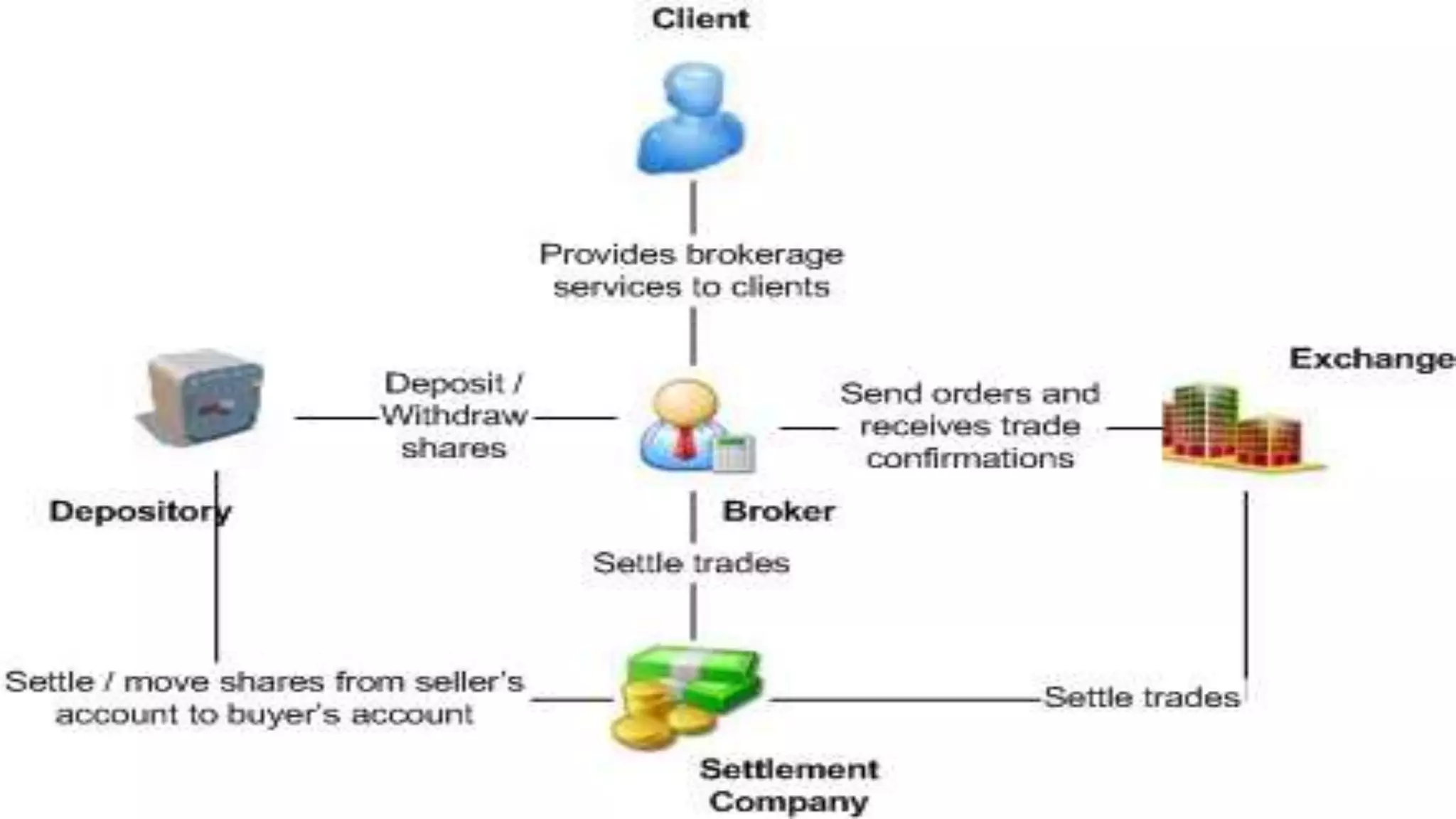

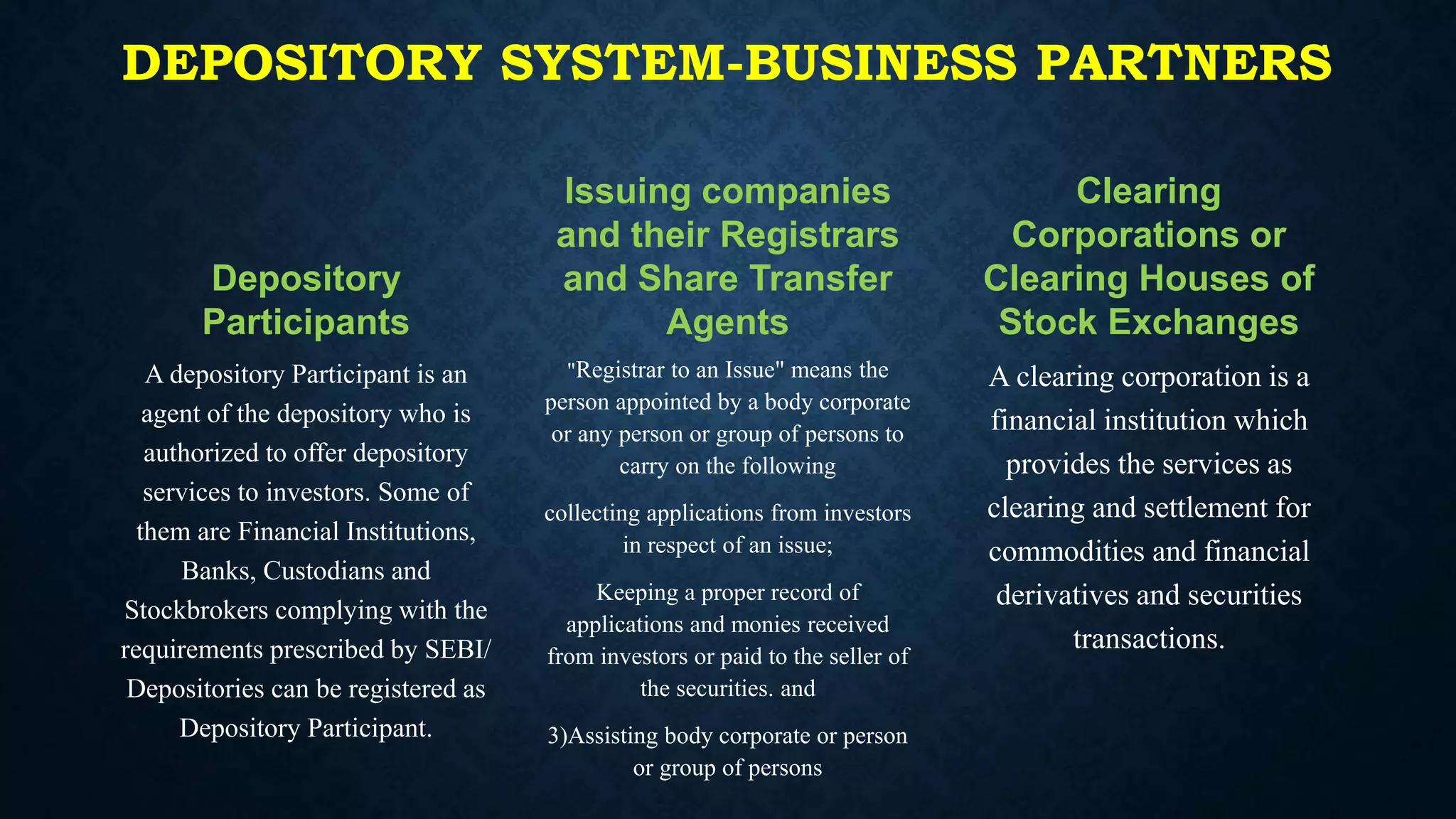

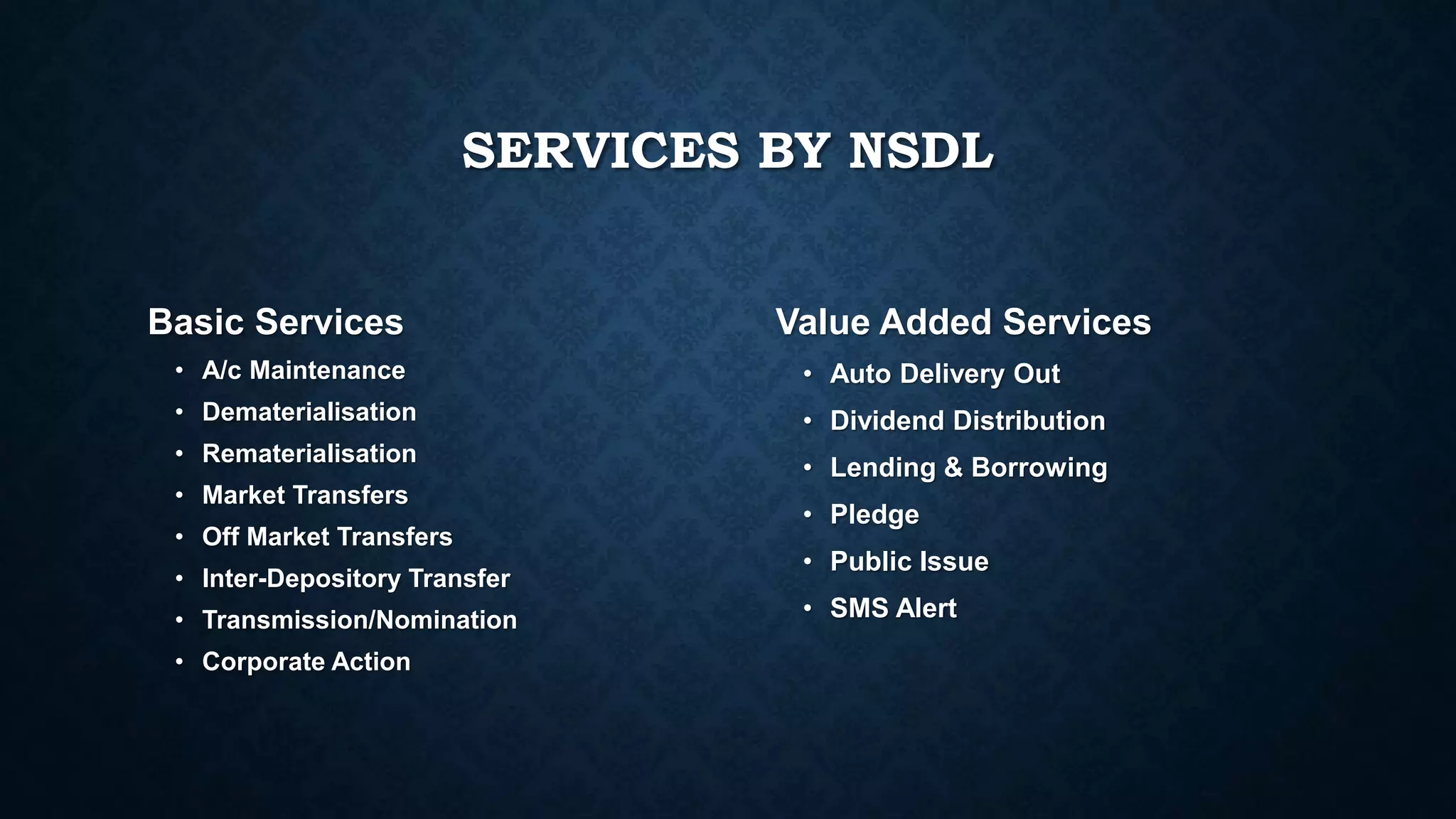

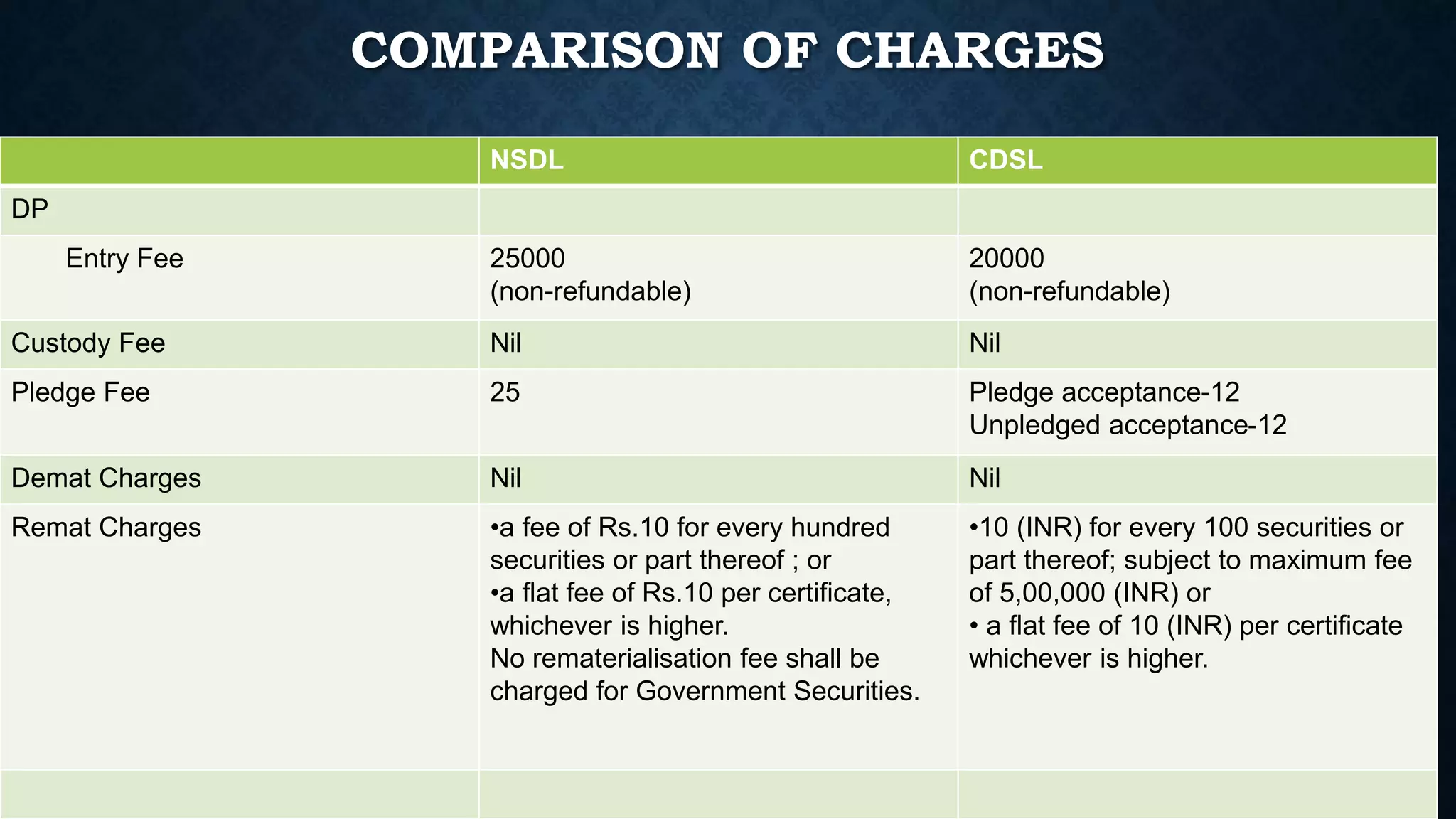

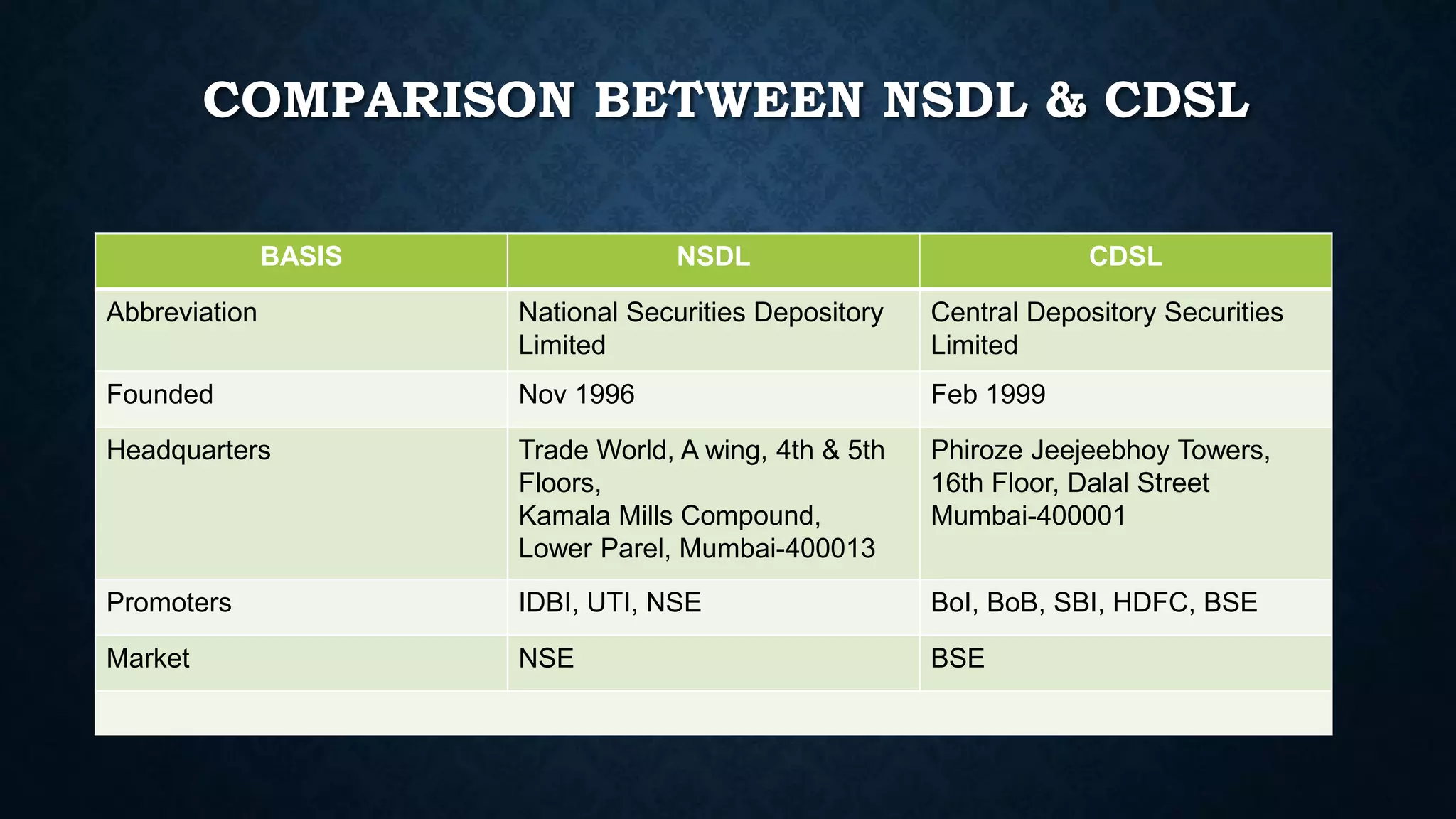

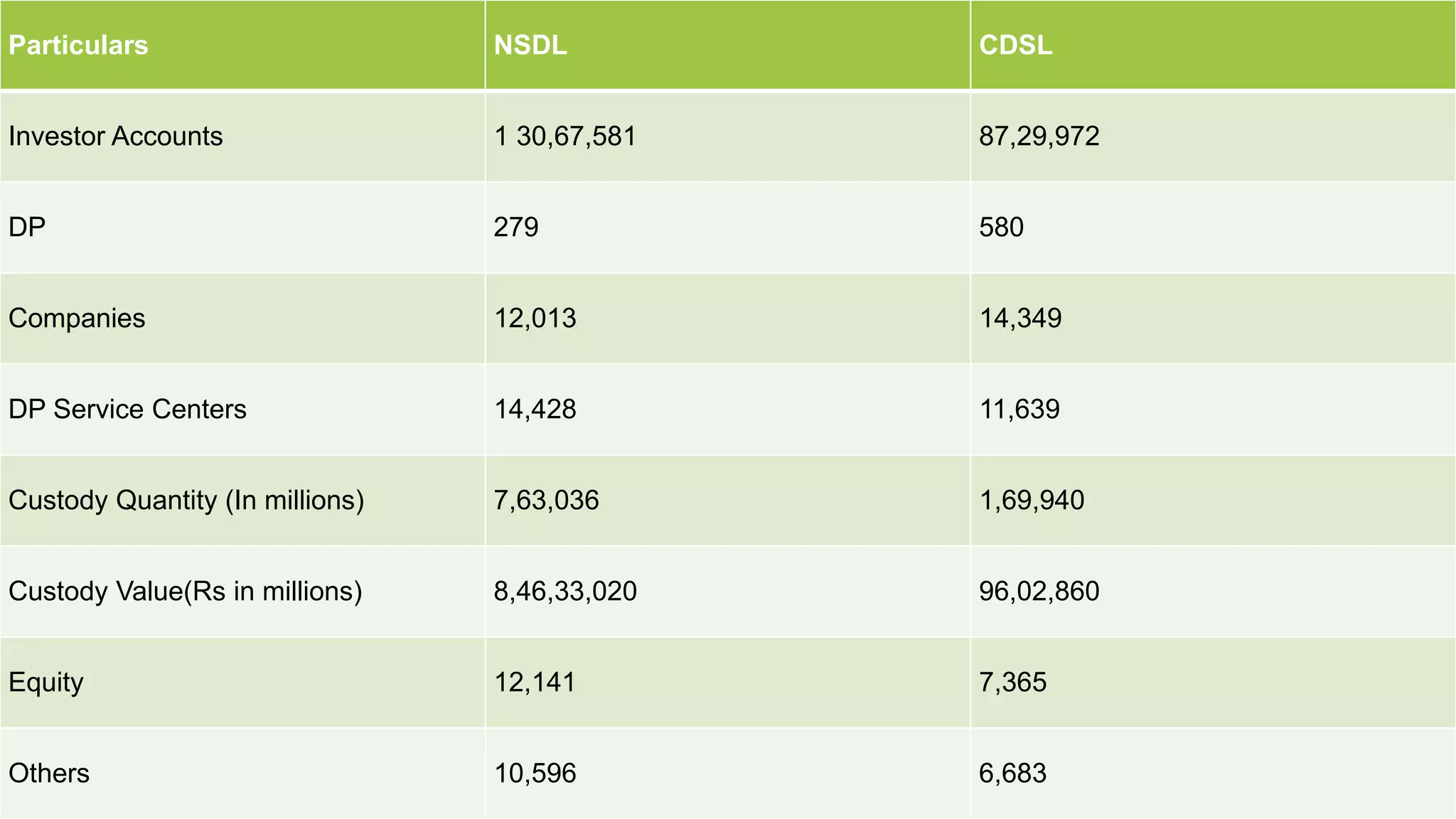

The document discusses the challenges faced by investors in the depository system in India, including bad deliveries and delays in transfers. It outlines the legal framework, services offered by depositories, and compares the two major depositories, NSDL and CDSL. Additionally, it highlights the need for increased awareness and training among investors regarding the depository system.