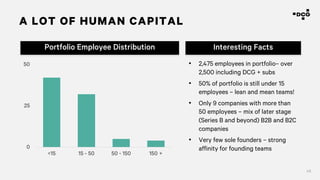

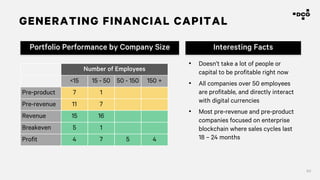

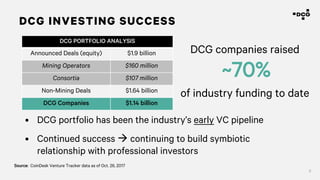

The Digital Currency Group (DCG) focuses on building a robust ecosystem to support the growth of digital currencies and blockchain technology, emphasizing their transformative potential for financial markets and global economies. In 2017, they reported significant portfolio growth, with investments in over 110 companies across 28 countries, and outlined their investment strategy targeting various stages and areas within the industry. The company is cautiously optimistic about the emergence of new asset classes while acknowledging the risks and challenges, including regulatory scrutiny and market volatility.

![18

• China crackdown on bitcoin (yes, again) and ICOs

• Scaling debate rages on

• Everybody is making money -> everybody is a trading/investing genius

• Over 100 crypto funds in the market raising capital

• ICO overload – greed and reckless investing permeates the space

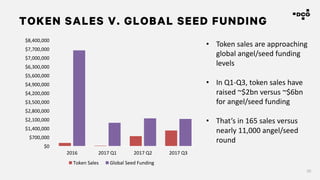

• Huge disconnect in valuations between ICOs and seed/Series A financings

• First Unicorns built – Coinbase & Ripple

• “Experts” weigh in and declare bitcoin is [pick one: fraud/Enron/ponzi/bubble/tulip]

• Massive transaction volume growth in South Korea, Japan, Mexico

• Futures and derivatives markets opening up

• Institutional investors starting to dig in, but not investing yet

INDUSTRY STATE OF AFFAIRS](https://image.slidesharecdn.com/dcgtechsummitpublicshare-171102111517/85/DCG-Tech-Summit-Opening-Remarks-18-320.jpg)