This document provides an overview of venture capital investing, including:

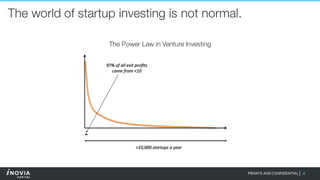

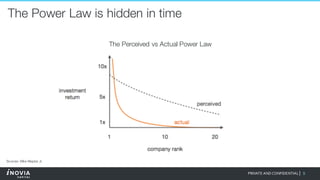

- The power law distribution of investment returns in venture capital, with the single best investment returning more than all others combined.

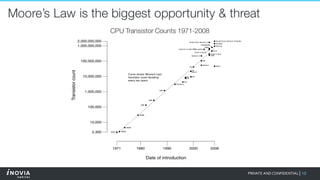

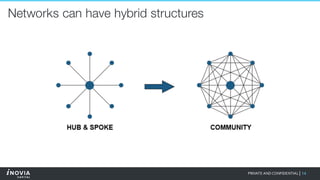

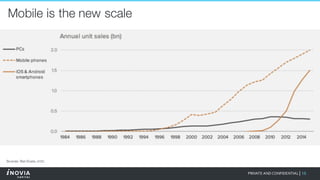

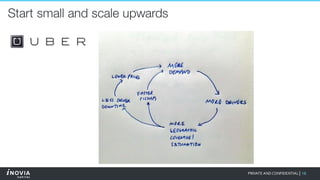

- Moore's law driving exponential growth opportunities for exceptional startups through computing advances and network effects.

- Examples of startups like YouTube and Skype that achieved massive scale despite initial skepticism.

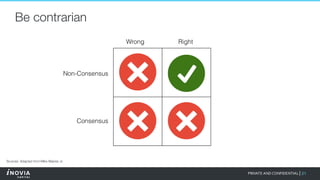

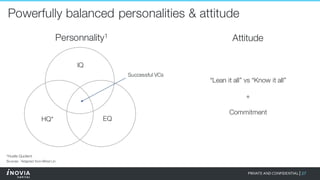

- Qualities like a balanced personality, hustle, and contrarian thinking that make for successful venture capitalists.