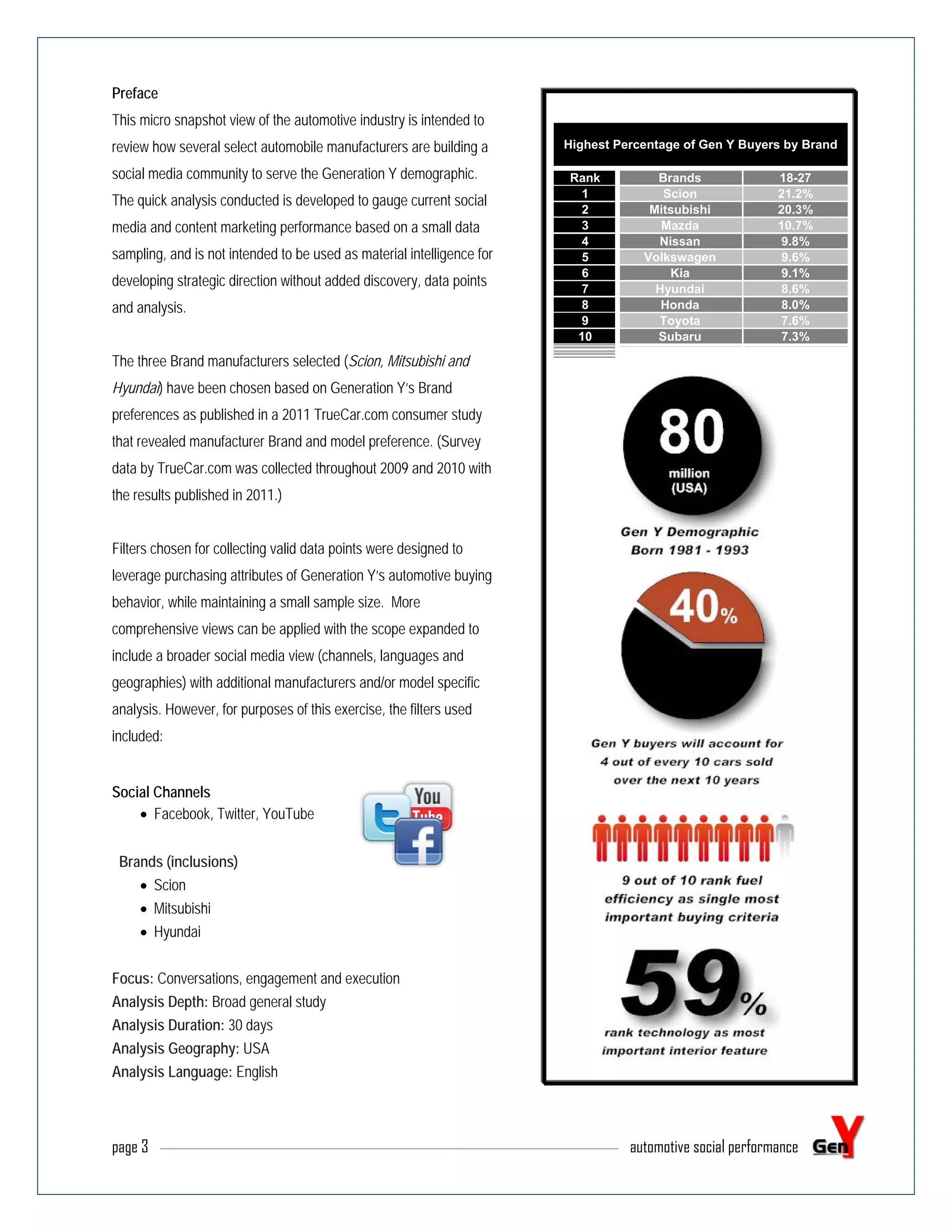

The document provides a micro snapshot of the automotive industry's social media performance targeted towards Generation Y, focusing on three manufacturers: Scion, Mitsubishi, and Hyundai. It analyzes community engagement, brand sentiment, and purchasing criteria, emphasizing the importance of relevant content delivery to enhance brand loyalty among younger consumers. The findings suggest that Scion performs well in consumer loyalty and happiness, while Hyundai leads in engagement metrics on social media platforms.

![page 44 automotive social performance

Baseline Brand Keywords

Roots: [Hyundai], [Scion], [Mitsubishi], [Mazda]

Keywords

Topical (all): [Hyundai] [&] car, auto, automobile

[Hyundai] [&] fuel efficiency, MPG, electric (car, auto, automobile), hybrid (car, auto, automobile), gas

mileage, cost of ownership, fuel economy

[Hyundai] [&] connectivity, technology, touch screen(s), touchscreen(s), infotainment system(s), iPod,

smartphone, smart phone, tablet PC, USB, online applications, applications, voice control, touch control,

steering wheel control, audio streaming, video streaming, social connection(s)

[Hyundai] [&] safety, collision avoidance, blind spot detection, sleep alert(s)

[Hyundai] [&] Generation Y, GenerationY, Gen Y, GenY](https://image.slidesharecdn.com/genysnapshot-230720225350-1b842510/75/Demographic-Social-Snapshot-44-2048.jpg)