

Available at: http://www.foodanddrinkbusiness.com.au/special-reports/special-report-trends-report-2018/three-

australian-trends-to-watch-in-2018 [Accessed on 11 May 2018]](https://image.slidesharecdn.com/05-190327032901/85/Doritos-Marketing-Strategy-62-320.jpg)

![#BOLD change

6) RMIT Central Authentication Service

Portal.euromonitor.com.ezproxy.lib.rmit.edu.au (2018). [online]

Available at: http://www.portal.euromonitor.com.ezproxy.lib.rmit.edu.au/portal/analysis/tab

7) 2016 Census Quickstats: Australia

Censusdata.abs.gov.au. (2018). 2016 Census QuickStats: Australia. [online]

Available at: http://www.censusdata.abs.gov.au/census_services/getproduct/census/2016/quickstat/036

9) Harvard Business Review. (1965). Exploit the Product Life Cycle. [online]

Available at: https://hbr.org/1965/11/exploit-the-product-life-cycle [Accessed 16 May 2018].

10) Vergis, n. (2018). 2012 Doritos Marketing Plan. [online] Issuu.

Available at: https://issuu.com/nikovergis/docs/final_doritos [Accessed 16 May 2018].

11) MBA Skool-Study. Learn. Share. (2018). Doritos Marketing Mix (4Ps) Strategy | MBA Skool-Study.Learn.Share. [online]

Available at: https://www.mbaskool.com/marketing-mix/products/17529-doritos.html [Accessed 16 May 2018].

12) Claessens, M. (2015). Product Life Cycle Strategies and Characteristics. [online] Marketing-Insider.

Available at: https://marketing-insider.eu/product-life-cycle-strategies/ [Accessed 16 May 2018].

13) App.xtensio.com. (2018). Xtensio | Documents = Web Pages = Presentations. [online]

Available at: https://app.xtensio.com/ [Accessed 16 May 2018].](https://image.slidesharecdn.com/05-190327032901/85/Doritos-Marketing-Strategy-63-320.jpg)

![#BOLD change

14) Bhasin, K. (2012). The Psychological Secrets Behind Nacho Cheese Doritos. [online] Business Insider Australia.

Available at: https://www.businessinsider.com.au/nacho-cheese-doritos-brand-2012-12?r=US&IR=T [Accessed 16

May 2018].

15) Passport (2017). Euromonitor International. Packaged Food in Australia

16) Aipt.edu.au. (2017). Australian Eating Habits: Stats and Survey Results. [online]

Available at: https://www.aipt.edu.au/articles/2017/07/australian-eating-habits-stats-and-survey-results

[Accessed 16 May 2018].

17) Harvard Business Review. (2017). How Customers Perceive a Price Is as Important as the Price Itself. [online]

Available at: https://hbr.org/2017/01/how-customers-perceive-a-price-is-as-important-as-the-price-itself

[Accessed 17 May 2018].

18) Harvard Business Review. (2016). The New World of Mini Consumer Packaged Goods. [online]

Available at: https://hbr.org/2016/09/the-new-world-of-mini-consumer-packaged-goods [Accessed 17 May

2018].

19) Theseus.fi. (2018). [online]

Available at:

https://www.theseus.fi/bitstream/handle/10024/67417/thesis_final%20version_Anh%20Hoang.pdf?sequence=1&is

Allowed=y

[Accessed 17 May 2018].](https://image.slidesharecdn.com/05-190327032901/85/Doritos-Marketing-Strategy-64-320.jpg)

![#BOLD change

20) Yourbusiness.azcentral.com. (2018). Examples of Price Promotion Methods. [online]

Available at: https://yourbusiness.azcentral.com/examples-price-promotion-methods-21128.html [Accessed 17

May 2018].

21) Spin Sucks. (2017). Do TV Well and All of Your Digital Marketing Boats Will Rise. [online]

Available at: https://spinsucks.com/marketing/tv-advertising-vs-digital-marketing/ [Accessed 20 May 2018].

22) Lynch, J. and Lynch, J. (2018). Why TV Is Still the Most Effective Advertising Medium. [online] Adweek.com.

Available at: http://www.adweek.com/tv-video/why-tv-still-most-effective-advertising-medium-165247/

[Accessed 20 May 2018].

23) Arkside. (2013). 5 Reasons to Use TV Advertising – Arkside. [online]

Available at: https://www.arksidemarketing.com/5-reasons-to-use-tv-advertising/ [Accessed 20 May 2018].

24) Woolworths.com.au. (2018). {{metaController.metaData.title}}. [online]

Available at: https://www.woolworths.com.au/shop/productdetails/826422/doritos-corn-chips-cheese-supreme

[Accessed 20 May 2018].

25) Inside FMCG. (2018). PepsiCo creates new Doritos Crackers - Inside FMCG. [online]

Available at: https://insidefmcg.com.au/2018/04/12/pepsico-creates-new-doritos-crackers/ [Accessed 20 May

2018].](https://image.slidesharecdn.com/05-190327032901/85/Doritos-Marketing-Strategy-65-320.jpg)

![#BOLD change

26) Foodanddrinkbusiness.com.au. (2018). Three Australian trends to watch in 2018 - Food & Drink Business. [online]

Available at: http://www.foodanddrinkbusiness.com.au/special-reports/special-report-trends-report-2018/three-

australian-trends-to-watch-in-2018 [Accessed 20 May 2018].](https://image.slidesharecdn.com/05-190327032901/85/Doritos-Marketing-Strategy-66-320.jpg)