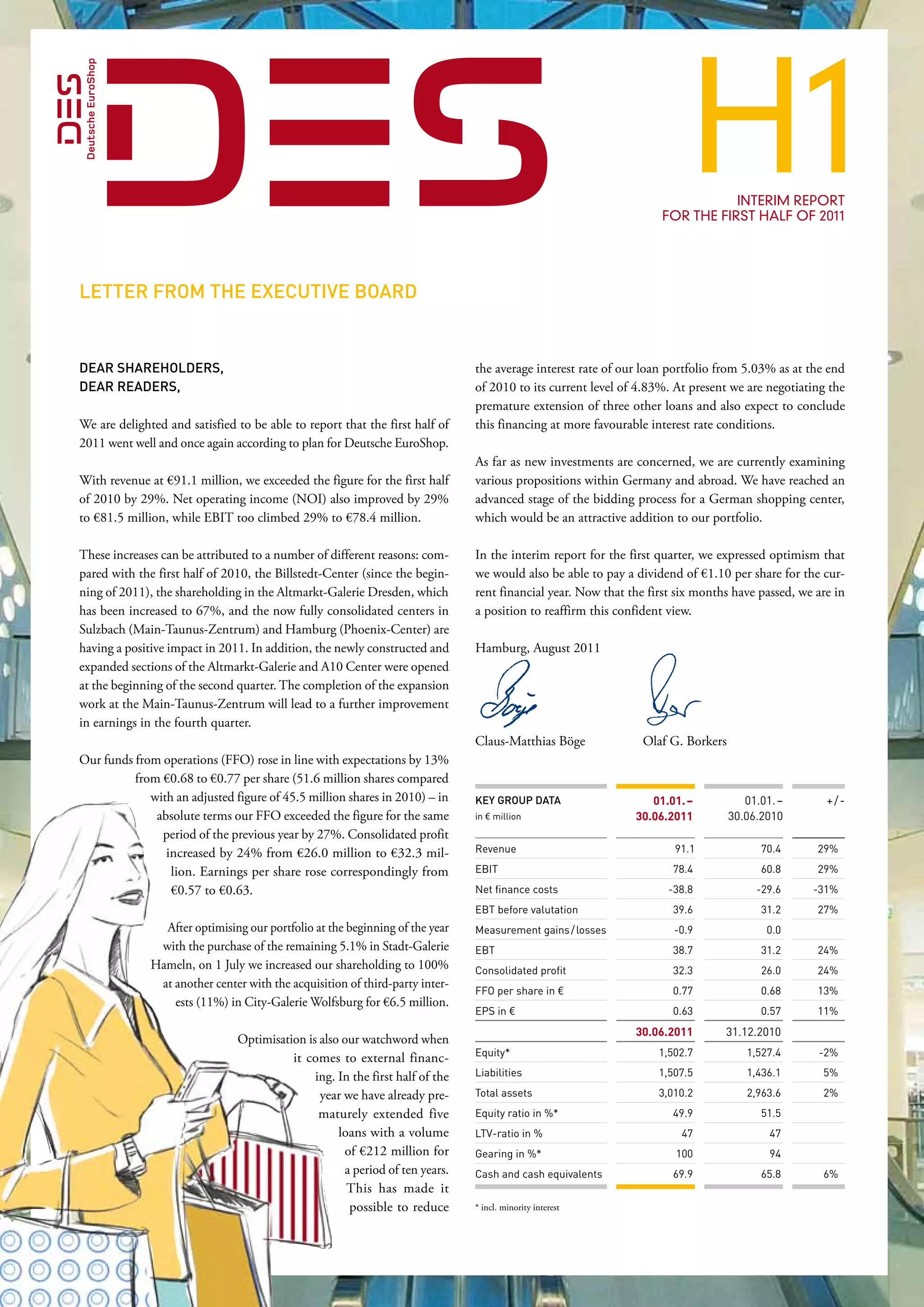

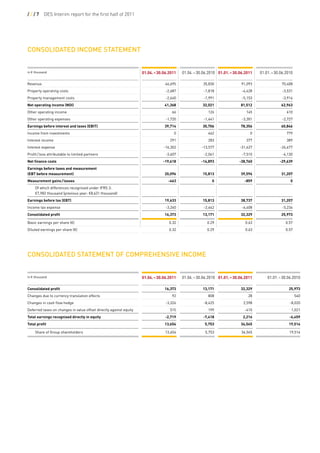

This interim report provides key financial information for Deutsche EuroShop for the first half of 2011:

- Revenue increased 29% to €91.1 million compared to the first half of 2010, due to acquisitions of new shopping centers.

- Funds from operations rose 13% to €0.77 per share, an absolute increase of 27% compared to the same period last year.

- Consolidated profit increased 24% to €32.3 million and earnings per share rose to €0.63.

- Deutsche EuroShop acquired additional interests in existing shopping centers and one new shopping center, expanding its portfolio.