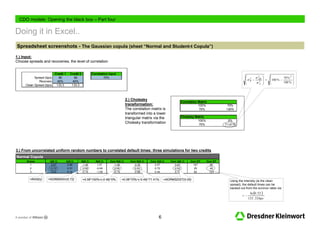

This document discusses using copulas to model dependency structures for credit default portfolio modeling and CDO pricing. It introduces copulas and how they can be used to separate the marginal default distributions from the joint dependency structure. The Gaussian and Student's t copulas are presented as examples. The document shows how to implement these copulas in Excel to generate correlated default times via Monte Carlo simulation. This allows for a flexible way to analyze portfolio credit risk under different dependency assumptions.

![CDO models: Opening the black box – Part four

What is a Copula? The maths..

Copulas allow expressing joint probability distributions independent from the shape of their marginals..

► The joint distribution function C of m uniform random variables U1, U2, …, Um can be referred to as copula function:

C ( u 1 , u 2 , ... , u m , ρ ) = Pr [U 1 ≤ u 1 , U 2 ≤ u 2 , ... , U m ≤ u m ]

► A set of univariate marginal distribution functions can be linked via a copula function, resulting in a multivariate distribution function:

C (F1 (x 1 ), F 2 (x 2 ), ... , F m (x m )) = F (x 1 , x 2 , ... , x m )

► Sklar’s theorem (1959) established the converse, showing that any multivariate distribution function F can be expressed via a copula

function

For any multivariate distribution, the univariate marginal distributions and their dependency structure can be separated

► Let F(x1, x2, …, xm) be a joint multivariate distribution function with univariate marginal distribution functions F1(x1), F2(x2), …,Fm(xm)

► Then there exists a copula function C(u1,u2,…,um) such that:

F (x 1 , x 2 , ... , x m ) = C (F1 (x 1 ), F 2 (x 2 ), ... , F m (x m ))

► C is unique if each Fi is continuous

► Depending on the type of copula, the dependency structure will be expressed in terms of a correlation matrix, as in case for the normal

copula, or via a smaller number of parameters as in case of Archimedean copulas (such as the Clayton or Gumbel copula)

4](https://image.slidesharecdn.com/dk6-copingwcopulas-managingtlrsk-130119234045-phpapp01/85/Dk6-coping-w-copulas-managing_tl_rsk-5-320.jpg)