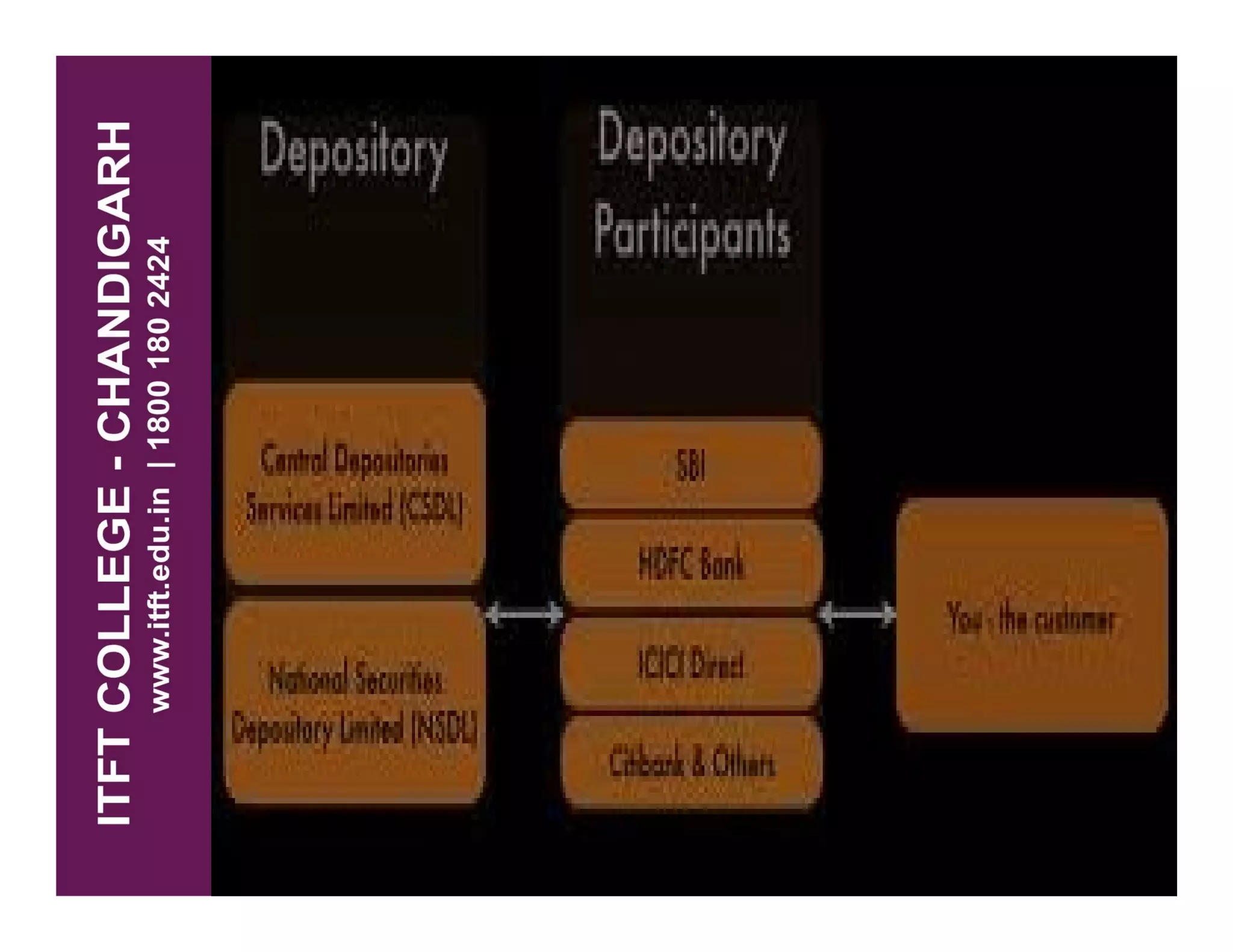

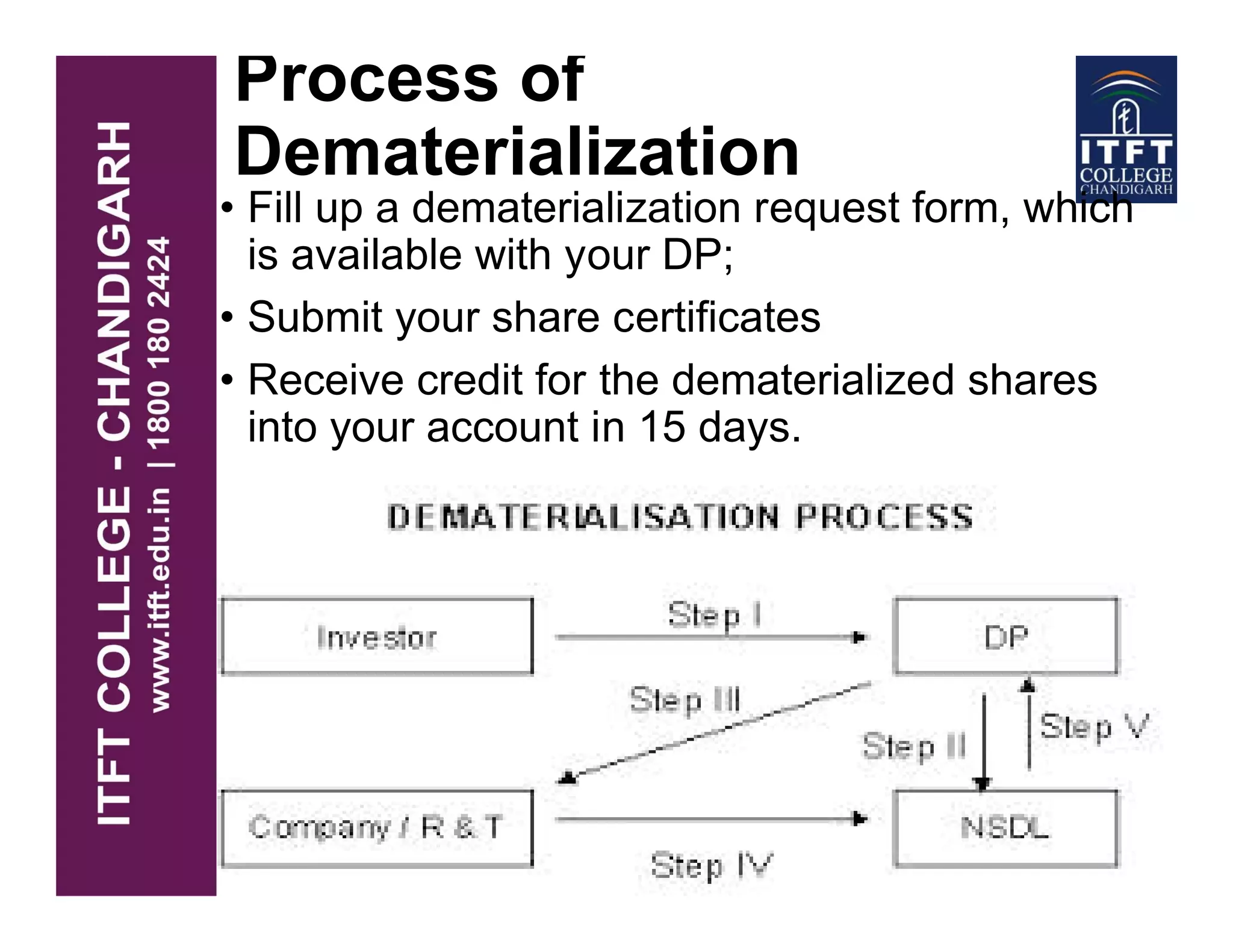

The document discusses India's depository system for securities trading. It defines a depository as an organization that holds securities deposited by others and facilitates exchanges. India adopted an electronic book entry system to replace the paper-based process for trading securities. The key features of India's depository system include a multi-depository structure, depository participants providing services, dematerialization of securities, fungibility of holdings, and free transferability of shares.