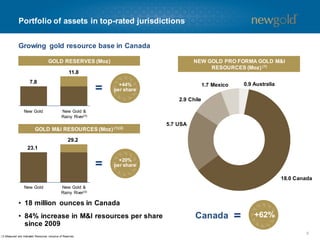

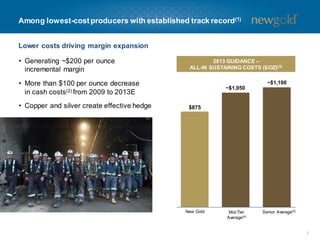

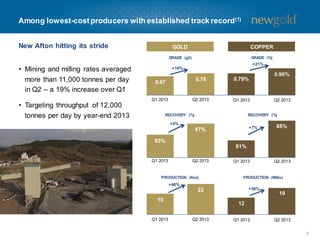

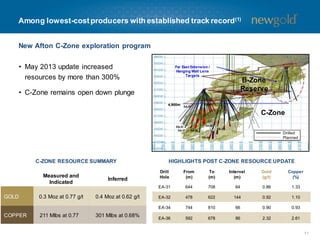

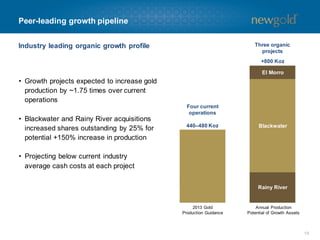

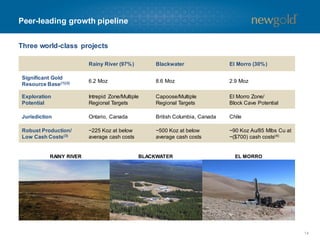

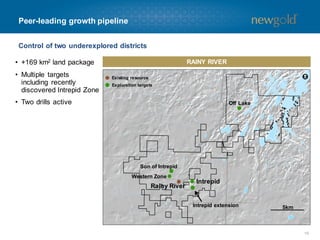

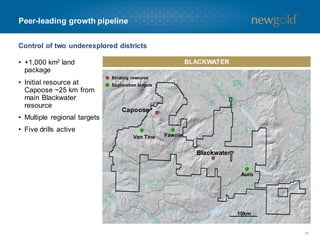

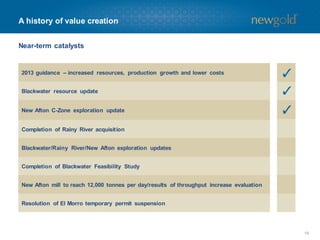

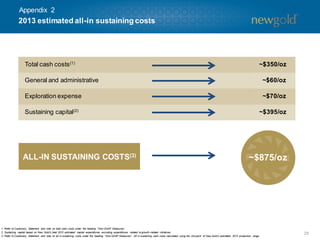

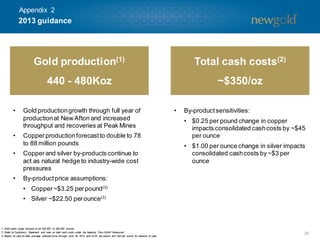

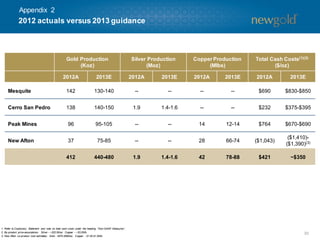

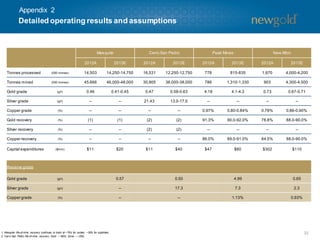

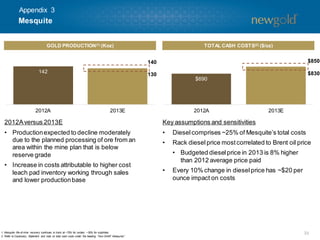

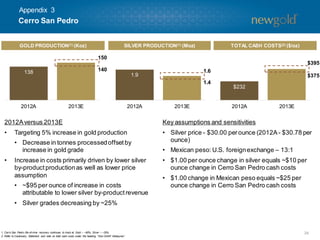

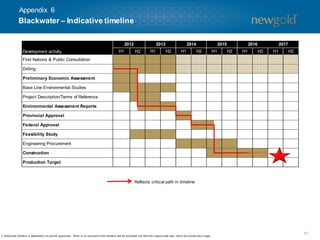

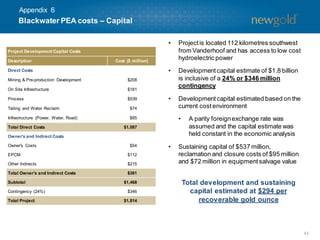

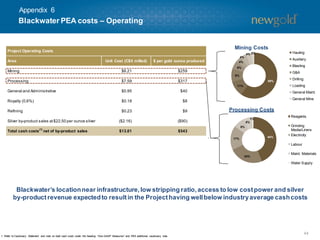

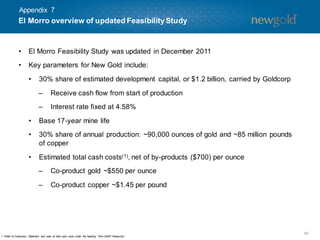

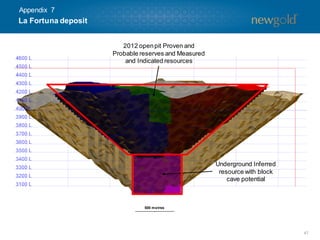

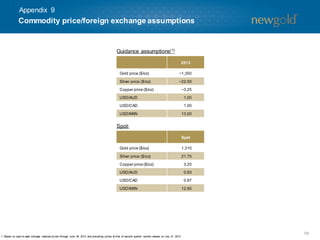

This document provides cautionary statements and an overview of the Denver Gold Forum held in September 2013. It cautions readers that monetary amounts are in US dollars unless otherwise stated, and that total cash costs are shown net of by-product sales. It also provides several cautionary notes regarding the use of forward-looking statements in the presentation. The document outlines New Gold's portfolio of assets in top-rated jurisdictions, its experienced management team, its position as a low-cost producer, and its peer-leading growth pipeline. It summarizes New Gold's production and cost guidance for 2013 and provides details on its current operations and projects.