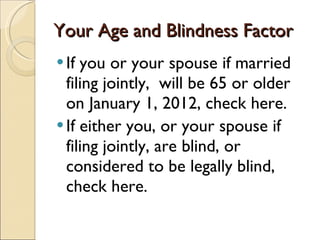

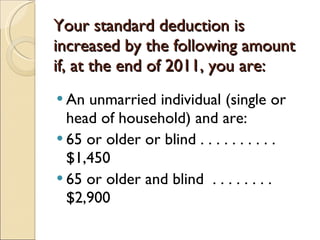

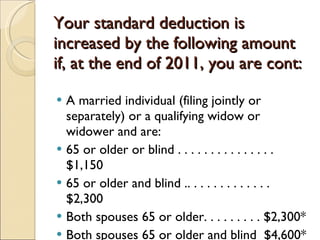

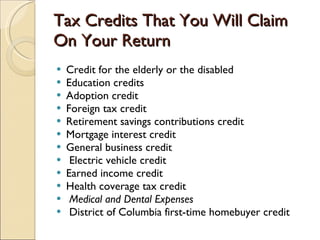

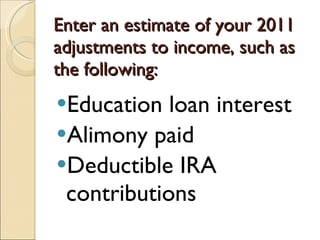

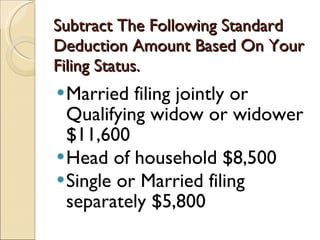

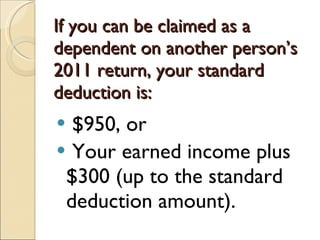

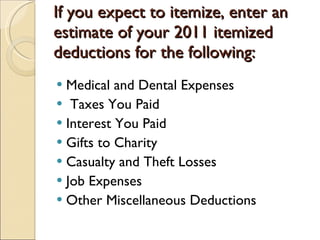

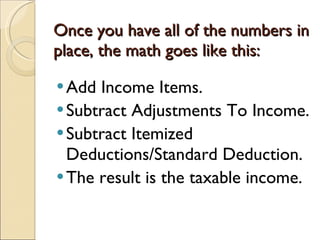

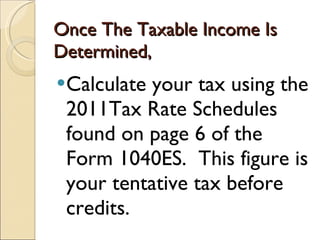

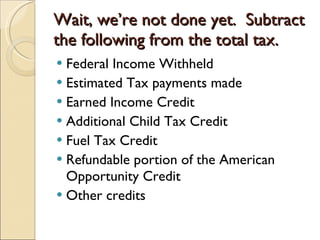

This document provides guidance to employees on conducting a year-end tax checkup to estimate their 2011 tax liability and refund. It walks through a series of questions to calculate estimated income, deductions, credits, withholdings and payments to determine what is owed or will be refunded. Key steps include estimating income sources, deductions, exemptions, credits, withholdings and payments to calculate taxable income, tax, and the final estimated balance owing or refund amount.