7. Non-Current Assets Held for Sale 10.10.23.pptx

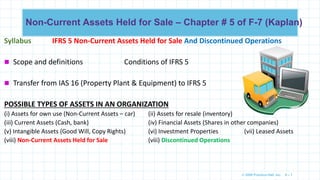

- 1. © 2009 Prentice-Hall, Inc. 6 – 1 Non-Current Assets Held for Sale – Chapter # 5 of F-7 (Kaplan) Syllabus IFRS 5 Non-Current Assets Held for Sale And Discontinued Operations Scope and definitions Conditions of IFRS 5 Transfer from IAS 16 (Property Plant & Equipment) to IFRS 5 POSSIBLE TYPES OF ASSETS IN AN ORGANIZATION (i) Assets for own use (Non-Current Assets – car) (ii) Assets for resale (inventory) (iii) Current Assets (Cash, bank) (iv) Financial Assets (Shares in other companies) (v) Intangible Assets (Good Will, Copy Rights) (vi) Investment Properties (vii) Leased Assets (viii) Non-Current Assets Held for Sale (viii) Discontinued Operations

- 2. © 2009 Prentice-Hall, Inc. 6 – 2 Non-Current Assets (Fixed Assets) Non-Current Asset: A non-current asset is an asset that does not meet the definition of current asset. E.g. Land, Building, Machinery. Non-Current Assets Held for Sale A non-current asset is classified as “held for sale” if the carrying amount will be recovered principally through a sale transaction rather than through continuing use. The entity intends to sell the asset & recover carrying amount through sale.

- 3. © 2009 Prentice-Hall, Inc. 6 – 3 Why Non-Current Assets “Held for Sale” are Reported Separately on Balance Sheet Users of financial statements intend to assess resources, a company has now and in future. This will require information about significant resources that are not going to be available in future. Companies therefore need to provide details of assets where it is known that they are going to be disposed of and sold, in other words non-current assets held for sale.

- 4. © 2009 Prentice-Hall, Inc. 6 – 4 Definitions A non-current asset is classified as held for sale if its carrying amount will be recovered principally through a sale transaction rather than through continuing use. A disposal group is a collection of assets to be disposed of, by sale or otherwise, together as a group in single transaction and liabilities directly associated with the assets that will be transferred in the transaction.

- 5. © 2009 Prentice-Hall, Inc. 6 – 5 Conditions for Classification as “held for sale” A non-current asset is classified as “held for sale” if all of the following conditions are met: 1. Asset is available for immediate sale in its present condition subject only to terms that are usual & customary; 2. The sale is highly probable (i.e., significantly more likely than not). Definition of Highly Probable i. Management is committed to a plan to sell the asset; ii. An active program to locate a buyer has been initiated; iii. The sale price is reasonable in relation to its current fair value; iv. Sale is expected to be completed within one year; and v. It is unlikely that the plan of sale will be withdrawn.

- 6. © 2009 Prentice-Hall, Inc. 6 – 6 Exception to the One-Year Requirement An extension of period required to complete a sale does not preclude (stop) an asset from being classified as held for sale if: 1. the delay is attributable to events or circumstances beyond the entity’s control; and 2. there is sufficient evidence that entity remains committed to its plan to sell the asset Q. 31 BN has an asset that was classified as held for sale at 31 March 2022. The asset had a carrying amount of $900 and a fair value of $800. The cost of disposal was estimated to be $50. According to IFRS 5 Non-current Assets Held for Sale and Discontinued Operations, which value should be used for the asset as at 31 March 2022? A $750 B $800 C $850 D $900

- 7. © 2009 Prentice-Hall, Inc. 6 – 7 Non-current Assets that are to be Abandoned (Discarded / Dumped) An entity shall not classify as held for sale a non-current asset that is to be abandoned since asset’s carrying amount will be not be recovered through sale. An entity shall not account for a non-current asset that has been temporarily taken out of use as “abandoned”. Example (Temporary Abandonment): An entity ceases to use a manufacturing plant because demand for its product has declined. However, it is expected that it will be brought back in to use if demand picks up. In this case plant is not regarded as abandoned Q. 36. At 1 Apr 2014, Tilly owned a property with a carrying amount of $800,000 which had a remaining life of 16 years. On 1 Oct 2014, Tilly decided to sell property & classified it as ‘held-for-sale’. An agent reported that property’s fair value less costs to sell at 1 Oct 2014 was $790,500 which had not changed at 31 Mar 2015. What should be carrying amount of property in Tilly’s Balance Sheet as at 31 Mar 2015? (A) $775,000 (B) $790,500 (C) $765,000 (D) $750,000

- 8. © 2009 Prentice-Hall, Inc. 6 – 8 Initial and Subsequent Measurement (Recording) Initial Measurement (Recording) Lower of carrying amount and fair value less cost to sell (NRV). A write-down to fair value less cost to sell, is recognized in profit or loss. Reversal of impairment is recognized as gain to the extent of cumulative impairment loss that has been recognized. Depreciation (amortization) ceases during period an asset is classified as held for sale.

- 9. © 2009 Prentice-Hall, Inc. 6 – 9 Illustration of Initial & Subsequent Measurement On January 1, 2019, an entity acquired an equipment at Rs. 5,000,000 to be used in ordinary course of business. Equipment has an estimated life of 10 years & residual value of Rs. 500,000. On Jan 1, 2022 equipment was classified as “held for sale”. On the date, fair value less cost of disposal was estimated at Rs. 1.9 million On Jun 30, 2022 equipment was sold for Rs. 1.5 million Journal Entries To Transfer Equipment from Non-Current Asset “Held for Sale” Equipment Held for Sale ….. Dr Accumulated Depreciation …. Dr Equipment ….Cr To Transfer Write Down Equipment to NRV (Impairment) Impairment Loss …. Dr Equipment Held for Sale ….. Cr To Record Sale of Equipment Cash …. Dr Equipment Held for Sale ….. Cr Loss / Gain on Sale …. Dr / Cr

- 10. © 2009 Prentice-Hall, Inc. 6 – 10 Presentation of Asset Classified as “Held for Sale” Non-current asset that is classified as “held for sale” is presented as current asset, usually below current assets. Further information is provided in notes to financial statements. Assets in disposal group are presented separately as a single amount under current assets. Liabilities in disposal group are presented separately as a single amount under current liabilities as “Liabilities directly associated with non-current assets held for sale” Assets & Liabilities of a disposal group are not clubbed.

- 11. © 2009 Prentice-Hall, Inc. 6 – 11

- 12. © 2009 Prentice-Hall, Inc. 6 – 12 Changes to a plan of sale (Held for Use Again) Asset that ceases to be classified as held for sale shall be measured at lower of the asset’s: 1. Carrying amount before it was classified as held for sale, adjusted for any depreciation, amortization or revaluation that would have been recognized, had the asset not been classified as held for sale, and 2. Recoverable amount (NRV) at date of decision not to sell.

- 13. © 2009 Prentice-Hall, Inc. 6 – 13 Summary Non-Current Asset When is Non-Current Asset classified as “held for sale” What are conditions for classification as “held for sale” Measurement of Assets “held for sale”. Abandoned & Temporarily Abandoned Non-Current Assets Change in Classification of a non-current asset classified as “held for sale” Presentation of non-current assets “held for sale” in Statement of Financial position.

- 14. © 2009 Prentice-Hall, Inc. 6 – 14 Questions – Non-Current Assets Held for Sale 1. A company intends to sell its headquarter building and has initiated actions to locate the buyer. Assume the following possible scenarios: a) The company intends to vacate the building once the buyer is identified. The time necessary to vacate the building is usual and customary for sale of such assets. b) Company intends to use building until construction of a new headquarter is finished Required: Identify whether headquarter building could be classified as Held for Sale. 2. Archie Co. committed itself at beginning of financial year to selling a property that is being under- utilized following economic downturn. As a result of economic downturn, the property was not sold by the end of year. The asset was actively marketed but there were no reasonable offers to purchase the asset. Archie is hoping that the economic downturn will change in future and therefore has not reduced price of asset. Required: Can Archie Co. classify the property as available for sale under IFRS 5?

- 15. © 2009 Prentice-Hall, Inc. 6 – 15 Questions – Non-Current Assets Held for Sale Previous [Answer - 1: a) Yes, b) No] [Answer - 2: “No” because due to downturn, price offered is not reasonable.] 3. On Jan 01, 2015, Jack Ltd acquired a machine costing Rs.10m with a useful life of 10 years having nil residual value. On 30 Jun 2017, company decided to sell the machine. The machine is short in supply therefore management is confident that it would be sold quickly. Its current market price is observed in market to be Rs.9m. In addition, it would cost Rs.200,000 to dismantle machine & make it available to buyer. Required: a) Assuming that machine meets all criteria to be classified as held for sale, calculate amount at which machine would be measured upon classification as held for sale. b) Assuming the fair value is Rs.7m instead of Rs.9m, what would be treatment?

- 16. © 2009 Prentice-Hall, Inc. 6 – 16 Questions – Non-Current Assets Held for Sale 4. On 1 January 2012 Piano Co. bought an item of plant for Rs.200,000. It has an expected useful life of 10 years but will realize nothing on final disposal. On 31 December 2014, after three years of using the asset, it was decided to sell the plant. A plan was put in place & instructions given to locate a buyer. Plant is in great demand so Piano is confident that machine will be sold promptly. Its current market value is Rs.130,000. As plant is of a considerable size dismantling costs to make it available for sale will be incurred of Rs.1,000. Show how asset should be presented in Statement of Financial Position as at 31 Dec 2014.

- 17. © 2009 Prentice-Hall, Inc. 6 – 17 Qs On 31 Dec 2019, Villa company classified as held for sale an equipment with carrying amount of Rs. 5,000,000. On this date, equipment is expected to be sold for Rs. 4,600,000. Disposal cost is Rs. 200,000. On 31 Dec 2020, equipment had not been sold & management decided to place equipment into operations. On 31 Dec 2020, entity estimated that equipment is expected to be sold at Rs. 4,300,000 with disposal cost at Rs. 50,000 Carrying amount of equipment was Rs. 4 million on 31 Dec 2020 if non-current asset was not classified as “held for sale” What is the impairment loss for 2019? (a) 600,000 (b) 400,000 (c) 200,000 (d) 0 What is the measurement of equipment on 31 December 2020? a. 4,300,000 b. 4,000,000 c. 4,400,000 d. 4,250,000 What is the loss on reclassification in 2020? (a) 300,000 (b) 250,000 (c) 400,000 d. 150,000

- 18. © 2009 Prentice-Hall, Inc. 6 – 18 Qs Criteria for Classification as “held for sale.” The directors of a company have agreed, in a board meeting, to sell a building and have instructed the chief administrative officer to start looking for a buyer. They wish to sell the building for £3 million, even though the current market prices indicate a value of £2.5 million. The company will continue to use the building until other suitable property has been found and no staff will be relocated until this is the case. Please advise if the building can be classified as “held for sale” Show the Accounting for an Asset classified as Held for sale Brea plc, which has a financial year end of 31 December, has an item of plant which meets the criteria to be classified as held for sale at 1 July 2019. The original cost of the asset was £120,000 with an estimated useful life of 10 years and, at 1 January 2019, had accumulated depreciation of £36,000. At 1 July 2019 the fair value of the plant is £50,000 with costs to sell estimated at £4,000. Required: Show how this asset would be accounted for in the 2019 financial statements