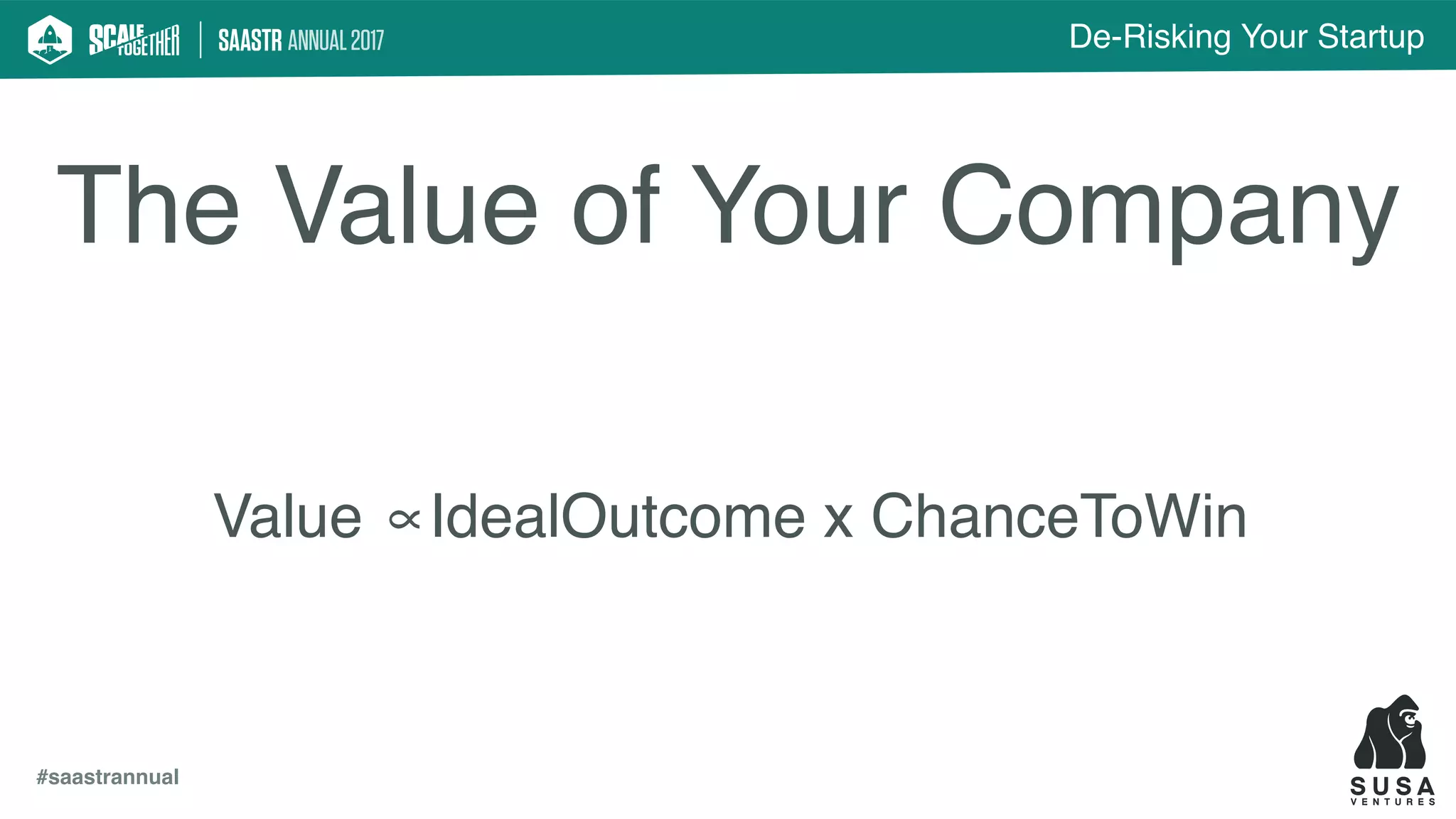

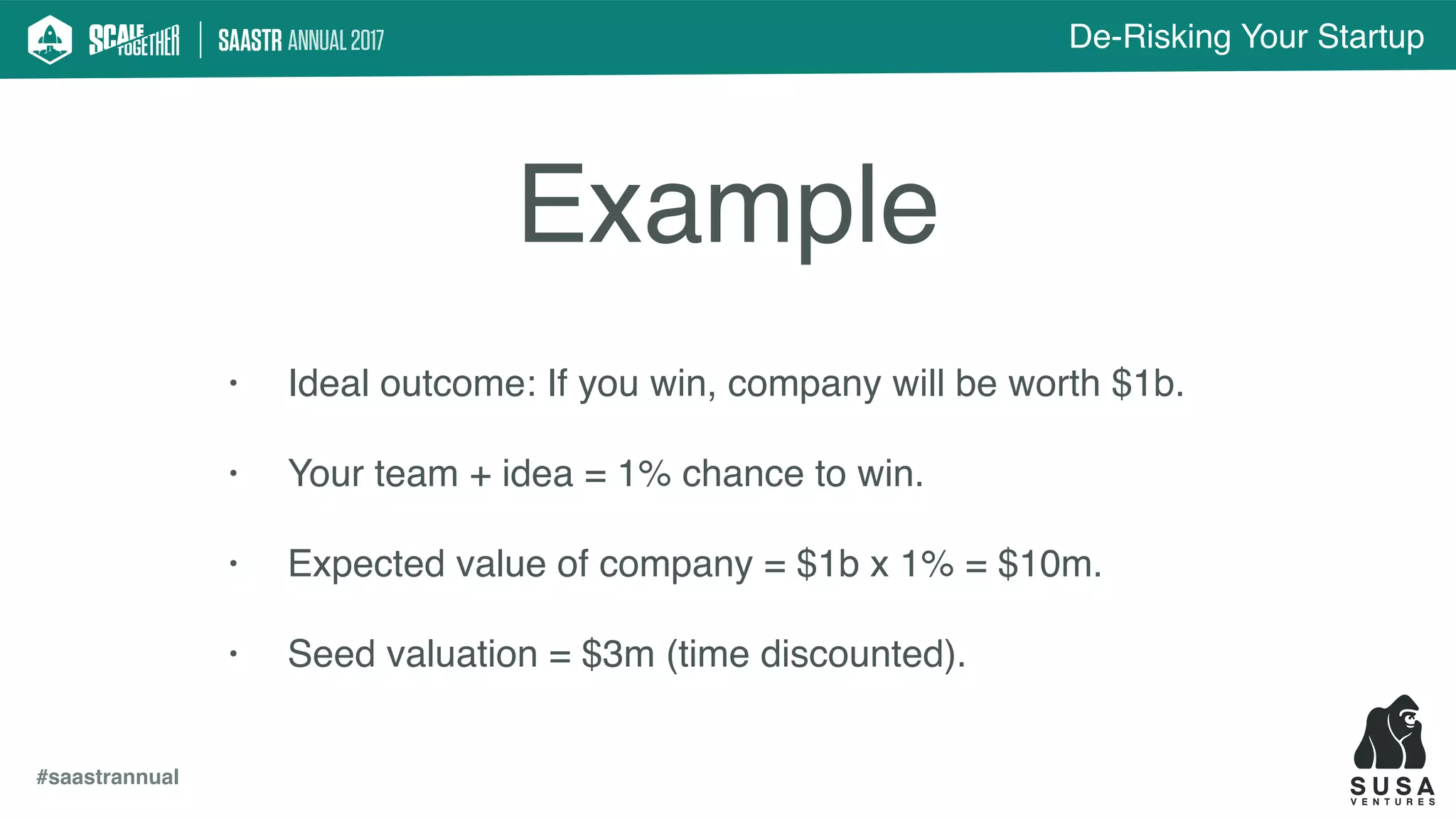

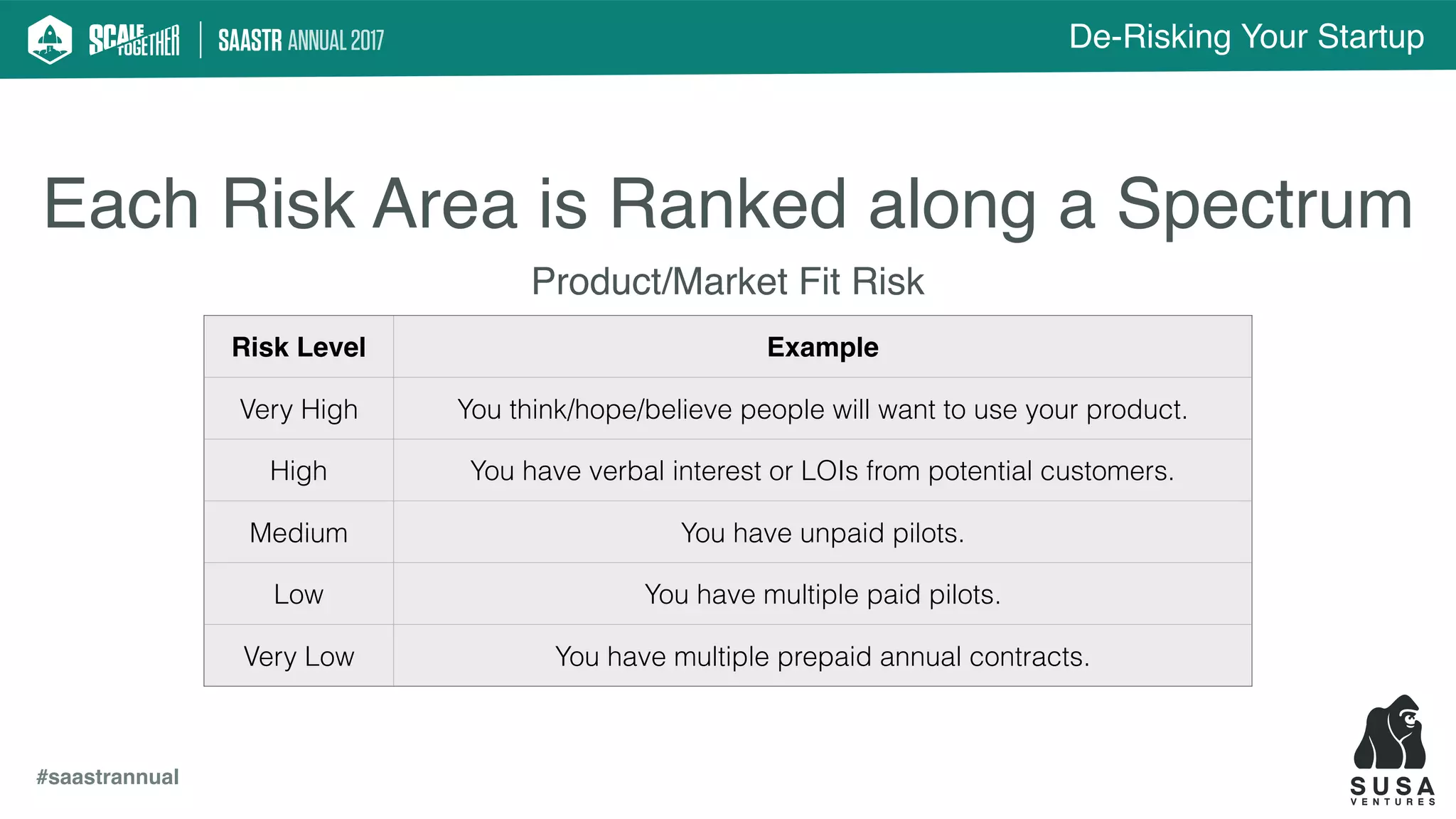

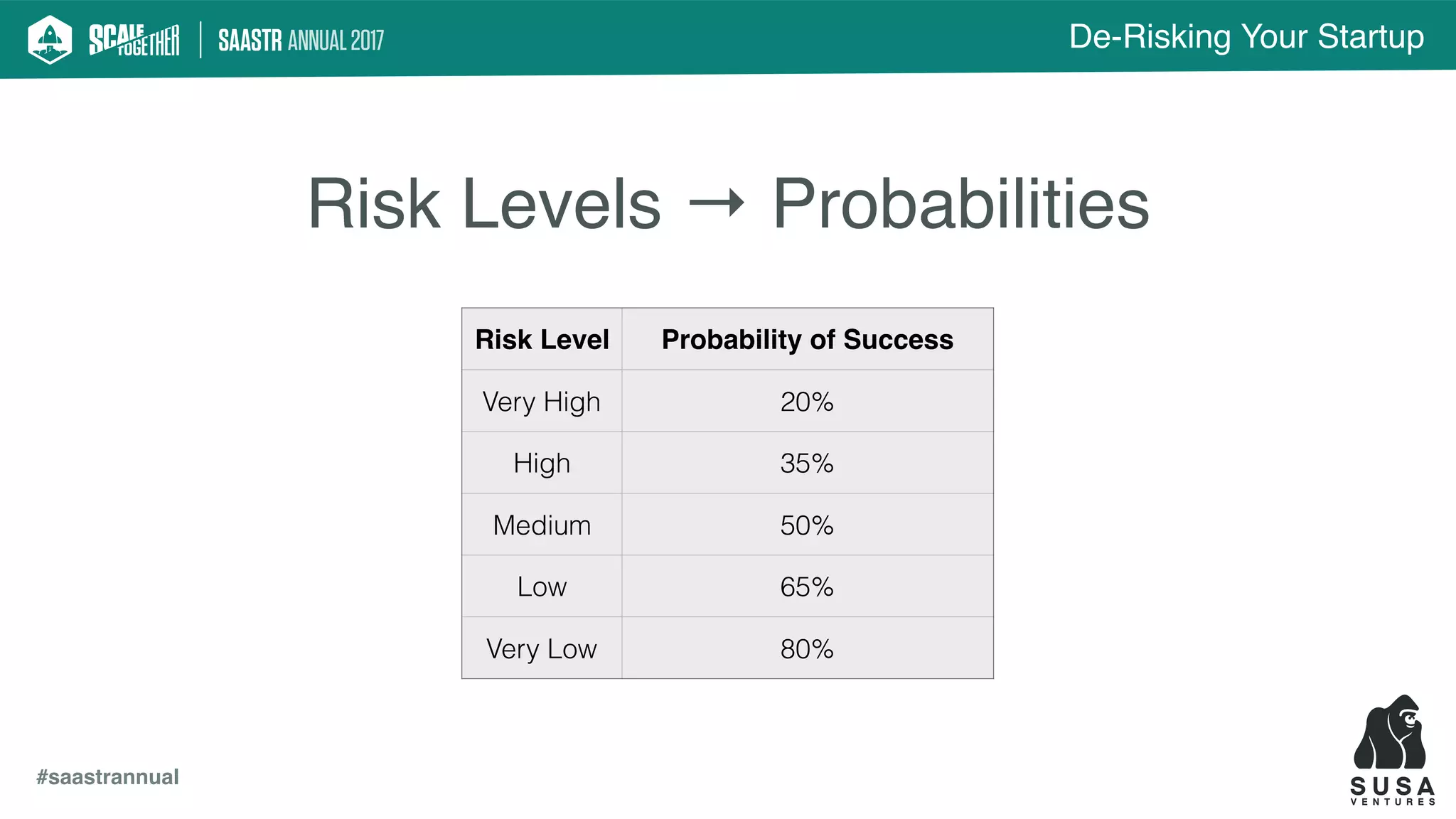

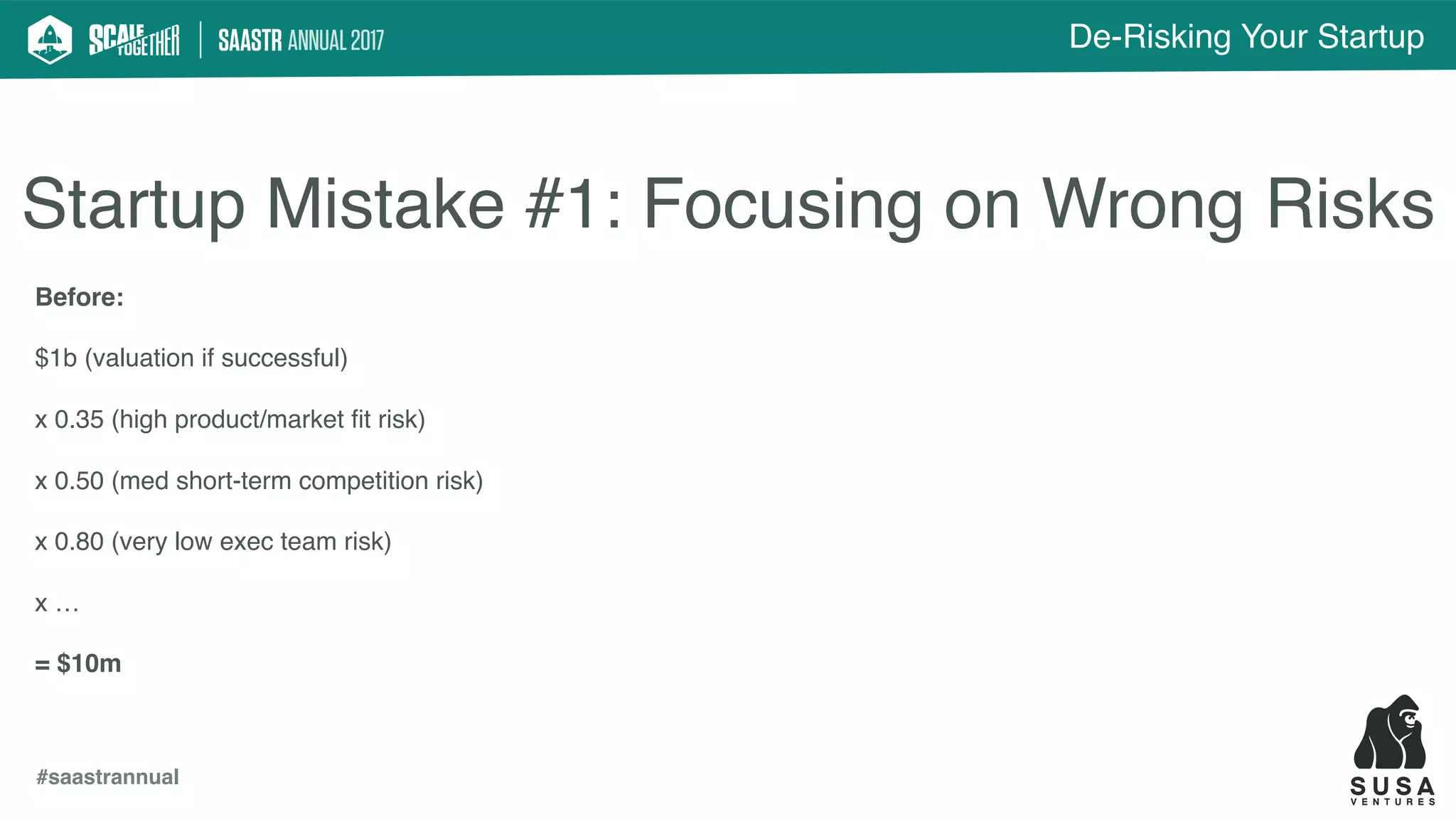

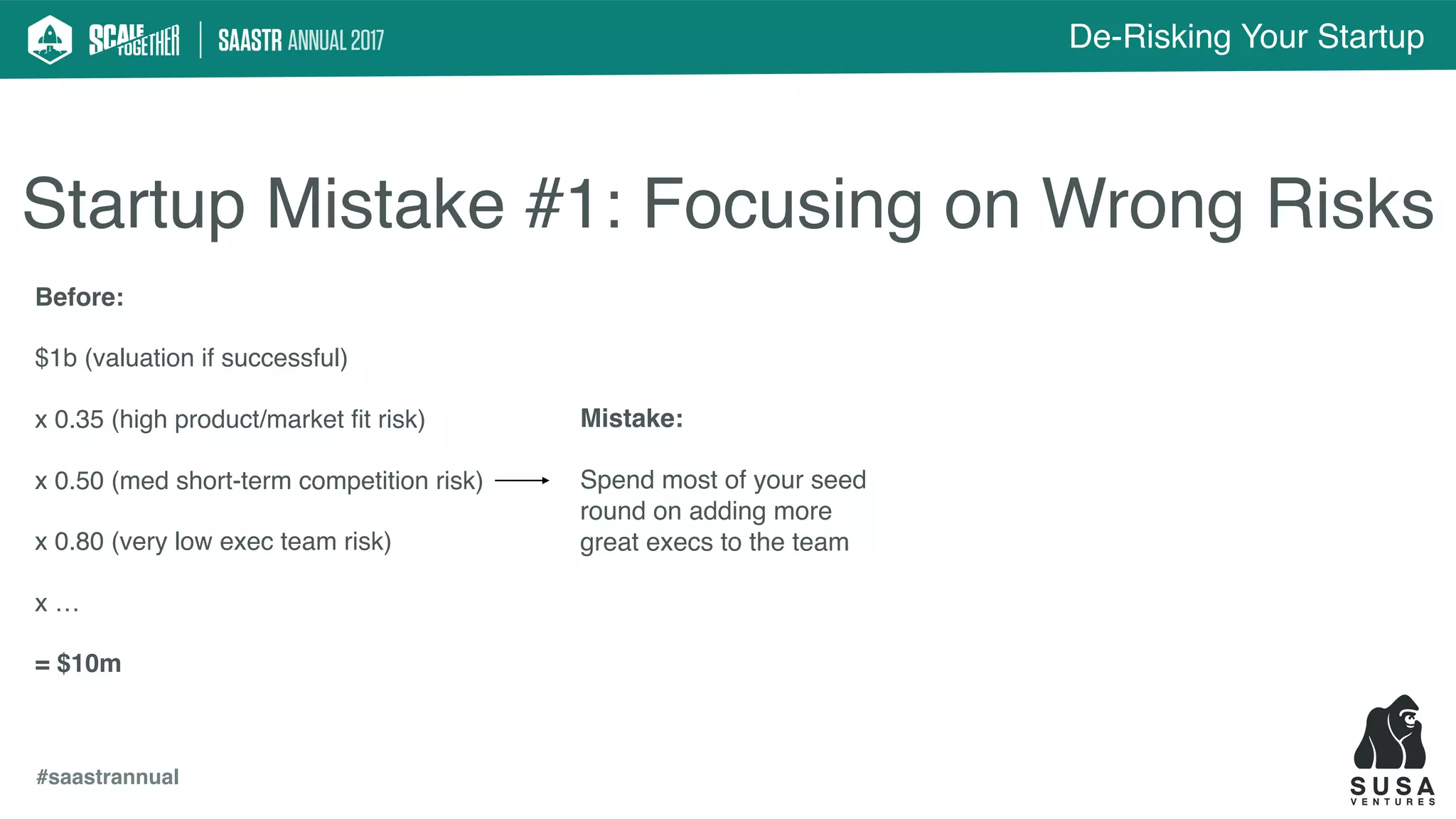

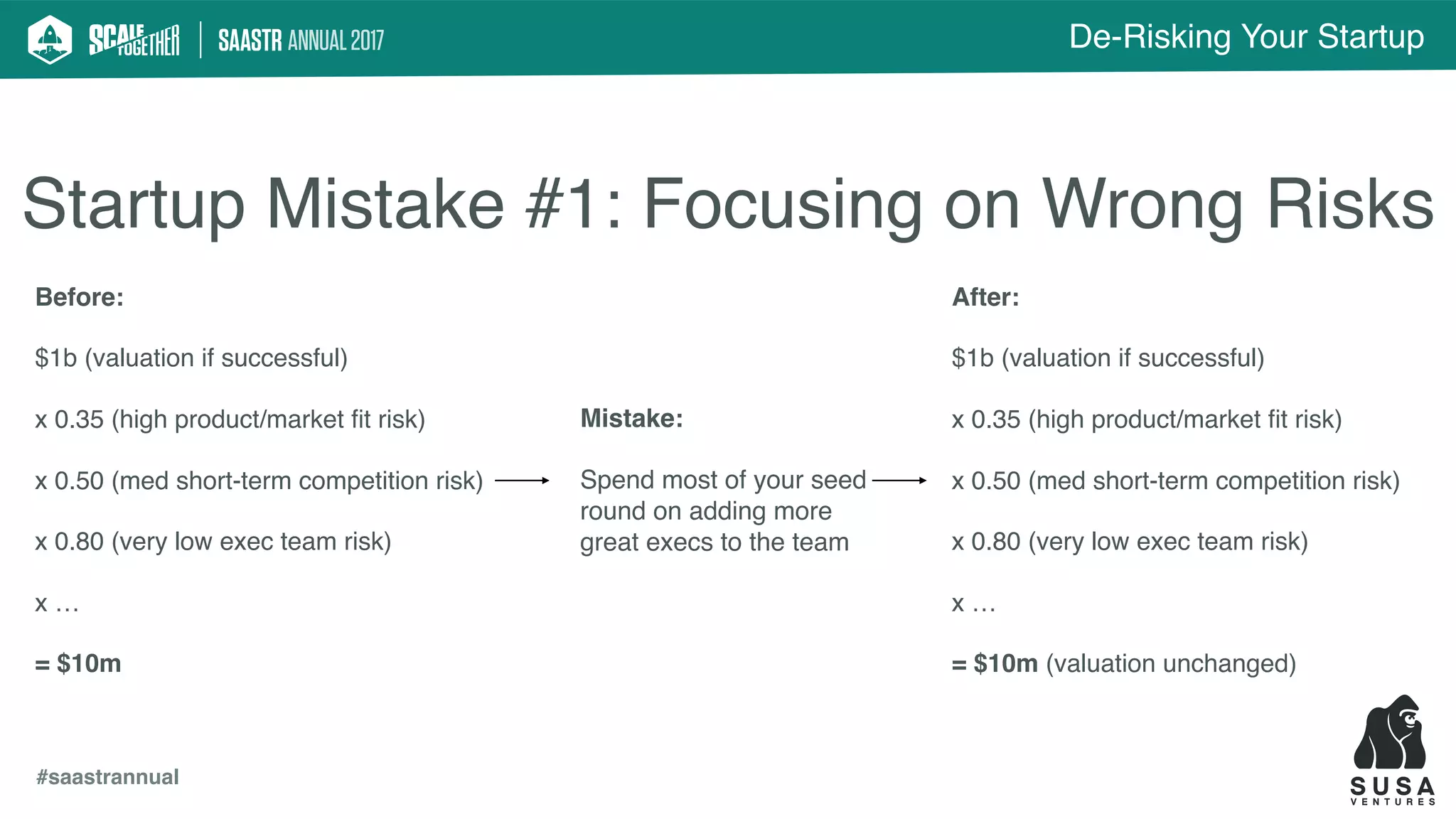

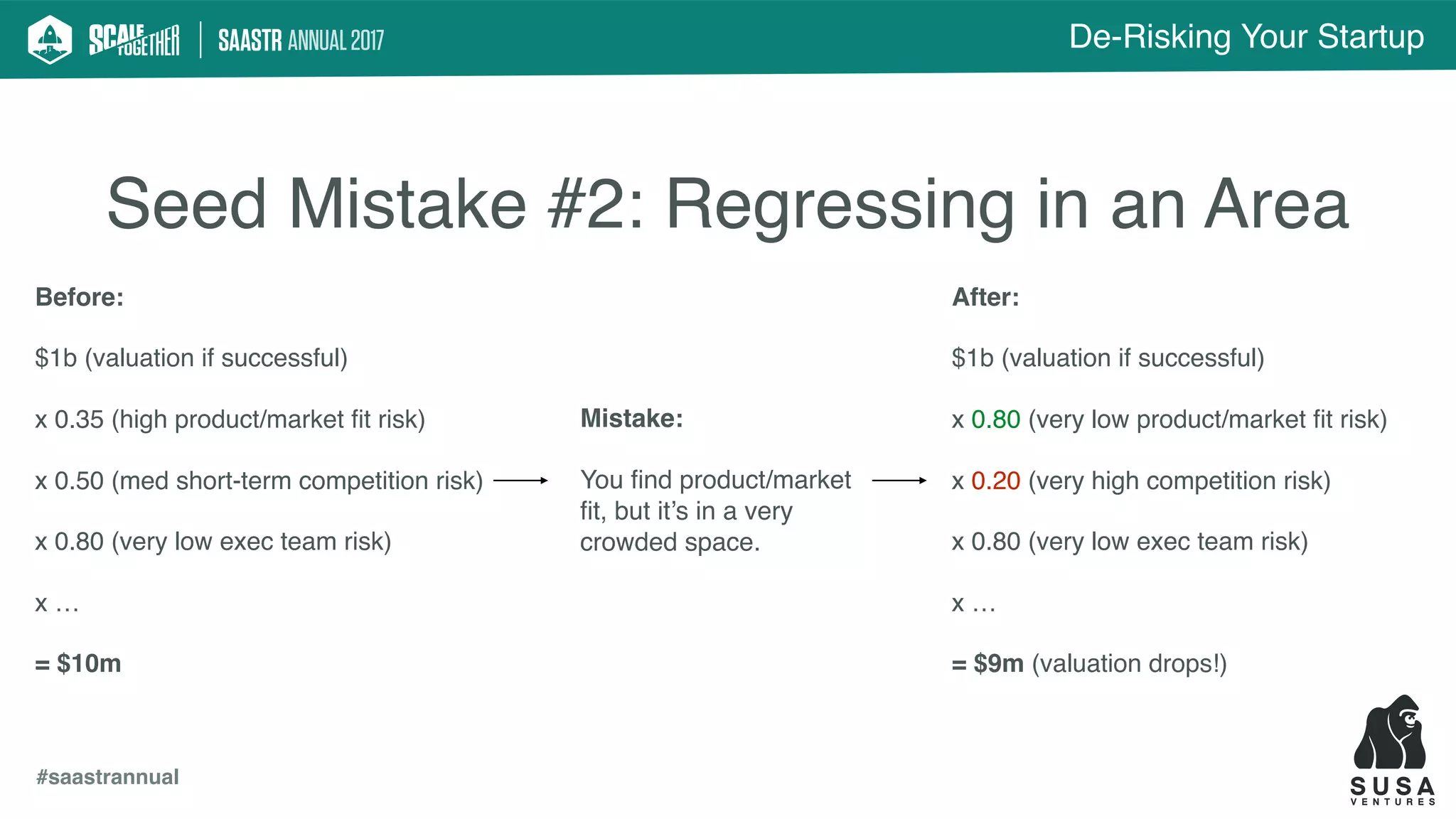

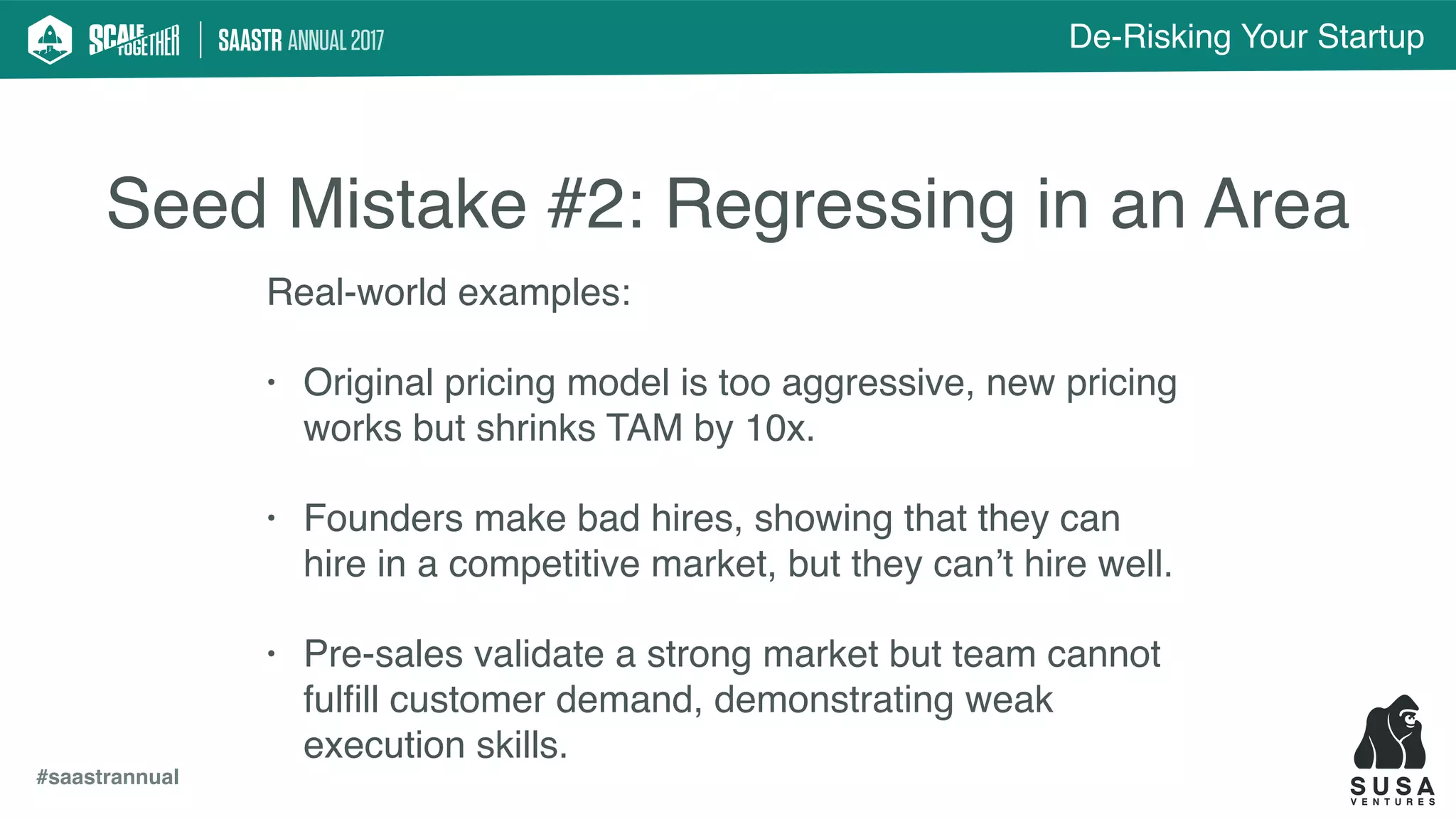

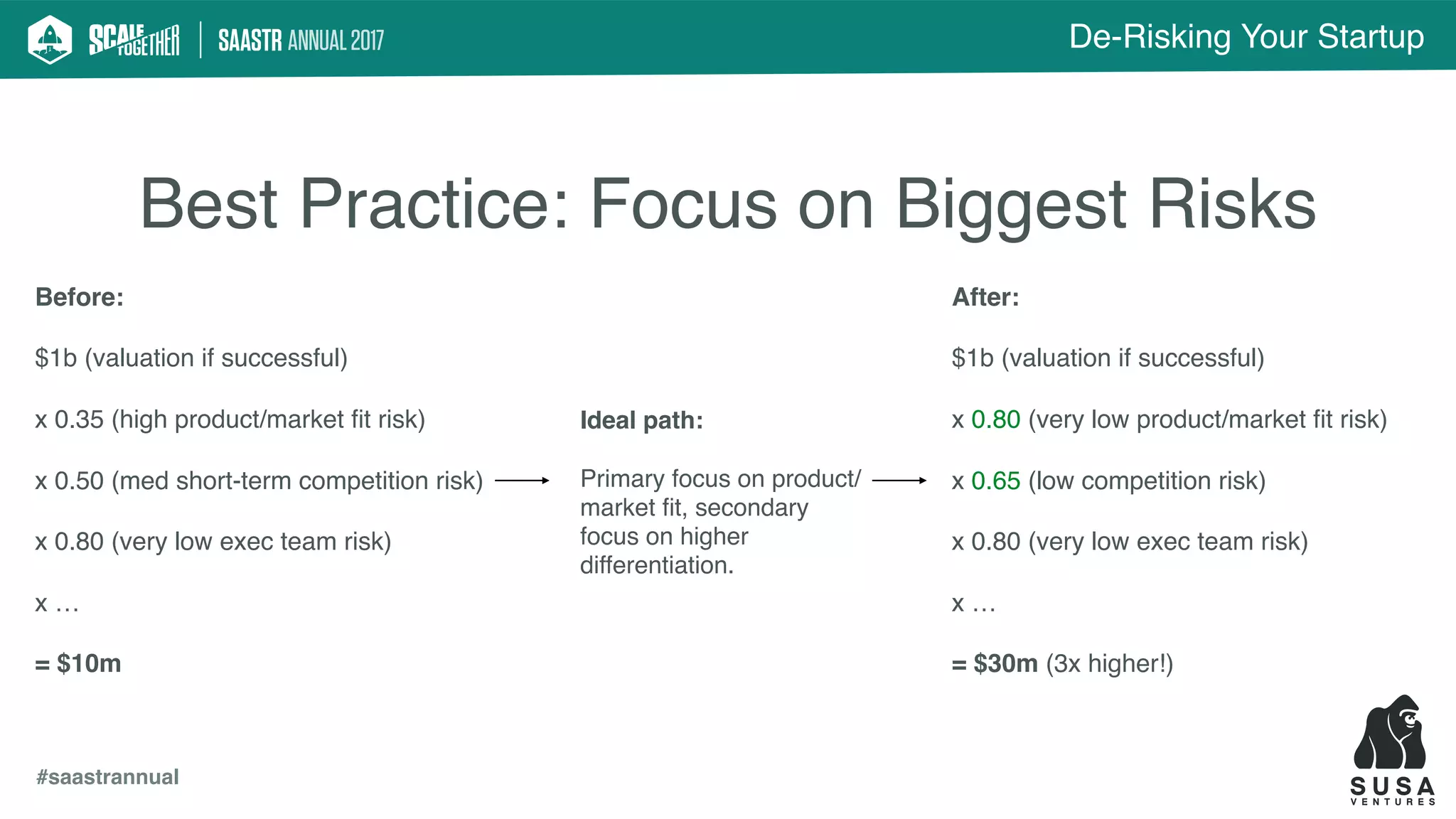

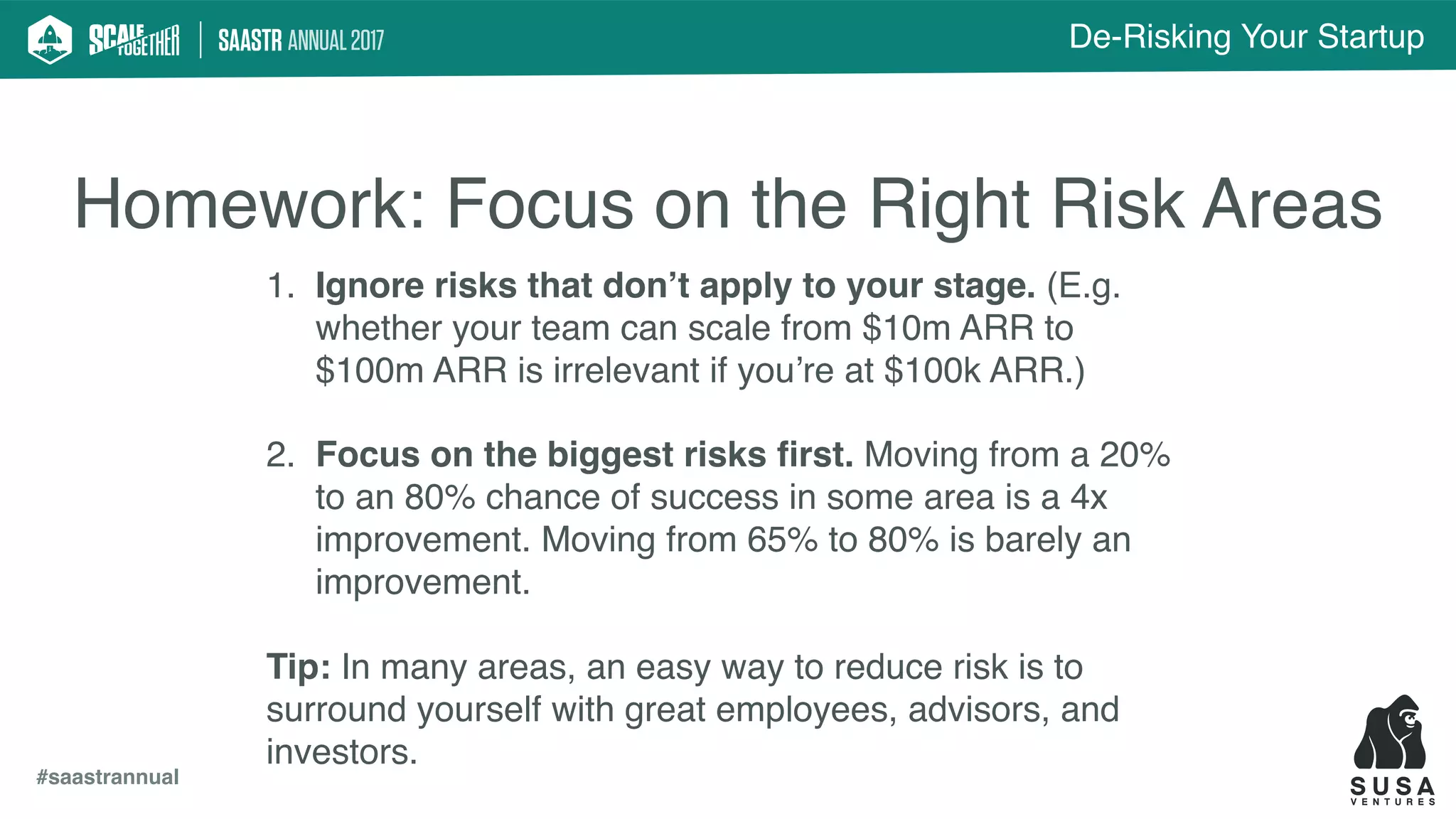

This document discusses how early-stage VCs estimate the chance of success and value of startups. It explains that VCs do not value companies based solely on revenue multiples, but rather on the ideal outcome potential multiplied by the odds of success. It breaks down how VCs estimate the chance of winning by assessing key risk areas like product/market fit, competition, and team strength. It warns against common startup mistakes like focusing on the wrong risk areas or regressing in areas that were previously de-risked. The document advocates that startups identify their biggest risks and focus their efforts on mitigating those first to improve their odds of success and valuation.