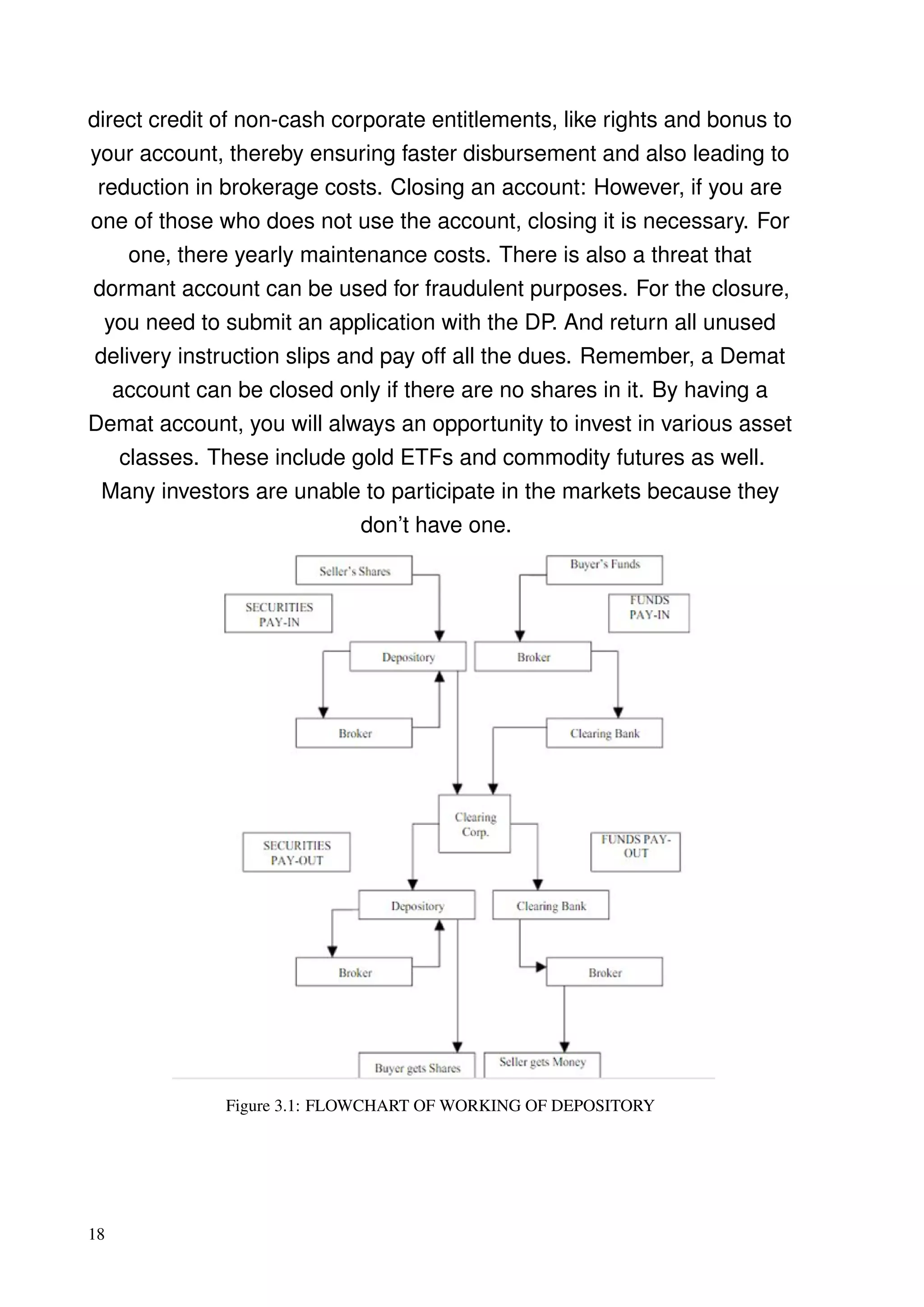

This document provides an overview of the demat system in India. It discusses the key entities involved like depositories (NSDL and CDSL), depository participants, and the process of dematerialization. Some key points:

- NSDL and CDSL are the two depositories that hold securities in electronic form and facilitate paperless trading.

- Depository participants act as intermediaries between investors and the depository for services like account opening and transaction processing.

- Dematerialization is the conversion of physical securities like shares into an electronic form to facilitate electronic trading and settlement.

![22nd March 1999. The initial capital of the company is Rs.104.50

crores All leading stock exchanges like the National Stock Exchange,

Calcutta Stock Exchange, Delhi Stock Exchange, the Stock Exchange

of Ahmedabad, etc have established connectivity with CDSL.CDSL was

set up with the objective of providing convenient, dependable and

secure depository services at affordable cost to all market participants.

Some of the important milestones of CDSL system are:

• CDSL received the certificate of commencement of business from

SEBI in February 1999.

• Honorable Union Finance Minister, Shri Yashwant Sinha flagged off

the operations of CDSL on July 15, 1999.

• Settlement of trades in the Demat mode through BOI Shareholding

Limited, the clearinghouse of BSE, started in July 1999.

• As at the end of July 2003, over 4600 issuers have admitted their se-

curities (equities, bonds, debentures, and commercial papers), units

of mutual funds, certificate of deposits etc. into the CDSL system.

2.4 DEPOSITORY PARTICIPANTS

The operations in the Depository System involve the participation of a

Depository, Depository Participants, Company/Registrars and Investors.

NSDL provides its services to investors through its intermediary called

depository participants (DPs). Depository Participant is the agent of the

Depository and is the medium through which the shares are held in the

electronic form. They are also the representatives of the investor,

providing the link between the investor and the company through the

Depository. These agents are appointed by NSDL with the approval of

SEBI. According to SEBI regulations, amongst others, three categories

of entities i.e. Banks, Financial Institutions and Members of Stock

Exchanges [brokers] registered with SEBI can become DPs. All the

DPs are appointed subject to fulfillment of uniform requirements of

SEBI (Depositories and Participants) Regulations, 1996 and

11](https://image.slidesharecdn.com/projectdemat1-180325063819/75/Dematerialisation-In-India-11-2048.jpg)