This document summarizes the findings of a study by IBM that surveyed over 5,000 C-level executives from over 30 countries. The key findings were:

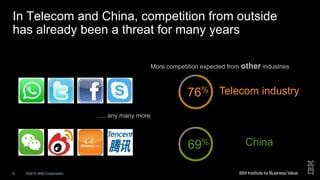

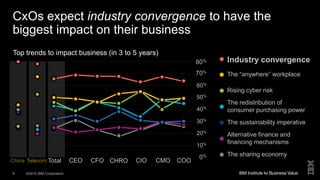

1) Executives feel increased competition, both from within their industry and outside from other industries, especially due to new digital business models like Uber.

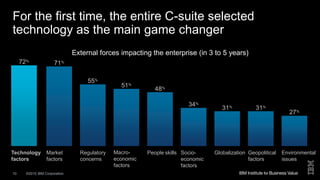

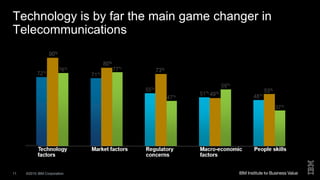

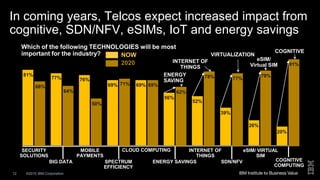

2) Technology changes, especially cognitive computing, were seen as the main driver of changes to business over the next 3-5 years.

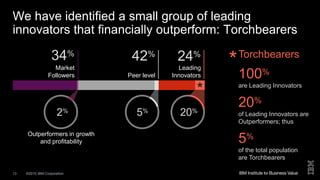

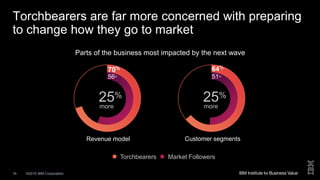

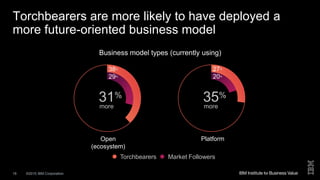

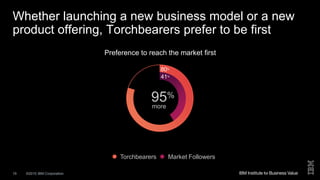

3) The study identified "Torchbearers", innovative companies that were early adopters of new technologies and business models and outperformed financially as a result.

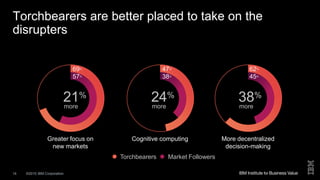

4) Torchbearers embraced strategies like decentralized decision making, a focus on new markets,