1. The document discusses modeling multivariate dependence using copula functions.

2. Copulas allow specifying marginal distributions independently and then modeling their joint dependence structure. This provides more flexibility than models that assume a joint distribution.

3. Key topics covered include copula properties, Sklar's theorem relating copulas to multivariate distributions, common copula types, and using copulas for risk modeling and pricing multi-asset derivatives.

![Giulio Laudani Cod. 20263

Scheme on CDS and Copula

Empirical data features: ____________________________________________________________________ 2

Univariate world:________________________________________________________________________________ 2

Multivariate world: ______________________________________________________________________________ 2

Multivariate insight: ______________________________________________________________________ 2

Measure and test _______________________________________________________________________________ 2

Dependence Measure: ____________________________________________________________________________________ 2

Test on distribution: ______________________________________________________________________________________ 4

Gaussian multivariate correlation __________________________________________________________________ 4

Other multivariate specification ____________________________________________________________________ 4

Copula function __________________________________________________________________________ 5

What is a copula e when it is suitable _______________________________________________________________ 5

Sklar’s theorem [1959] ___________________________________________________________________________ 6

How to generate a Copula: ________________________________________________________________________ 6

Type of copula function __________________________________________________________________________ 7

Implicit types: ___________________________________________________________________________________________ 7

Explicit types: ___________________________________________________________________________________________ 7

Meta-distribution:________________________________________________________________________________________ 7

Risk modeling ____________________________________________________________________________ 8

Goals and features: ______________________________________________________________________________ 8

Approaches: ____________________________________________________________________________________ 8

Comments and further details: _____________________________________________________________________ 9

Pricing Multi-asset derivatives _____________________________________________________________ 10

The BL Formula _________________________________________________________________________________________ 10

The Practitioners’ Approach: ______________________________________________________________________________ 10

The copula approach: ____________________________________________________________________________________ 10

Credit Derivatives focus: _________________________________________________________________________ 10

Market practice: ________________________________________________________________________________________ 11

Pricing a CDS: __________________________________________________________________________________________ 11

CDS typologies and CDO financial product: ___________________________________________________________________ 14

1](https://image.slidesharecdn.com/schemacdscopula-130303051812-phpapp02/75/Pricing-CDS-CDO-Copula-funtion-1-2048.jpg)

![Giulio Laudani Cod. 20263

Empirical data features:

We are going to use as an explanatory model of return evolution the one that is assuming the presence of two compo-

nent: the permanent information and the temporary noisy one. The second one prevails in the short term high fre-

quency observation, while the first emerges for longer horizon. This property implies:

In general, predictability of returns increases with the horizon. The best estimate for the mean of returns at high

frequency is zero, but a slowly evolving time varying mean of returns at long-horizons could and should be mod-

eled. [there is a strong evidence of correlation between industrialized countries stocks]

If we run a regression we are expecting high statistical significance for the parameters for log horizon

The presence of the noise component in returns causes volatility to be time-varying and persistent, and the an-

nualized volatility of returns decrease with horizon

Data shows non normality behavior, unconditional distribution with higher tails

Non-linearity is also a feature of returns at high frequency: a natural approach to capture nonlinearity is to diffe-

rentiate alternative regimes of the world that govern alternative description of dynamics (such as level of volatil-

ity in the market), for example Markov chain.

Univariate world:

Those time series have little serial correlation, high absolute return correlation, excepted conditional return are close

to zero, volatility appears to change over time, leptokurtosis and skewness are main features and extremeevent ap-

pear in cluster (thus it can predict), lastly long term interval converge more to Gaussian hp

Multivariate world:

Little correlation across time, except for contemporaneous returns, strong correlation for absolute returns, correla-

tion[to compute the correlation we should fit different models for changing correlation and make a statistical compari-

son] vary over time (and clustering effect), extreme returns in one series are correlated with other returns (extreme

dependence)

Multivariate insight:

This topic is relevant for pricing. Asset allocation and risk management issues. When we dealt with multi securities we

need to model not only the dynamics of each securities, but also the joint evolution, i.e. their dependence structure.

Before starting to describe the first approach we need to provide some notation that will be used here after:

Consider a d-dimensional Vector X the joint distribution is

The marginal distribution will be

If the [marginal distribution] is continuous we can obtain the densities by computing the first derivatives,

so the joint densities will be the non-negative function

Note that the existence of a joint density implies the existence of all the marginal densities but not vice-versa,

unless the components are orthogonal one to the other

Measureand test

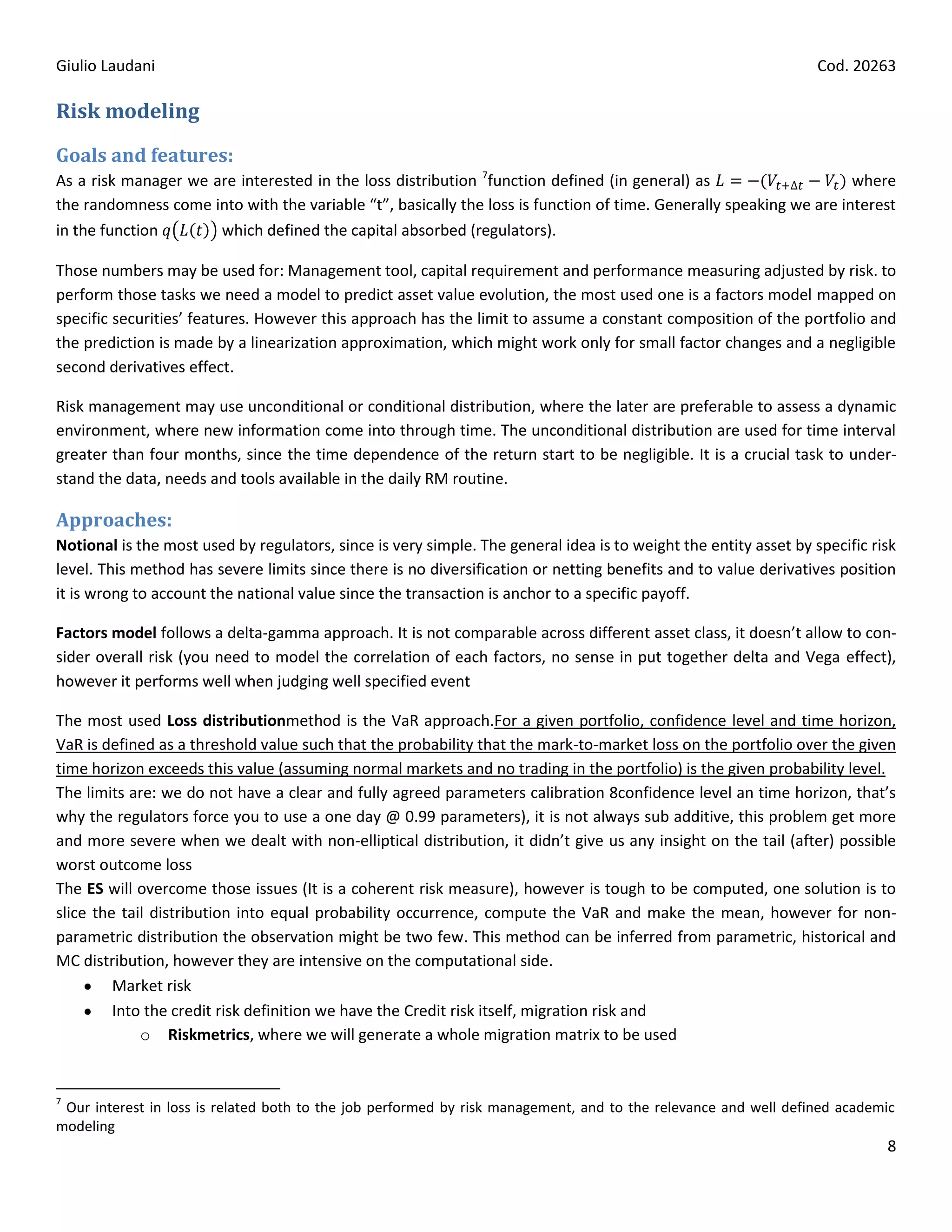

Dependence Measure:

The Linear correlation is the natural dependence measure only for multivariate normal (it will coincide with the maxi-

mum likelihood estimators, hence it will satisfied all the desirable properties) and when the variance is (must be) a finite

number (not obvious, insurance business). It depends on marginal distribution (since it is computed with moments,

2](https://image.slidesharecdn.com/schemacdscopula-130303051812-phpapp02/75/Pricing-CDS-CDO-Copula-funtion-2-2048.jpg)

![Giulio Laudani Cod. 20263

Hoffding formula )), hence it is not invariant under more general transformation (it

is still invariant under liner transformation) and it wouldn’t capture the correlation dynamic under more generic func-

tion.

The Rank Correlations are dependence measure that depend only on the copula and not on marginal, so it is invariant

under general increasing transformations. To compute the rank correlations we need to know the ordering1 of each va-

riable, not the actual numerical value ( we are assuming continuous margins for simplicity) : there exist two measures:

Kendall’s tau, we compute the number of “c” concordant and “d” discordant pair between

two variables with n variables. sample version. The population version simply consider the probability of

concordance minus the probability of discordance

, where the two are vectors with iid distribution

Spearman’s rho [sample version], we need to compute the rank variables (the same time series are ordered) of

the two variables and then compute the correlation between these new variables . The popula-

tion version is the correlation of the marginal value

Here in the following we will provide a proof on the dependence of the estimators only on copula distribution function:

The Kendall’s rho , since the sum of

the two is one, we can write the one as a function of the other

. We know that

since the two variable are i.i.d. this last term is the joint distribution, which can be

expressed as an integral form thanks to the Sklars’ theorem we can rewrite

the previously equation as function of copula distribution (by change the integral interval with 0,1).

hence we have proven that the estimator depends on .

The Sperman’stao population estimators is . The covariance formula is

, hence we can rewrite it as a function of copula . The

so if we put together all this findings we ends up with

There exists also a multivariate version of the rank correlation measure, where instead of taking the expected value

(population version) we will take the “cov” function or correlation matrix depending if we were using the Kendall or

Spearman measure, hence the estimator will be at least semi positive definite. Both the measure can assume the value

in the interval [-1,1] and 0 is independent.

The tail dependence measure has been set to judge the extreme dependence between pair of variable (it is hard to ge-

neralize to the d-dimensional case), the idea behind is to limit conditional probabilities of quantileexecedances. The up-

per measure is given by and the value are in the interval [0,1], the opposite for

the lower tail . Those formula can be written s function of copula (this measure

depends only on copula, hence it is a proper dependence measure), by applying the Bayes theorem

1

When we refer to the ordering of a variable we need to introduce the concept of Concordance and Discordance. In the first case it

is meaningful to say that one pair of observations is bigger than the other (without use the Probability distribution)

3](https://image.slidesharecdn.com/schemacdscopula-130303051812-phpapp02/75/Pricing-CDS-CDO-Copula-funtion-3-2048.jpg)

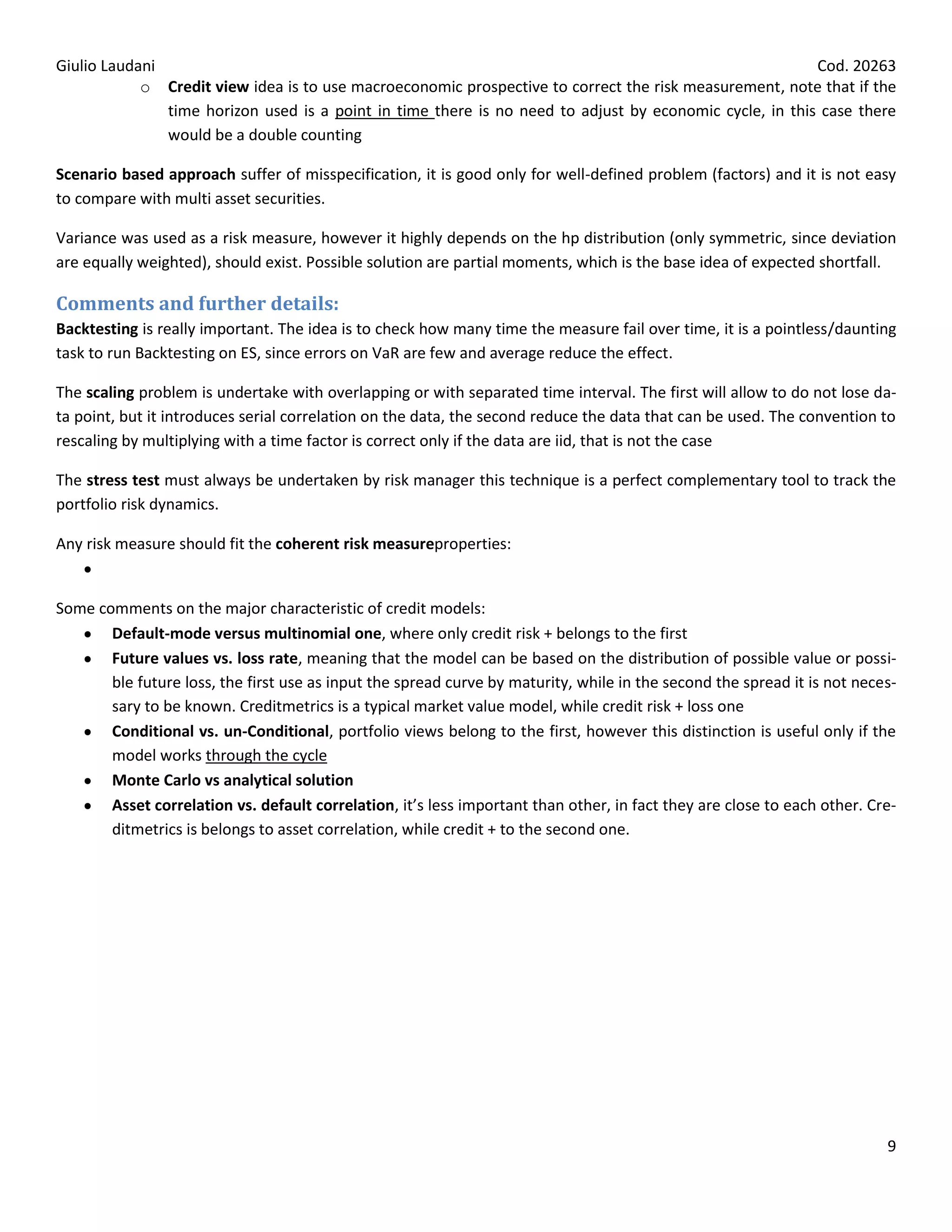

![Giulio Laudani Cod. 20263

Some example are provided: the following Gaussian is asymptotically independent in both tails, t-copula has a symme-

tric (thus not good for real data features) dependence , where higher value of v degree of free-

dom will bring an higher tail dependence. The Gumbel copula has upper tail dependence , and the Clayton copula

has lower tail dependence is

Test on distribution:

To test univariate distributionhp we can use the QQ plot technique to have a graphical sense of the validity of the hp.

To have a numerical sense we can use the Jarque-Bera test which is based on the joint check of the skewness and kurto-

sis of the sample.

To test multivariate distribution we need some other tools, specifically set up. The first is based on a quadratic form

where we will compute for each observation the , which should be distributed according to

a chi-square with d degree of freedom , which can be seen graphically with a QQ plot or numerically with the Marda

Test(by using the D, third and fourth moments, the first distribute as a chi-square with degree of freedom [ ],

the second follow a standard Gaussian) which is basically a ri-proposition of the jarque-Bera idea, however it is not a

joint test, since we test the skewness and kurtosis separately.

Gaussian multivariate correlation

The first and most trivial measure of dependence is the correlation or equivalently the variance covariance matrix. It is

at least a semi-definite matrix, and if it is positive-definite it is possible to apply the Cholesky decomposition. It is usually

computed with the sampling estimators2.

The Gaussian distribution is the most simple hypothesis, it is characterized by the first two moments, which will entirely

describe the dependence structure, linear combination remains normally distributed and it is easy to aggregate different

distributions (we just need to know the correlation between them).

There exist several closed formula under the geometric Brownian motion in the derivatives pricing and it is simple to

manage the risk by using the VaR approach.The Gaussian world is unfeasible with the empirical evidence, it has a poor

fit with real data3, hence we need to develop a new set of model which allow for fat-tail and more flexibility in defining

the dependence structure. Note that a multivariate set of variable to be jointly Gaussian, each of the univariate distribu-

tion must be Gaussian if self.

Other multivariate specification

The first attempt to solve the problem was to work with the conditional distribution, such as GARCH model ,

where we are hoping that the rescaled return by volatility is normal. Even if those model performs better than the clas-

sical one, we still need something more complete model, furthermore it is a really demanding specification for multiva-

riate needs4. The second attempt was to use different distribution with fatter tails, such as the t-Student’s

2

We are implicitly assuming the each observation is independent and identically distributed, in fact only in this case this estimator

will coincide with the maximum estimators and have all the desired properties, furthermore this estimator will depend on the true

multivariate distribution

3

We observe fat tail both in the marginal distribution and in the joint distribution, furthermore the volatility seems to move in clus-

ter, while return are less time dependent, and correlation vary over time

4

We need elements for each securities in the matrix to be modeled, where d is the number of coefficient in the algorithms

specification. The same problem for the ETV

4](https://image.slidesharecdn.com/schemacdscopula-130303051812-phpapp02/75/Pricing-CDS-CDO-Copula-funtion-4-2048.jpg)

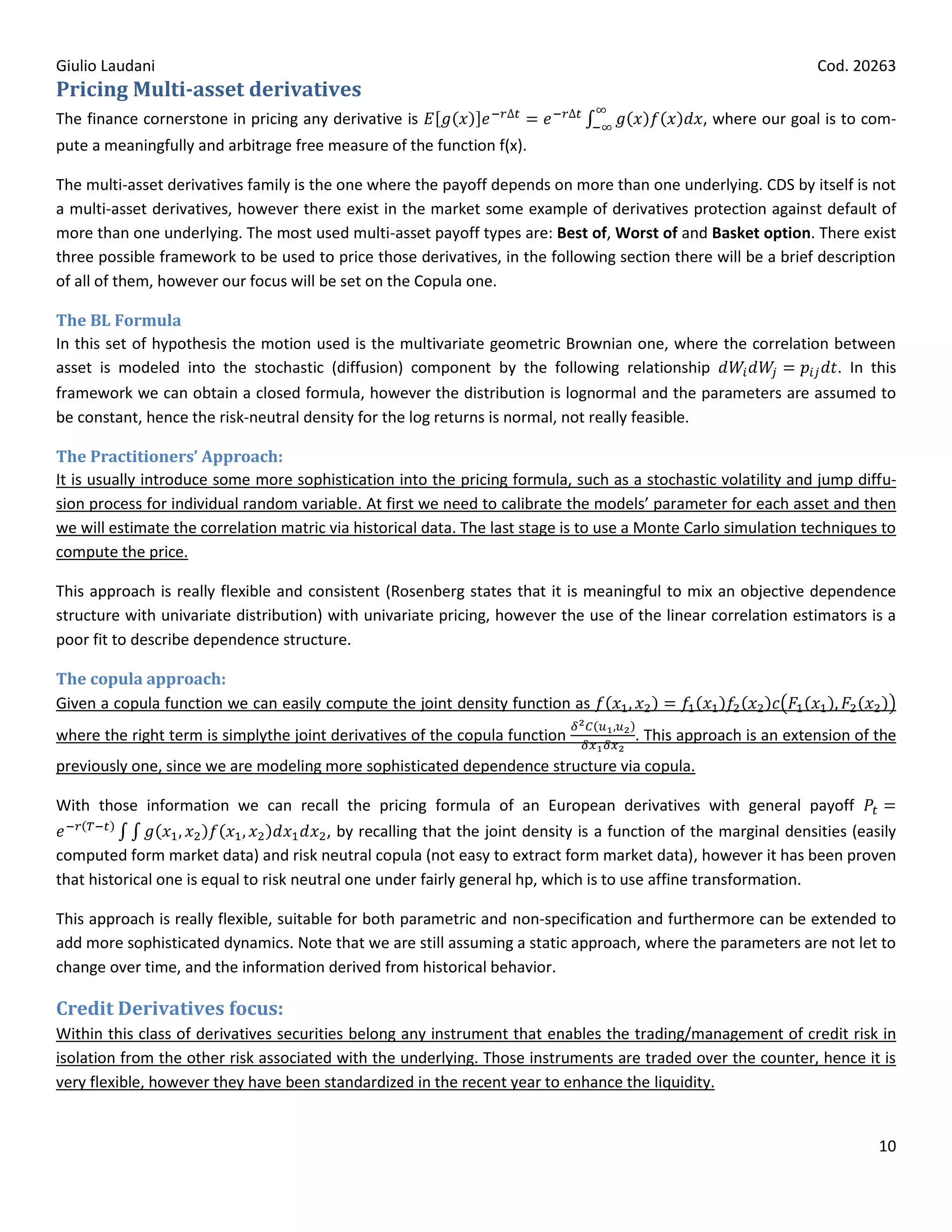

![Giulio Laudani Cod. 20263

Sklar’s theorem [1959]

This famous and import theorem states that Copula can be extracted from a joint distribution with known margins and

that the copula uniqueness is granted if marginal distribution are continuous, vice versathe space of existence of the

copula is the multiplication of the marginal distribution range. The proof relies on the generalized inverse theorem.

The first part of the proof is, by assuming the existence of the joint distribution function

with margins , then exist a Copula , where

(by assuming continuous margin), by substituting we have .

The second part given a Copula (unique) with given margins, we want to prove the existence of joint distribution with

the previously defined margins.

1. We take the vector U with the same distribution of the Copula

2. Then we compute the variable X defined as , where the F are the inverse marginal distri-

bution (used to build the Copula).

3. We then write the distribution function of the variable X

this last term shows the equivalency of the

distribution X (joint distribution) to the Copula, if the margin are assumed to continuous.

Another important result of the theorem is that Copula could be extracted by multivariate joint

tion .Copula is bounded between the Fréchet limit: countermonotocity

( ) [it is a copula only if d<2] and comonotocity , which are two copula function itself.

How to generate a Copula:

Structural model proposes as correlation the asset correlation, basically the equity correlation. Intensity based approach

propose to use for a given time horizon , unfortunately not enough data available for joint obser-

vation. Thus has been proposed a MC algorithm called Li’s model (2000), where by using the hazard rate bootstrapped

from CDS term structure and a given correlation taken from asset correlation, however it is computationally intense

since default events are rare.

If we start form a given copula distribution (the first example will be a Gaussian one) We need to decompose via Cho-

lesky decomposition the correlation matrix (we need to specify a procedure to produce this matrix). We need

to run d-random variable Y and multiply them with A to obtain the variable Z (where A will contribute to give the corre-

lation structure) we will use this variable Z to compute our distribution given a chosen Gaussian copula. To run a t-

copula we need to add a step, basically we need to multiply the variable Z by where v are the degree of free-

dom and s is a random variable generated by a chi-square distribution with “v” degree.

How to fit a copula on empirical data:

A different problems to fit empirical data into a proper copula dependence structure specification, there exist several

methodologies available:

Full maximum likelihood where we will estimates both the copula and margins parameter all together, this me-

thod is of course the more accurate and unbiased, however it is tremendously intense.

IFM or inference function for margins, where we specify a parameter marginal distribution, which will be used

to compute the cumulative probability of the empirical data set, then we will used those probability to run a

6](https://image.slidesharecdn.com/schemacdscopula-130303051812-phpapp02/75/Pricing-CDS-CDO-Copula-funtion-6-2048.jpg)

![Giulio Laudani Cod. 20263

maximum likelihood to estimate the copula parameters. This method highlydepends on the marginsspecifica-

tion, hence it is quite instable

Canonical maximum likelihood is similar to the previous one, however we are going to use empirical marginal

distribution, we are neutral on this side, while we are more focus on the joint dynamics

Method of moments (used by MatLab), basically we are going to use the empirical estimates for some rank cor-

relation measure, which is assumed to be our lead indicator/driver

Type of copula function

All those copula function can be expressed in term of survival probability, they are named survival copula. An index of

the flexibility of the copula dependence structure is the number of parameter in the algorithms, the most flexible pre-

sented is the t-copula (degree of freedom and the correlation)

Implicit types:

In this class of copula belongs all those classes which do not have an explicit formula. The Gaussian [], where the inde-

pendent and the comonoticity , defined only for the bivariate caseare special case of the Gaus-

sian for correlation value equal to 0 or 1. It depends on the correlation variable only, which is a matrix.

The t-student is another example. Note that in this case we do not require the margin to follow a specified distribution

Explicit types:

Closed formula are available for this class of copula. The Fréchet copula is the combination of the three fundamental

copula: independent and the two limits (each of those is an explicit copula). It is a sort of average with coefficients β,

α.We can obtain copula as a linear combination of this fundamental copula as follow

1,…+ ( 1,…), the beta and Alfa describe the dependence structure

Belonging to the Archimedean class we have:Gumbel Copula defined by the equation

Where the variable is the only parameter (not really flexible), it is bounded between 1 and infinite. At

extreme it converge to the independent and to comonotonicity copula. Clayton Copuladefined by the equation

Where the variable is the only parameter (not really flexible), it is bounded between 0 and infinite.

At extreme it converge to comonotonicity the and to independent copula

Meta-distribution:

In this case we not directly apply the Skalar’s theorem. At first we will generate the random variable U (cumulative

probability) form a specified copula function (which is the one that we want to use). We will use those generate va-

riables into a specified marginal inverse distribution to generate our random variables. Basically we have run the apply

the inverse procedure form the top to the bottom

An example is the Li’s model where Gaussian copula is used to joint together exponential margin to obtain a model for

the default times of copula when these default time are considered to be correlated.

7](https://image.slidesharecdn.com/schemacdscopula-130303051812-phpapp02/75/Pricing-CDS-CDO-Copula-funtion-7-2048.jpg)

![Giulio Laudani Cod. 20263

They have been used as risk management tools and as a trading tool to synthetically take exposure on creditworthiness,

in 2012 the whole CDS market (single and multi-name) has a market value equal to 1.666$ billion, this market account

for 72% of the whale derivatives notional amount.

Regulators have add new requirement for accounting/capital requirement for those classes of assets, CVA (risk of coun-

terpart). The elements of this “new” risk are: it is a highly skewed for protection buyer, the buyer riskiness should take

into account (bilateral), the maximum loss is the MTM at default. Possible solutions to hedge this risk are: netting, diver-

sifying the counterpart (not feasible for CDS derivatives), posting collateral (illiquid, require time to acquire) or clearing

house (pricing of those instruments will account for cash). It may be priced we will use the present value of swaption for

each nock (default time) multiplied by the probability of default bootstrapped from CDS. [with structural or reduced ap-

proach] this solution is justified by the economic intuition of the kind of risk undertaken by one considering the position;

basically a default of the counterpart will cause a loss on a random time in the future of a given amount we can hedge it

by buying a swaption so that a random date into the future we will have the option to protect our self against this credit

event. This kind of risk is defined as a Wrong risk, since it will always move against.

Market practice:

CDS is an insurance contract through which one party provides protection (protection seller) against credit risk of sin-

gle/multi entities in exchange of periodic premium payments. These premium are paid on a regular basis (normally

quarterly) until the credit event occurs or till the CDS expiry8.

The spread traded in the market is the annualized premium under the convention act/360, expressed in basis points.

The recent convention is to quote at standard spread (100bp for investment and 500bp for junk bond, US convention)

(European convention has more than two nocks[]) corrected with upfront payment which varies according to the default

risk. In the contract it must be clearly specified which is the credit event considered as a liable at starting date by the

protection seller, furthermore it must be clarify if there will be a cash settlement9or a physical settlement10, which is the

most common11.Possible events are bankruptcy, failure to pay or any restructuring event.CDS starts usually 3 days after

the contract date, spot contract, if longer it will be a forward starting CDS, when the protection seller receive the notifi-

cation it has 72 days to deliver the Cheapest to deliver securities

Pricing a CDS:

CDS market is so liquid that the pricing is led by demand and supply, however there exist two main pricing formulas

needed to price more exotic payoff, for unwinding12 existing CDS positions or in general when we need to assess the

marked to market value of existing CDS position. To perform those tasks we need to specify a model we cannot simply

take the difference between spread, since the credit event is random.

The whole set of possible models available to price a CDS need to properly define the default probability of both the

reference entity and protection seller, their correlation; any cheapest to delivery option granted, the maturity of CDS

and the expectedrecovery rate.

8

The most liquid maturity is the 5 years, followed by the 3,7 and 10 years

9

The seller pays the buyer the face value of the debt minus the recovery rate calculated on the basis of dealer quotes

10

The buyer delivers any deliverable obligation of the reference entity to the seller in return for the notional amount in cash

11

There exist default digital swap agreement, where the amount paid by the seller is pre-determinate

12

To close an existing position there could be three possible solutions: pay any difference to the originator, sell the position to

another counterparty (so the buyer is replaced) and entering in an offsetting transaction with another counterparty

11](https://image.slidesharecdn.com/schemacdscopula-130303051812-phpapp02/75/Pricing-CDS-CDO-Copula-funtion-11-2048.jpg)

![Giulio Laudani Cod. 20263

The first model is the Asset Swap Approach, which intuition lie on the possibility to replicate the CDS payoff with other

trader securities, i.e. an interest swap agreement plus buying/selling the underling bond financed/invested in the repo

market. This approach may sound equal to the CDS poor strategy, however the position on the IRS is not automatically

cancelled in case of default13, that why there is a basis between the two strategies which is equal zero in the long term

(average). Some hedge fund will tray two trade on the two market to make money out of it, by believing in a sort of re-

verse behavior in the long run.

The second one is the Default probability models family, which is divided into structural models and intensity

based/reduced form models14. The first try to estimate the default as a consequence of the reference entity characteris-

tic, limits are that the data (usually accounting based) are not really reliable/transparent, it is not enough flexible to fit

the market structure (there is no fitting procedure, we should believe that our model deliver the same result of the

market (no boundary to constrain the model)) and it is not easy extendable to price CDS. The second focused on model-

ing the probability of the credit event itself, those models are extendable, flexible and the most used one (Tumbull &

Jarrow, 1995).

Those last two models consist on finding into thebreak even CDS spreadequation (latterly defined) the survival probabil-

ity. The break even CDS is found by exploiting the relationship between the premium and protection leg, which must be

equal at origination. Hereafter there are the formulas used to value the two positions.We need to find out the Market to

Market value of the protection and premium legs:

The MTMis equal to [if we are long, negative sing the short position[where the

last term is the expected value of 1bp premium till default or maturity, whichever is the sooner. To assess the

value of the RiskyPV01 we need to understand how we can offset the position:

o Ask the original counterpart to close the position or be replaced by other market participant, in this case

all the P&L is taken immediately

o Create another strategy that allow to receive the spread difference, in this case the P&L is taken during

the remaining life, and the payoff is random, since if the default will came before maturity the flow will

end. Note that there won’t be any default risk since the deliver if offset

The PV01 must be NA and we need to take into account the riskiness/occurrence of each premiums

The Model

Desirable properties of the model are: capture the credit risk of the reference entity; model the payment as percent of

FV, modeling the timing, be flexible ad NA and simple, given the respect of Bid-ASK constrain(model value are within

that spread) and by controlling for the time burden.

The present value of the premium leg will be PMLPV + PVAP, where

where is the contractual CDS spread, is the day count fraction, is the Discount factor and

is the arbitrage free survival probability from 0 to the N payment date. This formula is ignoring the effect of the

premium accrued15 form last premium payment to credit event, to consider this effect the formula will be

13

Furthermore there other factors to be considered: [Fundamental] different payoff, different liquidity, different market participant

and possible friction in the repo market; [Technical] cheapest to deliver option, counterparty risk differential, transaction cost to

package the asset swap

14

The difference is in how the probability measure in the formula has been computed

15

If the accrued premium is not considered the value of CDS is always higher, this effect depends on the RR and default frequency, if

we assumed a flat structure the effect is represent as follow

12](https://image.slidesharecdn.com/schemacdscopula-130303051812-phpapp02/75/Pricing-CDS-CDO-Copula-funtion-12-2048.jpg)

![Giulio Laudani Cod. 20263

, which is hard to be computed, so we will approximate it with

which is an average.

The present value of the protection leg16 is , we are assuming that the payment

is done as soon as the notification is sent, the formula’s idea is to compute the probability of each payment for any time

interval (infinitesimal), it is simplified with a discrete proxy, where twelve nocks per year is a good proxy17.The CDS

Breakeven spread will be . This equation have more variables than equation, so we

will use an iterated process (bootstrapping approach) form short maturity to longer one. The

[]bootstrapping number of variables

The RR is computed with two possible approaches: use rating or Bond price. The first one has limits related with the

rules used to compute rating (American biased, different definition of default).The second is to extract info form bond

price, however it is not good for good name, where the effect of the RR is negligible

The intensity-based model consists on modeling the probability of credit events itself as a certain jump process, like a

Poisson counting process or more sophisticated one, where the credit event is the jump occurrence. This class is elegant,

very easy to be calibrated, however there is no clues on what is driving the default, so we cannot know how far the

company is from the credit event. By calling with the intensity measure we can assume COX process to model

how it varies as new information arrives(continuous) from the market, so that the survival probability will be

, or alternatively we can use a time varying deterministic intensities where the lambda is made piecewise

constant and the survival probability or lastly by assuming that the lambda is constant through

time and independent from RR and interest rates, i.e. the hazard rate term structure is flat for all maturity. When we

have decided the term structure of lambda we can compute the CDS spread, on the other hand from the market CDS we

can bootstrap a term structure of hazard rates and survival probabilities.

The two authors used a Poisson counting process to predict credit event which occur at time τ

, so the probability measure depends on a time dependent function (hazard rate) and time interval. The hazard

rate are usually assumed to be deterministic. The hazard rate risk neutral are higher than the historical one, since the

first will account for more factors (liquidity for instance). Note for inverted curve it could be a case to obtain negative

hazard rate, this may be an arbitrage (model dependent or independent)

Our model needs, to compute the hazard rate, the interest rate structure and a sound estimates of RR, we also assumed

to deal with continuous function, discretized to ease the math.

The structural models are based on the general idea that the firms’ value follows a stochastic process and when this

value goes below a certain amount the default occurs. This class is intuitive and linked to tractable value, however we

need accounting data18. The most simple example is the Merton model (1974), where the CDS is the overhead of the

effective return on the investment and the significant risk free.

16

We were assuming that the number of possible credit event is finite, in this case one per month

17

The proxy is r/2M difference, assuming flat structure

18

Recent papers show that it is not consistent to really upon balance sheet data, since they are dirty measure and may not consider

real transaction and data. Those papers had shown a superior information ratio from rating agency outcome

13](https://image.slidesharecdn.com/schemacdscopula-130303051812-phpapp02/75/Pricing-CDS-CDO-Copula-funtion-13-2048.jpg)

![Giulio Laudani Cod. 20263

The passage to arrive to this relation is to set the company values as the sum of Equity (which is described as a call) and

the debt position which is , where “r” is the risk free since we are hedging our position with the short put.

Economic principles told us that the risk free position made by shorting the put is equal to the risky present value of the

notional debt amount, by exploiting this we will compute the risky return as function of the previous findings. Note that

the volatility value is the implied value of the stock market value (reversing the BL formula)

This model is over-semplicistic, in fact it has a poor fit, especially for investment grade bond or low spread period, the

academia has come out with lots of possible extension. The structural model allow to find a “fair CDS” to be compared

to the market data, so that to start possible trading strategy, the name of those strategies is relative value.

CDS typologies and CDO financial product:

A basket or Index CDS is built by considering the most liquid securities and dividing into investment grades nocks (for

example the iTraxx 125 is a proxy of the best 125 European and Asian companies, in North America and emerging mar-

ket we have the dow jones CDX).

Those index are highly standardized: Every six month a new index is launched (20 march and September), hence on the

run index are most liquid one (note that the index will continue to exist till all the company into the basket will default),

those index are divided into sub sector activity and credit worthiness (investment, cross over and High yield [typically

the lower grade considered is B]). If one company default the buyer will continue to pay the premium on the remaining

notional and he will receive the n-defaulted notional. Each reference entity is equally weighted, hence the premium paid

is close to an equally weighted average of the single name CDS.

The payment is settled every quarter and the difference between index spread and single name average is called index

skew and it is due to different liquidity in the instrument, where the first has an higher one. Index are more used since

they have lower bid ask spread, diversification, standardization.The correlation won’t pay any role since premium and

payment depends sole on each underlying asset

The CDO securities are bonds issued on basket of other asset which benefit the cascade or trenching credit enhancing,

to price this securities we need to define a loss function. Related to the previous point there are the definition of the

tranche default probability , where the first is the cumulative loos function

and the second is . Basket securities may have a n-to default optionality, where the pro-

tection seller is liable to pay only when the n reference entity has defaulted. The CDO pricing is

We can extract the implied correlation used to price the CDO, it is suggested a one factor model with LHP approach [].To

bootstrap the implied correlationcompound and based correlation []

The first is assuming a flat correlation that reprise each tranche to fit market value (we can use historical data), the re-

sult shows a smile, higher level for equity (lower implied correlation than historical one, but high sensitivity) and senior

tranches; mezzanine are cheap in correlation due to the higher demand. The second consists on set the base tranche

with the equity one, the other are bootstrapped and are long combination of the equity one; the correlation in this

model is an increasing function (winner take all, while the senior bear the “hazard risk”)

CDO is a security backed with a different pool of debt obligations (loan, bonds, other CDO and other structured product).

[add the process of origination]

[ad the tranching process and benefits]

14](https://image.slidesharecdn.com/schemacdscopula-130303051812-phpapp02/75/Pricing-CDS-CDO-Copula-funtion-14-2048.jpg)

![Giulio Laudani Cod. 20263

CDO are sold to remove asset from balance sheet and to refinancing the originator and to exploit the arbitrage granted

by the tranches pricing system, creation of value by credit risk transformation.

To price CDO tranches we need to define: the attachment point19, tranche width, portfolio credit quality, RR, maturity

and default correlation. From those elements we need to define the Loos distribution, which features are to be highly

skewed (the more, the lower the correlation), monotonically decreasing when the correlation increases and U shaped

(the higher the correlation).

[]

Sensitivities:

A single name CDS is affected by:

Changes in the CDS spread

RR estimates hypothesis

Counterparty risk

A more structured product is affected by the correlation between reference entity and change in CDS spread both in

index and single name.

Hedging:

At first we need to decide if we are going to use index or single name CDS, later one we need to compute the delta

hedging (numerically defined as the ratio between the product and its underling percent change given a change in the

CDS spread).

Each tranche has a specific hedge ratio, it is higher for equity tranches, lower for senior one, since the likelihood of

losses absorbed by the junior tranches. Furthermore the cost depends on the CDs used (index is by far more costly), sin-

gle name CDS are more costly for equity tranche if the reference entity is riskier, the reverse for the senior, the econom-

ic rationale is that an increase of the CDS spread for good quality entities is a signal of overall deterioration of the

backed securities. Making more probable a loss for senior tranche, basically all the entities is going to default all togeth-

er.

The second derivatives sensitivity to CDS spread is negative for equity and positive for senior, while mezzanine depends

on the CDO capital structure. The economic rational is: senior are more sensible to deterioration of the credit quality

since they might be affected.

Those methods highly depends on model assumption on valuing the position and the sensitivity, making them really in-

stable and costly (dynamic rebalance is frequent due to the instability of the estimation), moreover the market still

doesn’t provide a consensus on the most appropriate model. Hence we may account for model, miss specification risk

Sensitivity to correlation (change in MTM by a change of 1% of correlation) is related to the gamma one, since equity

are long (winner, win all), senior are negative (riskier scenario in case of default clustering), mezzanine are typically neg-

ative

19

That is the lower and upper bound of the loss for each given tranche

15](https://image.slidesharecdn.com/schemacdscopula-130303051812-phpapp02/75/Pricing-CDS-CDO-Copula-funtion-15-2048.jpg)