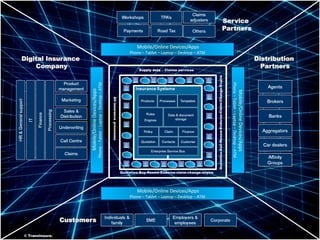

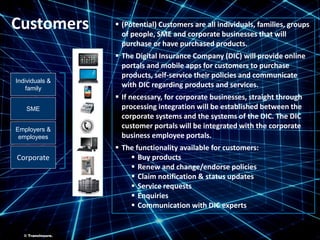

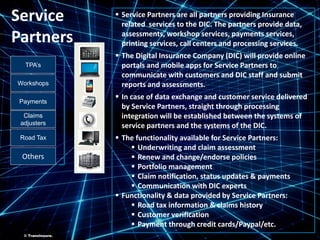

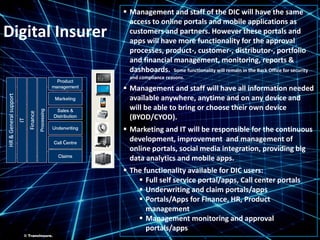

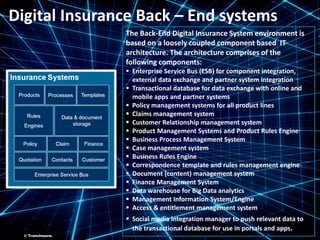

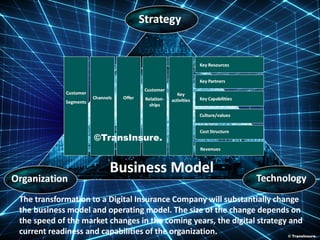

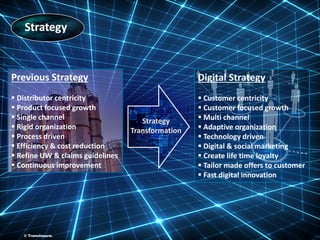

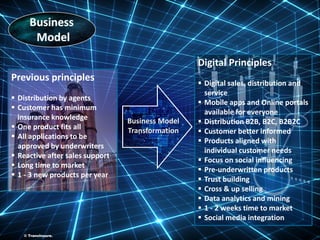

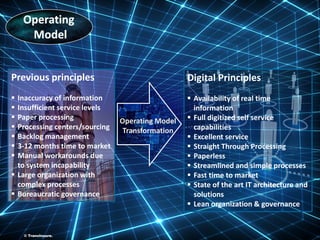

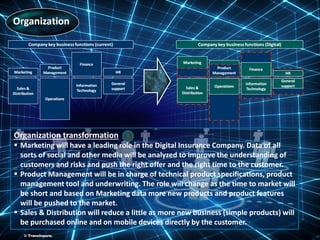

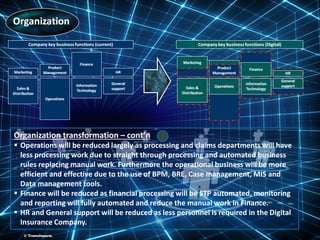

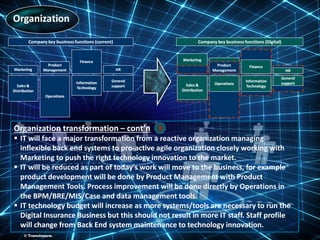

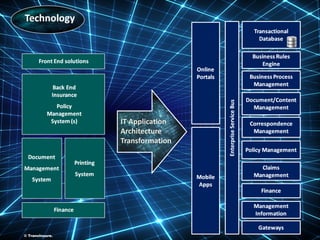

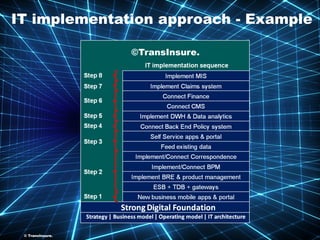

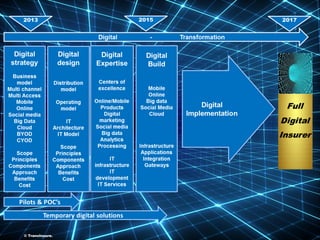

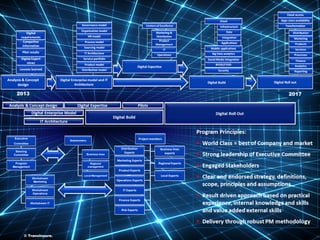

The document discusses the transformation of traditional insurers into digital insurance companies, emphasizing the need for customer-centricity, automation, and real-time data access. It outlines the digital strategies and principles necessary for this transition, including the use of mobile and online portals for self-service and streamlined processes. Additionally, it describes the implications for various roles within an insurance organization as it adapts to a technology-driven market.