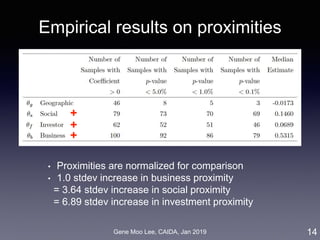

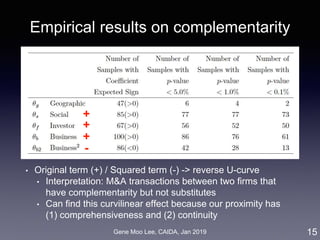

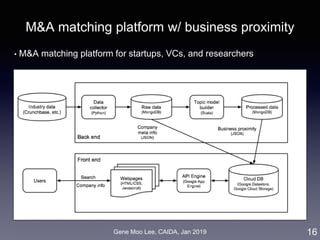

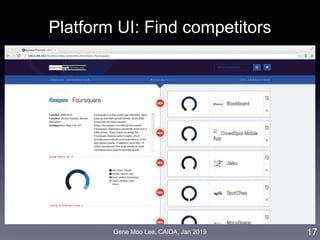

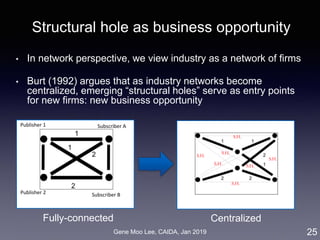

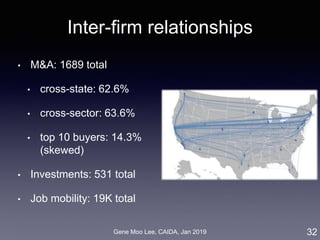

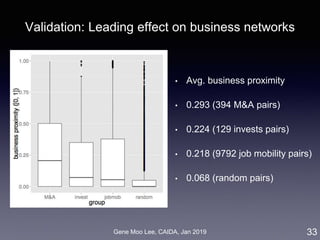

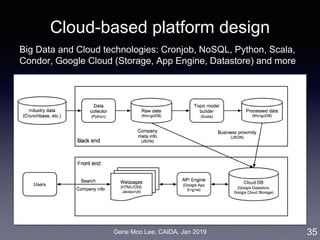

The document discusses the development of a big data analytics framework for industry intelligence, focusing on business analytics and the challenges of unstructured data. It details an approach using machine learning, particularly topic modeling and network analysis, to analyze industry dynamics and improve measures of business proximity among firms. Additionally, it outlines a matching platform for mergers and acquisitions (M&A) leveraging business proximity insights to enhance decision-making for startups and investors.

![Gene Moo Lee, CAIDA, Jan 2019

Our approach on business proximity

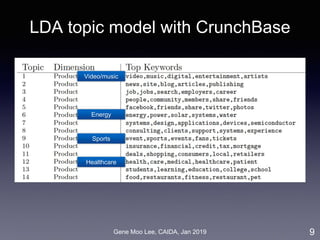

• Approach: LDA topic modeling [Blei et al. 2003]

• Unsupervised learning to discover latent “topics” from a large

collection of documents

• Business proximity = cosine similarity of topic distributions

7

LDA

Industry-wide topics

Company’s topics

Company

descriptions](https://image.slidesharecdn.com/20190121caidagene-190122174454/85/Developing-A-Big-Data-Analytics-Framework-for-Industry-Intelligence-7-320.jpg)

![Gene Moo Lee, CAIDA, Jan 2019

ERGM for M&A network

ERGM (Exponential Random Graph Model):

• Based on random graph [Erdos and Renyi 1959]

• Probability of realizing a graph = a function of the graph’s

statistics [Robins et al. 2007]

• Inter-firm proximity: business, geographic, social, co-invest

• Selective mixing: 50 states, 30 industry sectors

• Degree distribution: node degree, M&A experiences

11

degree selective mixing proximity](https://image.slidesharecdn.com/20190121caidagene-190122174454/85/Developing-A-Big-Data-Analytics-Framework-for-Industry-Intelligence-11-320.jpg)

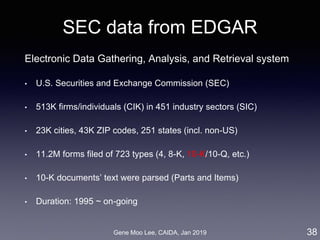

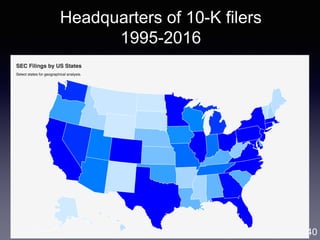

![Gene Moo Lee, CAIDA, Jan 2019

Data: Annual reports of U.S. public firms

• Form 10-K filings from SEC EDGAR: 165K reports (1995-2016)

• Use doc2vec [Le & Mikolov 2014] to get semantic vectors of 10-Ks

• Data: IPO/delisting events, financial and accounting metrics

27](https://image.slidesharecdn.com/20190121caidagene-190122174454/85/Developing-A-Big-Data-Analytics-Framework-for-Industry-Intelligence-27-320.jpg)

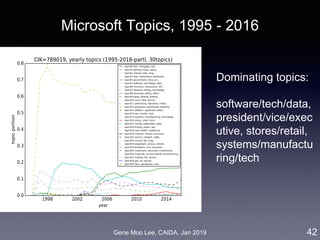

![Gene Moo Lee, CAIDA, Jan 2019

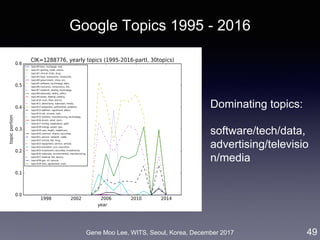

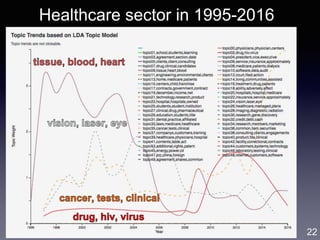

Analysis I: Trend analysis with LDA

• Approach: LDA topic modeling [Blei et al. 2003]

• Unsupervised learning to discover latent “topics” from a large

collection of documents

• Each document is represented as a distribution over the topics

41

LDA

Industry-wide topics

Company’s topics

Business

descriptions

(10-K)](https://image.slidesharecdn.com/20190121caidagene-190122174454/85/Developing-A-Big-Data-Analytics-Framework-for-Industry-Intelligence-41-320.jpg)

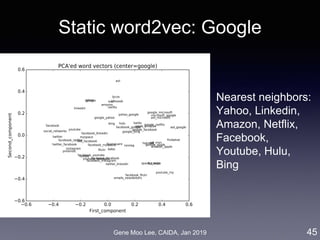

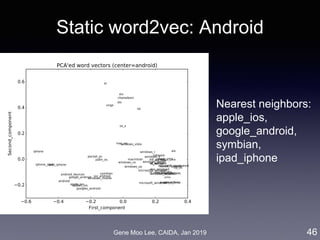

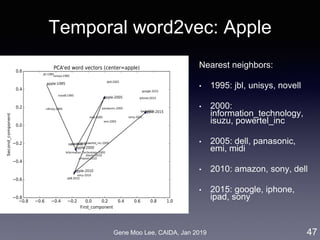

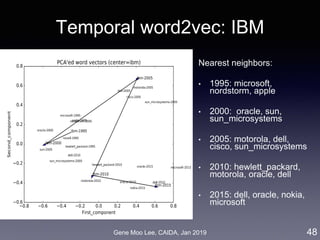

![Gene Moo Lee, CAIDA, Jan 2019

Analysis II: Competitive analysis with word2vec

• Approach: word embedding called word2vec [Mikolov et al. 2013]

• Represent words in a high-dimensional vector space where

semantically similar words are nearby

• Train a model that maximizes prediction of words co-occurrence

(K words before/after the focal word)

• Competition level = distance between word vectors

44

Word2Vec

Business

descriptions

(10-K)](https://image.slidesharecdn.com/20190121caidagene-190122174454/85/Developing-A-Big-Data-Analytics-Framework-for-Industry-Intelligence-44-320.jpg)