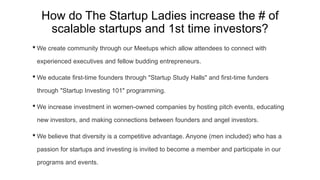

The document provides information about an angel investing conference held by VisionTech Angels. It includes details about the conference sponsors and speakers, including Oscar Moralez, founder of VisionTech Partners, who discusses what angel investors are and VisionTech Angels' investment process and criteria. Kristin Cooper, CEO of The Startup Ladies, discusses her organization's mission to support women entrepreneurs and how they work to increase the number of startups and first-time investors. The document concludes with brief introductions of additional speakers at the conference.