Tyron Hyde hosted a webinar on property depreciation tips to help boost cash flow. The webinar covered:

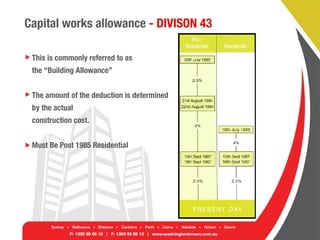

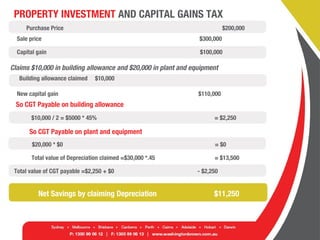

1. How to maximize deductions for depreciation of buildings, plant and equipment, renovations, and common property items.

2. Key differences between commercial and residential depreciation, and how the building allowance works.

3. Strategies for renovating properties, "scrapping", and maximizing depreciation claims for older properties.

4. Using super funds to own commercial properties and lease to associated businesses.

The webinar concluded with a live Q&A session and offered free depreciation estimates to attendees.