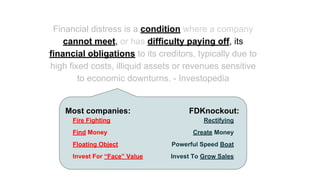

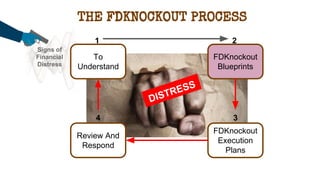

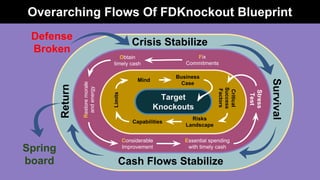

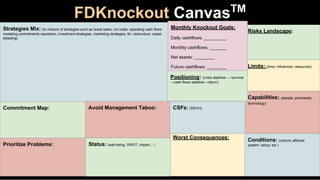

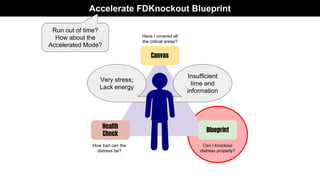

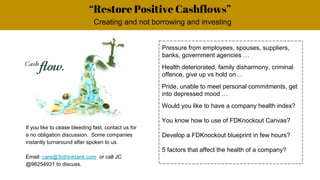

The document discusses a solution called fdknockout, designed to restore positive cash flows for companies in financial distress by creating a strategic blueprint to improve financial health quickly. It emphasizes the urgency of addressing financial challenges and provides a structured approach to stabilize cash flows and ensure survival. Additionally, it highlights the importance of timely intervention and offers a means for companies to assess their financial situation and the factors affecting their performance.