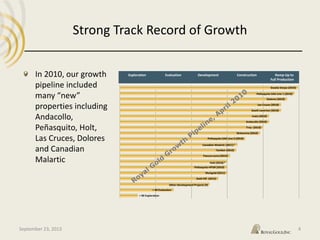

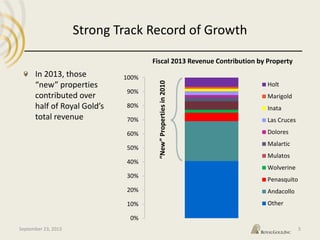

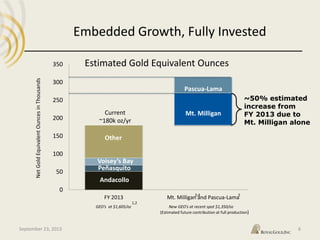

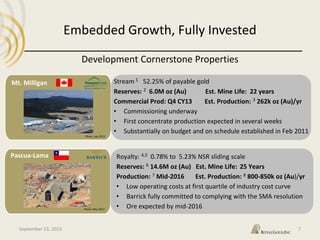

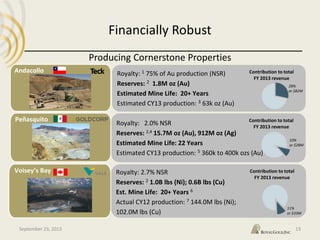

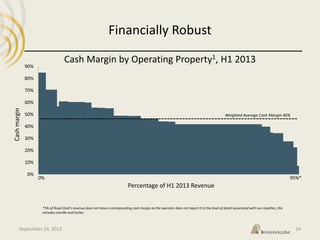

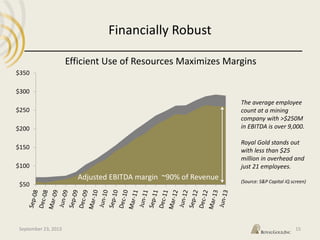

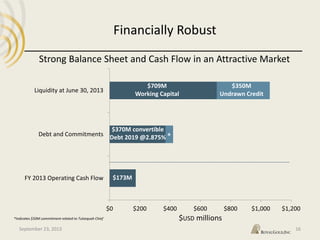

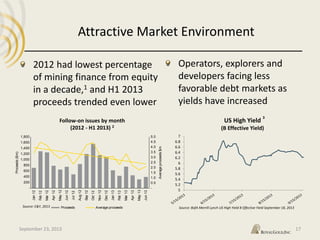

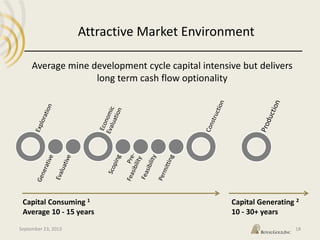

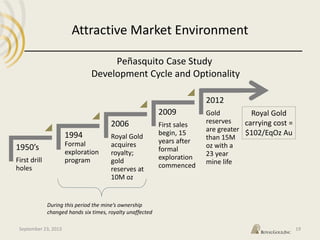

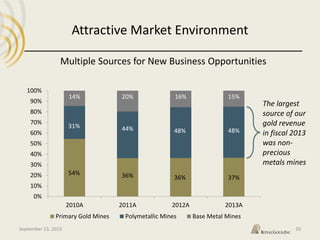

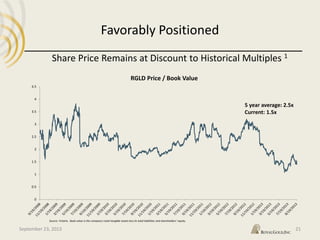

Tony Jensen, President and CEO of Royal Gold, presented at the Denver Gold Forum on September 23, 2013. He discussed Royal Gold's embedded growth from projects like Mt. Milligan and Pascua-Lama, which are expected to increase production by around 50% from current levels. Royal Gold is financially robust with high margins, significant liquidity, and a low-cost business model. The current market environment favors streaming and royalty companies as mining operators face challenges accessing capital through equity and debt markets.