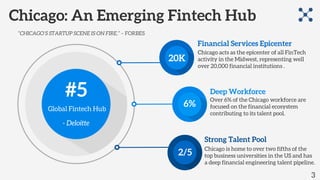

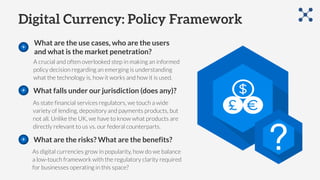

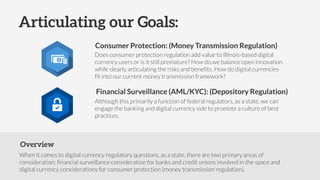

The document outlines Illinois' regulatory perspective on digital currency, highlighting the state's financial innovation initiative and the importance of fintech in Chicago. It emphasizes the need for collaboration among regulators and innovators to facilitate a regulatory framework that promotes innovation while ensuring consumer protection. The document suggests a light-touch regulatory approach, focusing on ongoing assessment and guidance to adapt to the evolving landscape of digital currencies.