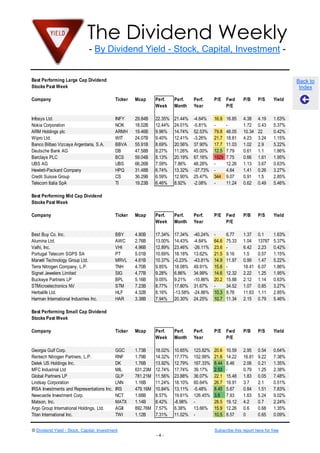

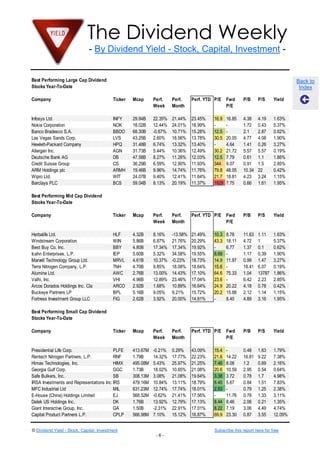

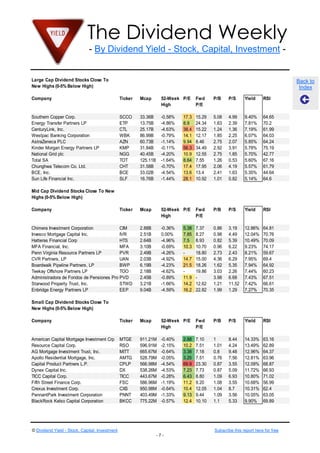

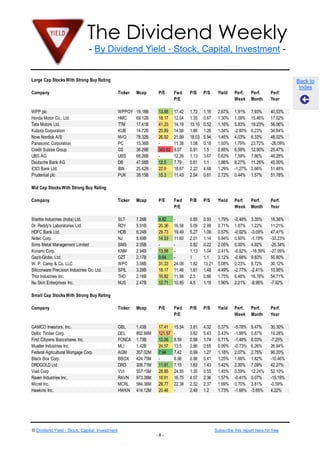

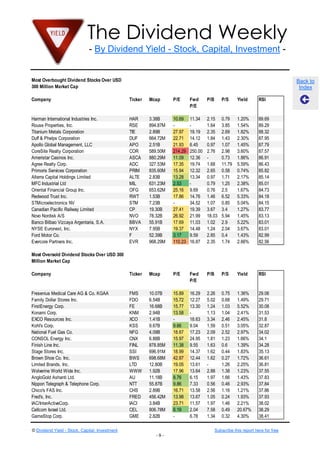

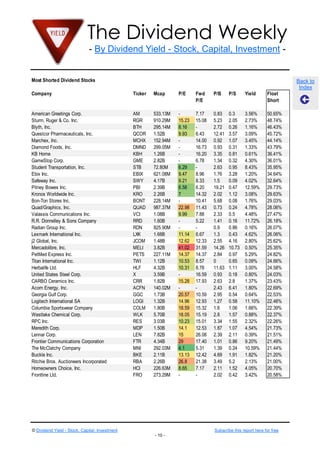

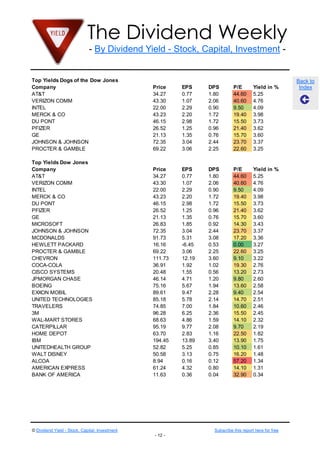

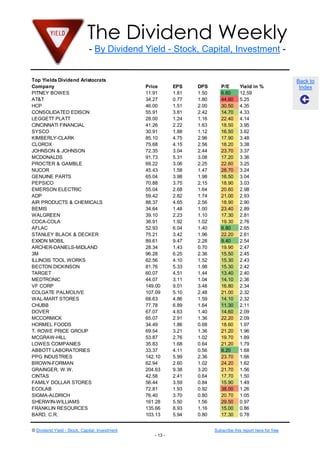

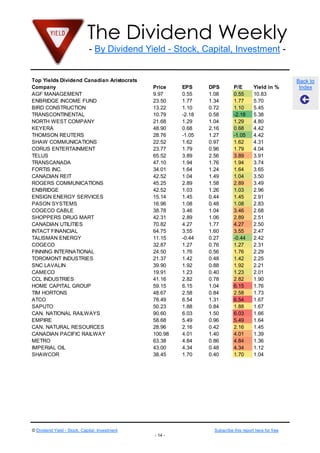

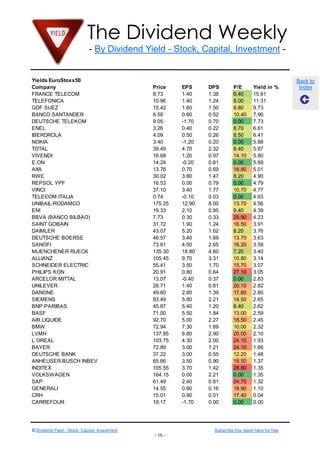

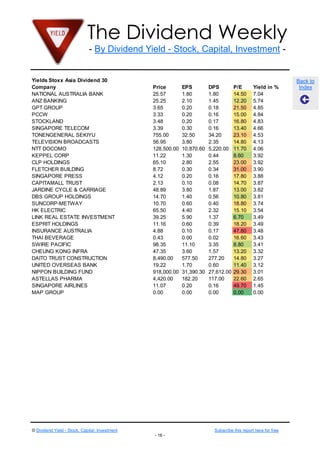

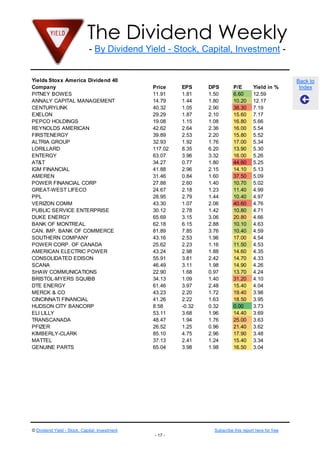

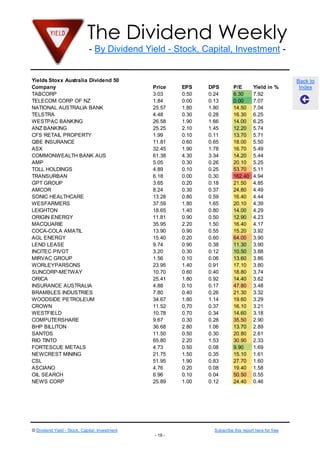

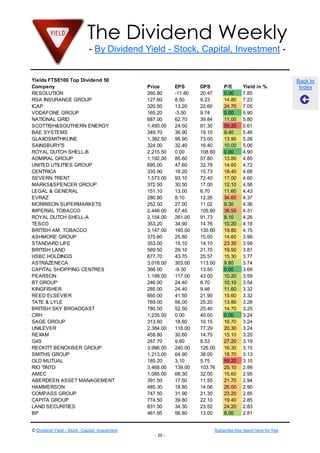

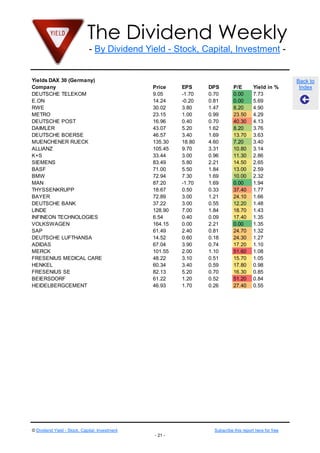

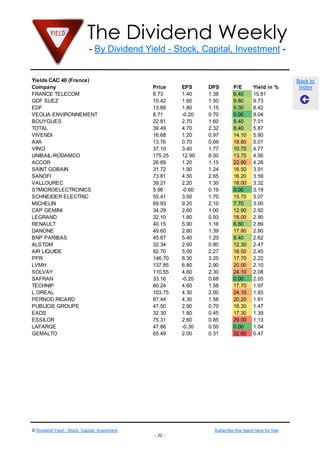

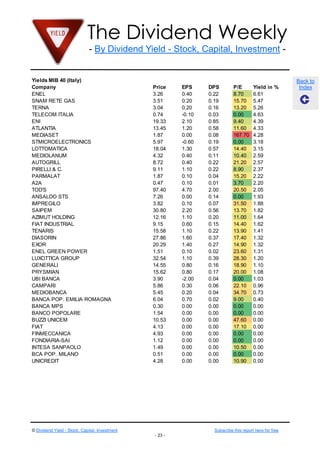

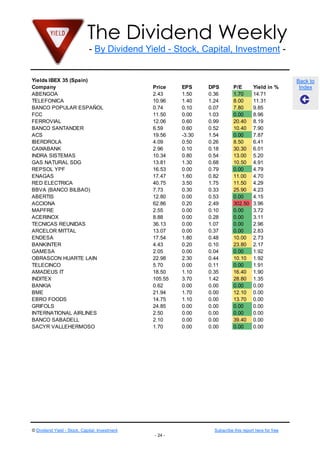

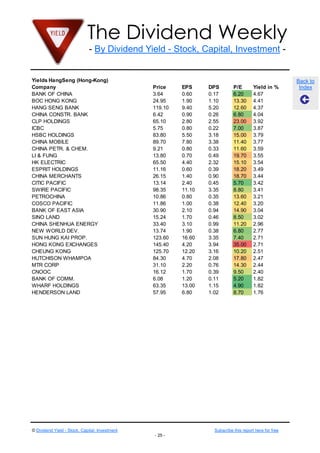

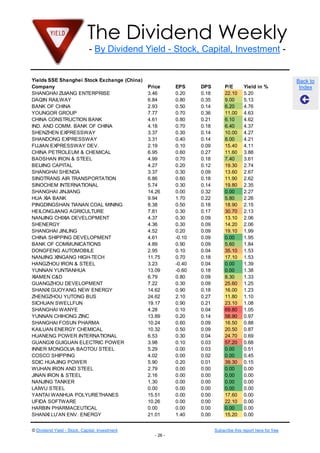

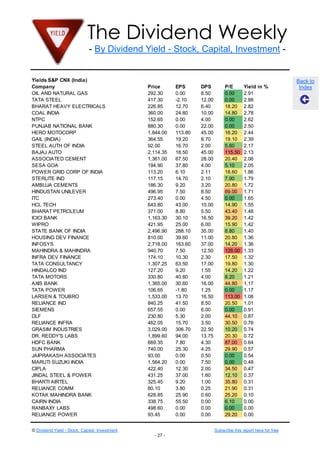

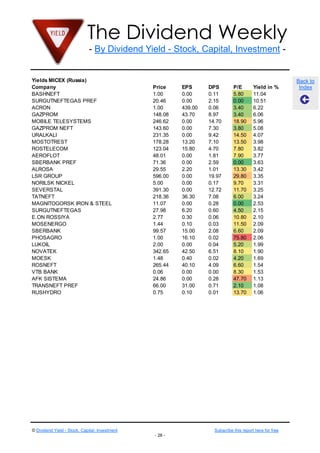

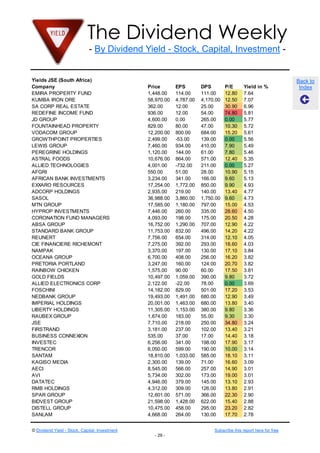

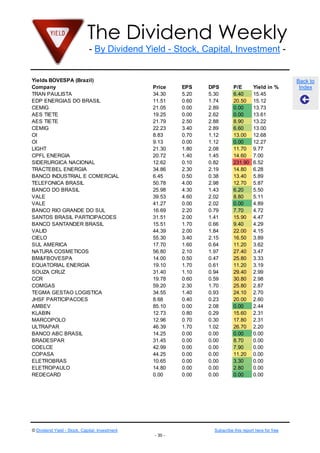

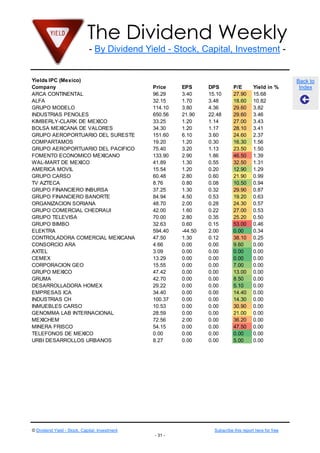

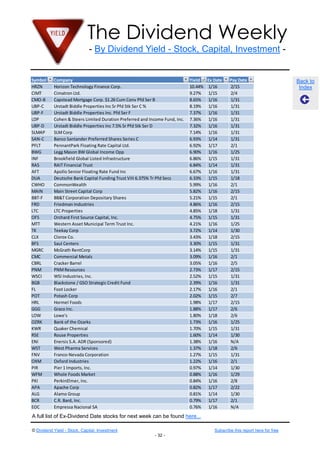

The document presents a comprehensive report on dividend yields, featuring a list of various high-yield dividend stocks across multiple sectors, including technology, healthcare, and utilities, as of February 2013. It highlights best-performing stocks, categorized into large, mid, and small-cap stocks, alongside their performance metrics and recommended purchase strategies. Additionally, the document offers insights on dividend champions and champions, providing recommendations and a subscription service for regular updates.