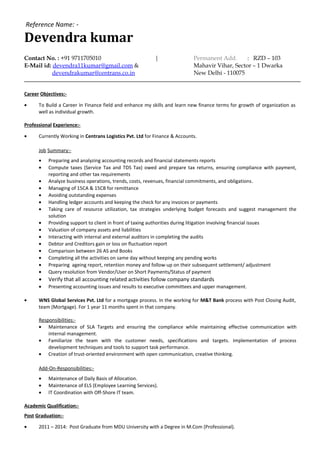

Devendra Kumar is seeking a career in finance with over 5 years of experience. He currently works at Centrans Logistics Pvt. Ltd handling accounting, taxes, financial reporting, and analysis. Previously, he worked at WNS Global Services Pvt. Ltd for over 1 year supporting a mortgage process. Devendra holds an M.Com degree and B.Com degree and has attended seminars on topics like PMJDY, TDS, and Service Tax. He is proficient in Microsoft Office, Advanced Excel, and Tally ERP-9.