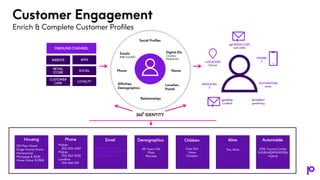

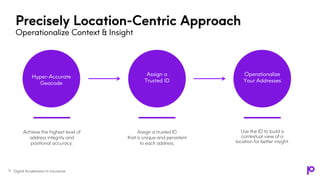

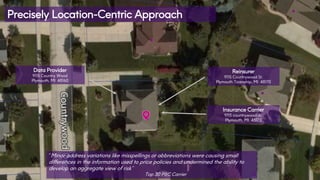

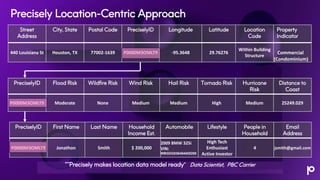

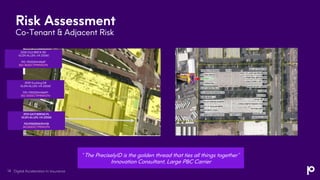

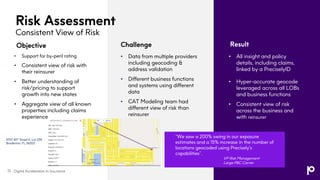

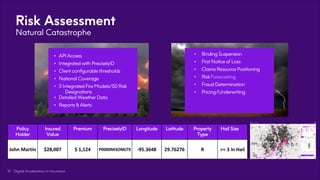

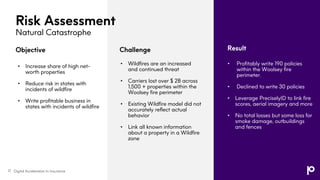

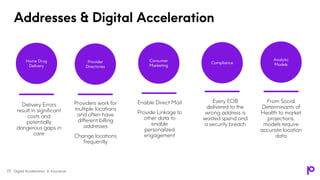

The document discusses the importance of digital acceleration in the insurance sector, emphasizing the critical role of data for innovation and customer insights. It highlights various strategies for leveraging data analytics, improving customer engagement, and enhancing operational efficiency across multiple functions such as underwriting and claims management. Ultimately, it outlines how accurate data integration and enriched customer profiles can significantly transform the insurance industry by driving growth and risk assessment.