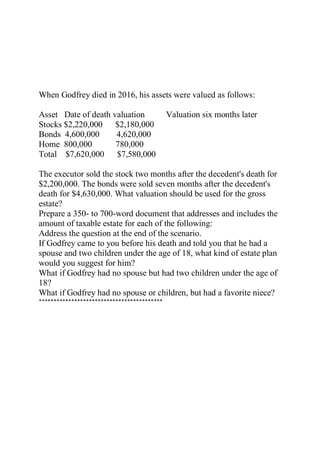

The document is a study guide covering various tax scenarios and regulations including gift tax exclusions, estate tax rules, and personal income tax deductions. It outlines examples involving individuals' financial transactions, property valuations, and tax filing implications. Moreover, it discusses concepts related to primary and secondary tax sources, personal and business tax filings, and scenarios for asset management after death.