Embed presentation

Download to read offline

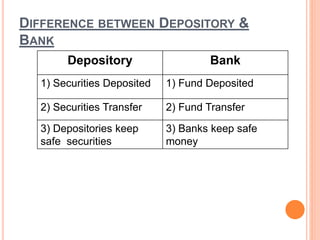

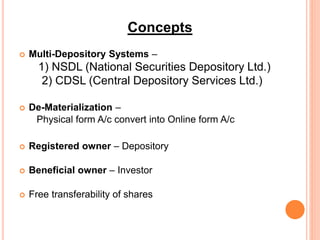

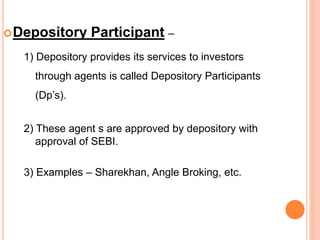

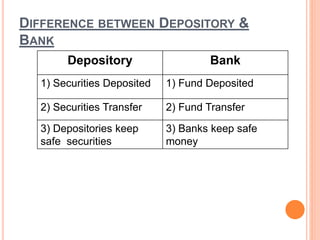

A depository system allows investors to hold securities like shares, bonds, and government securities electronically rather than in physical form. There are two main depositories in India, NSDL and CDSL, which provide depository services through approved intermediaries called depository participants such as brokers. The depository system provides advantages like easy online trading, less paperwork, lower costs, and convenient transfers compared to holding physical securities. While both depositories and banks hold assets, depositories focus on keeping securities safe whereas banks focus on keeping money safe.