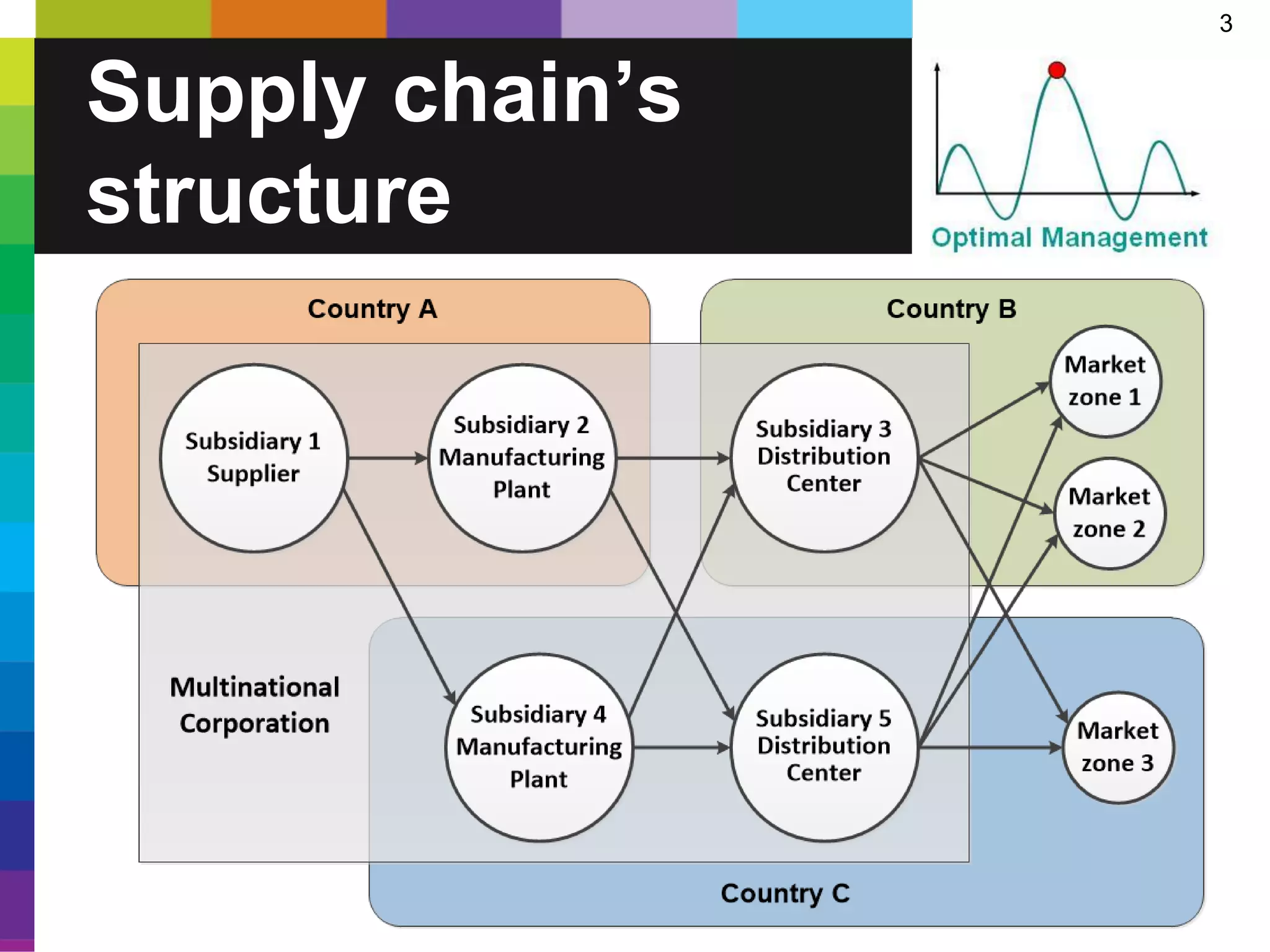

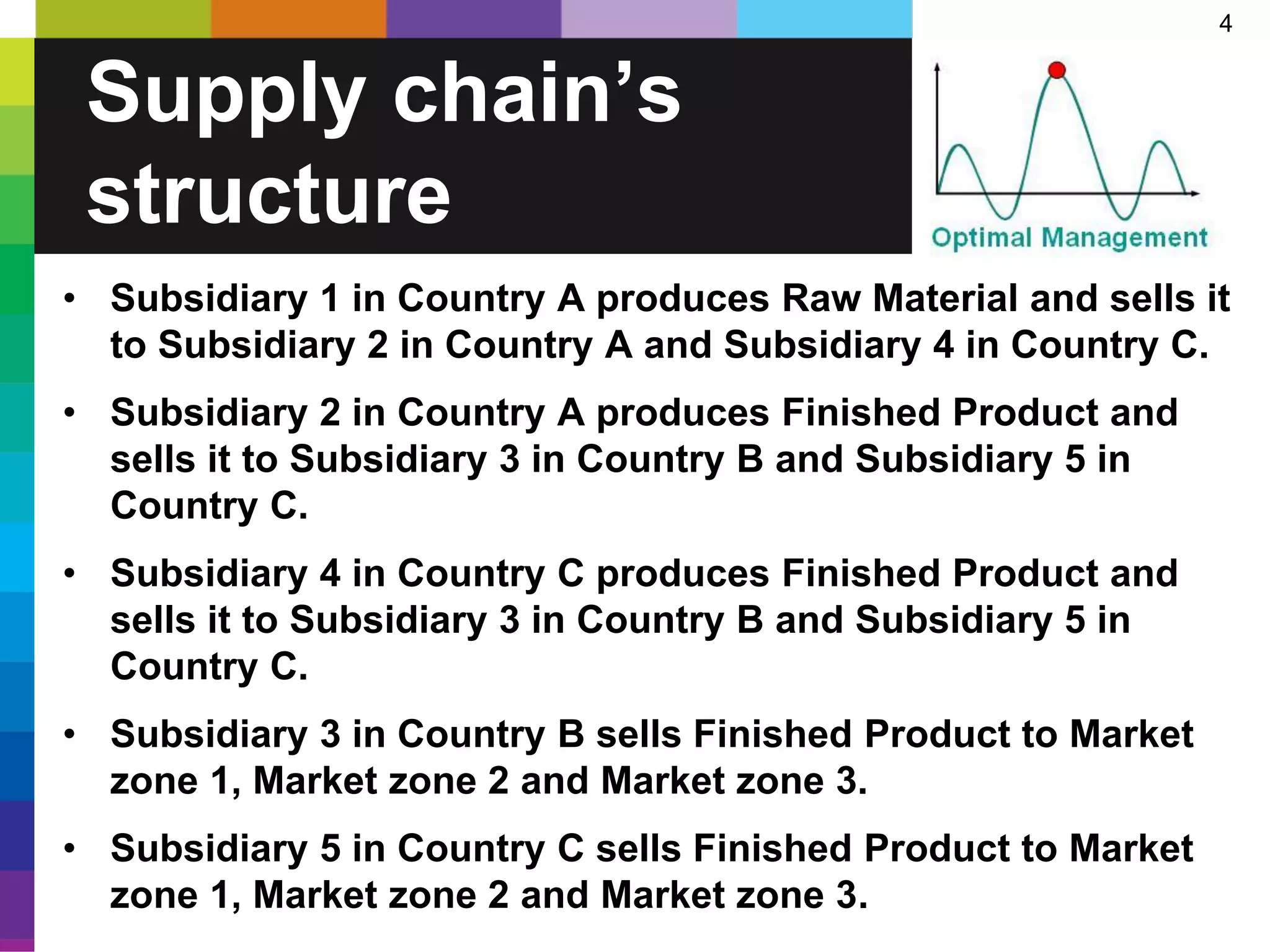

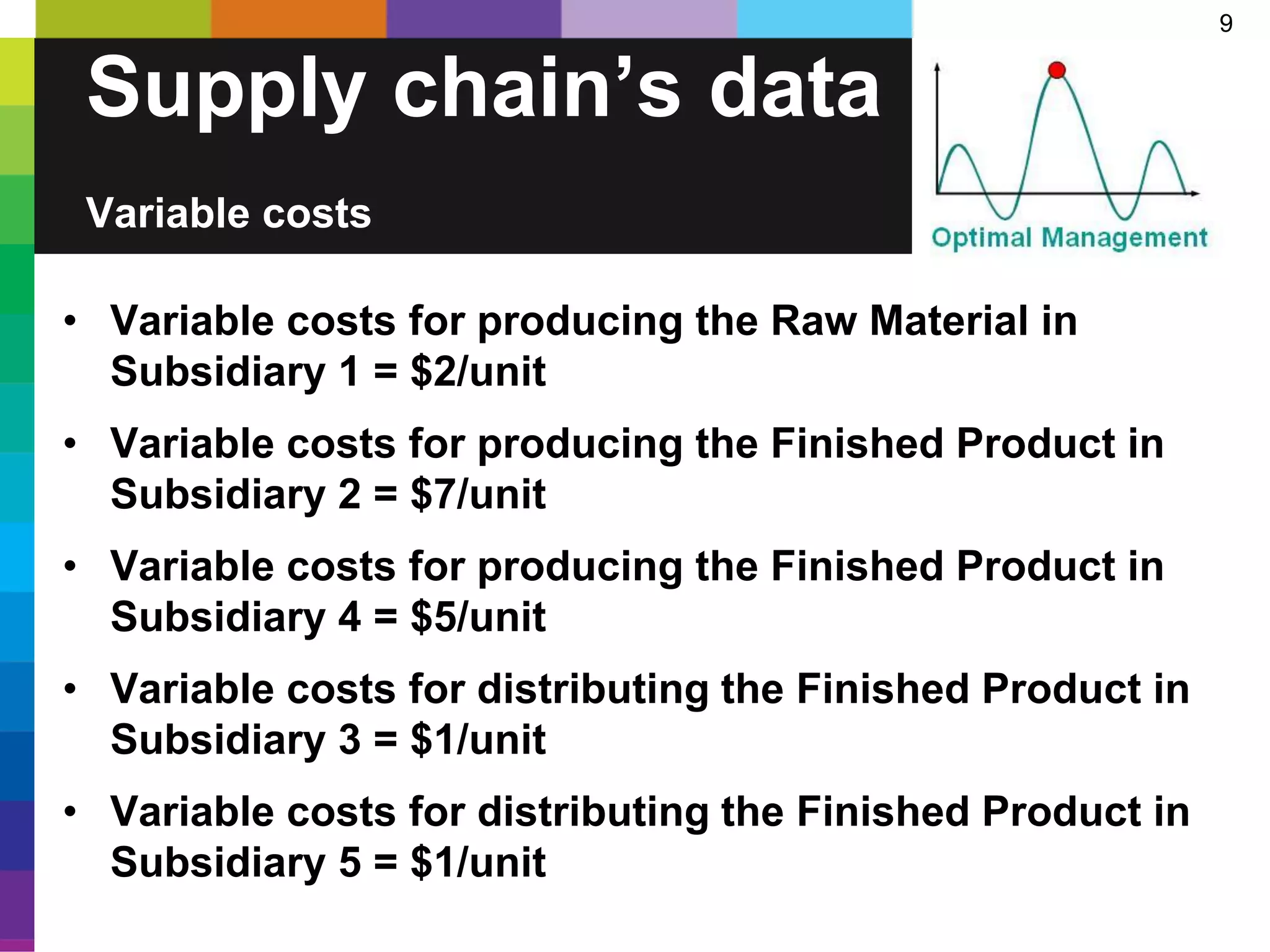

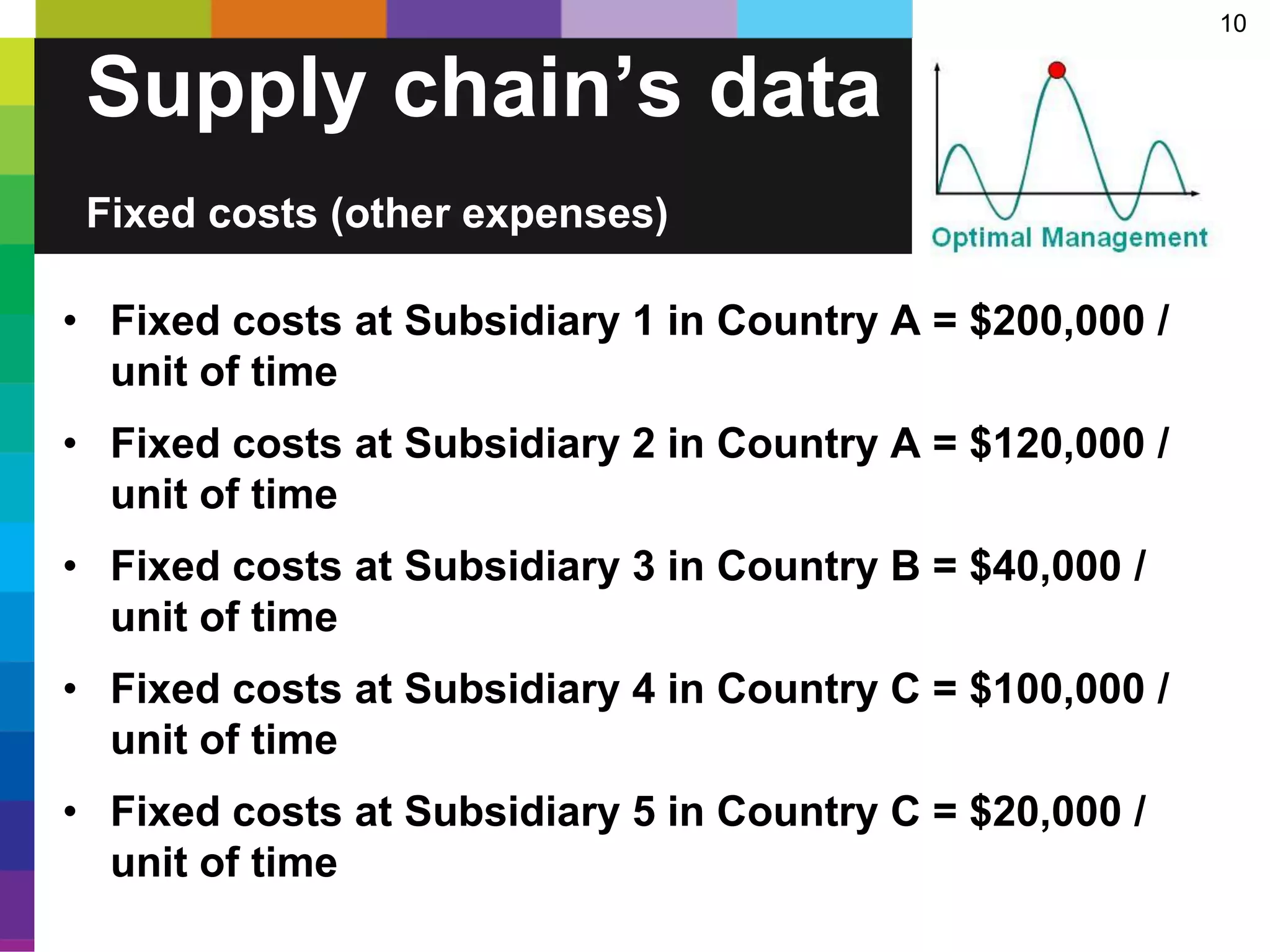

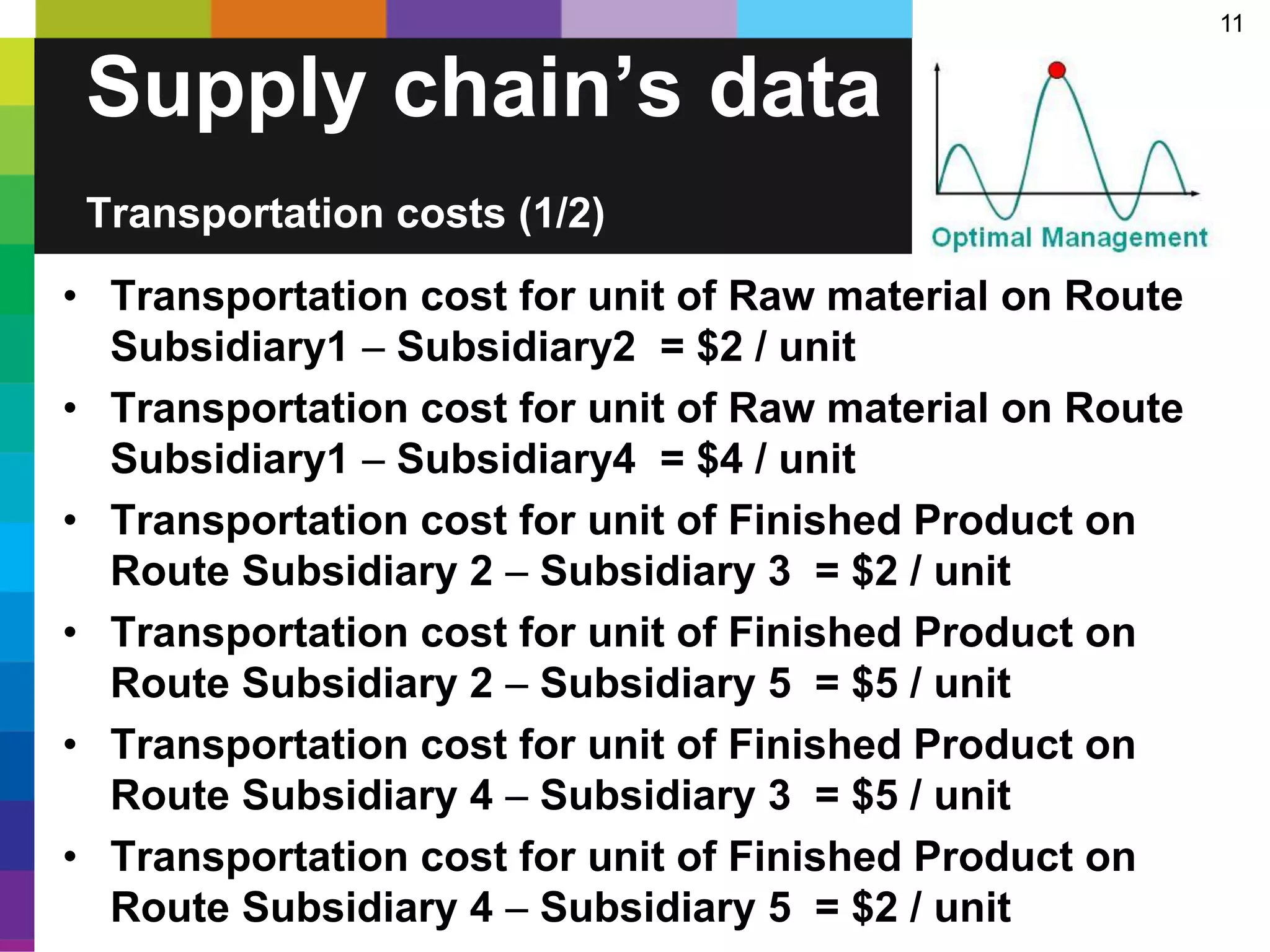

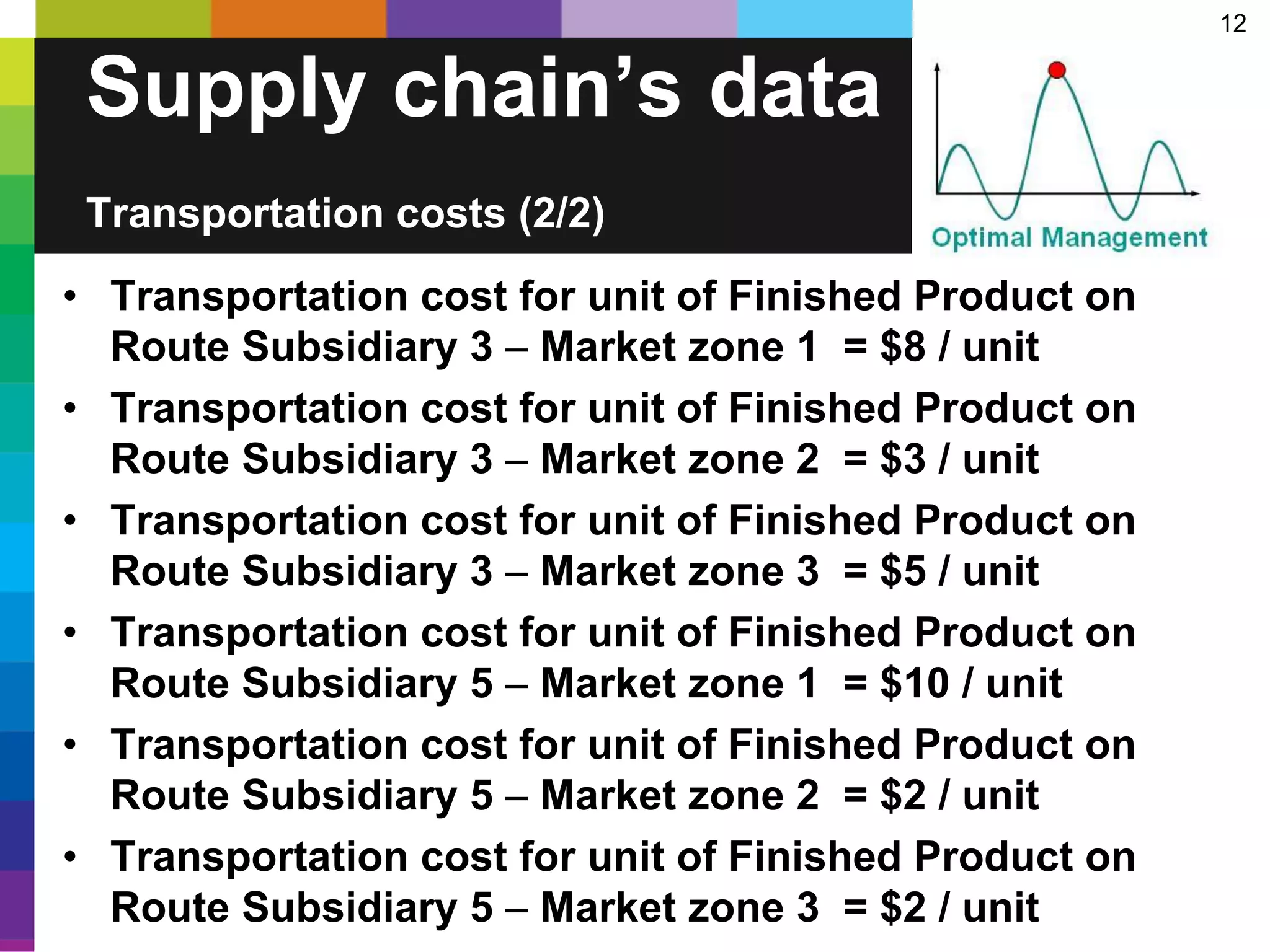

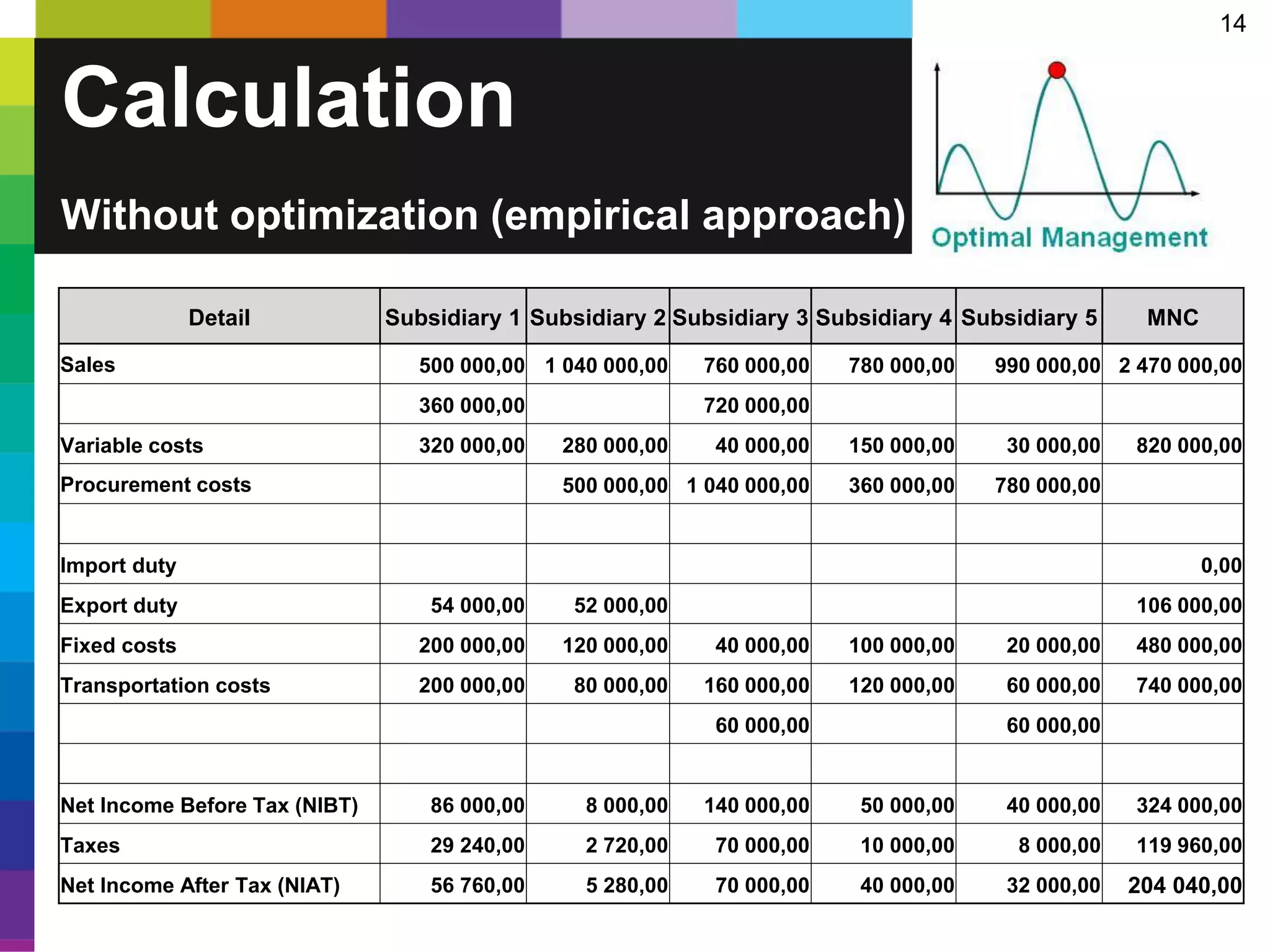

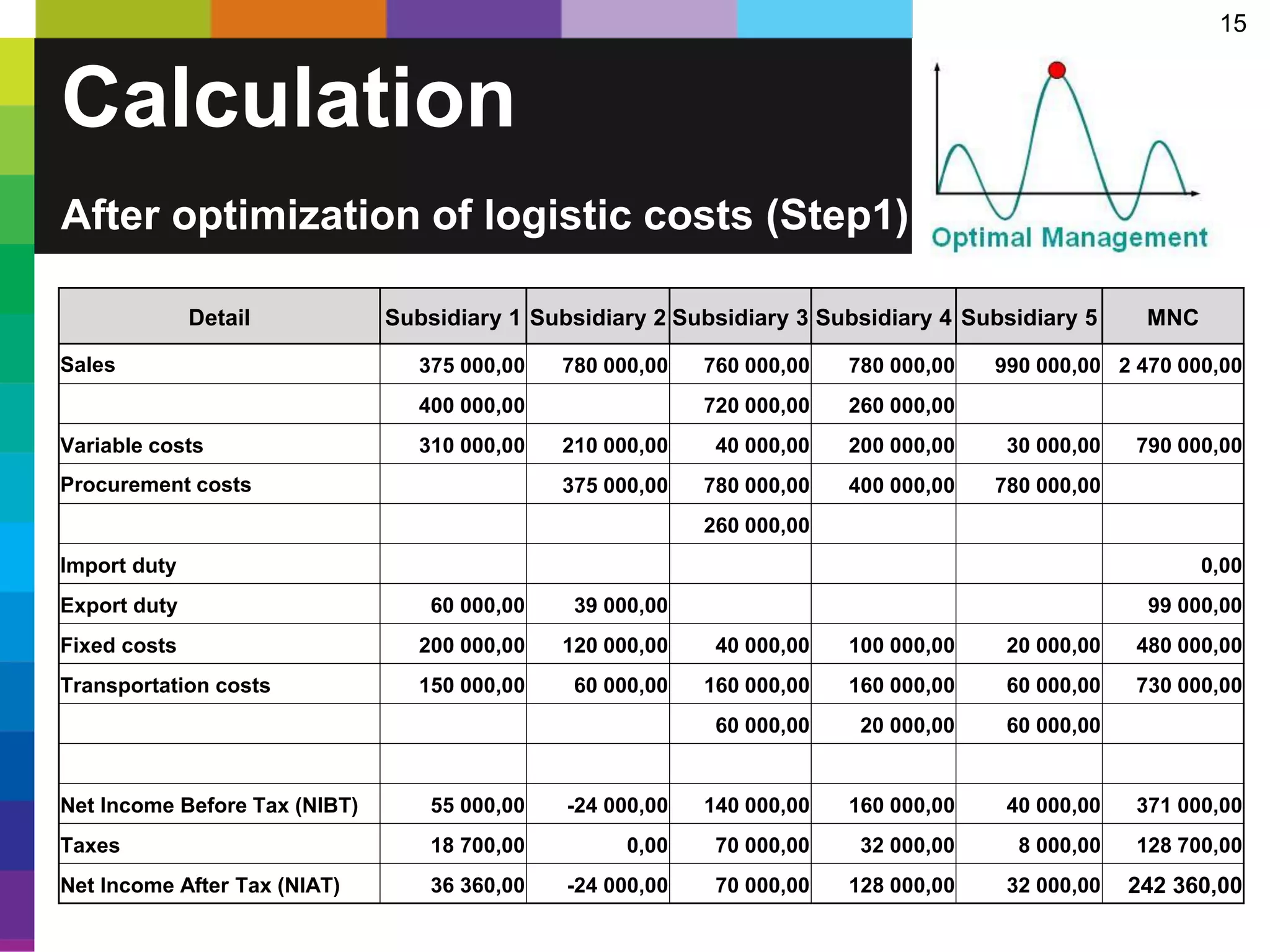

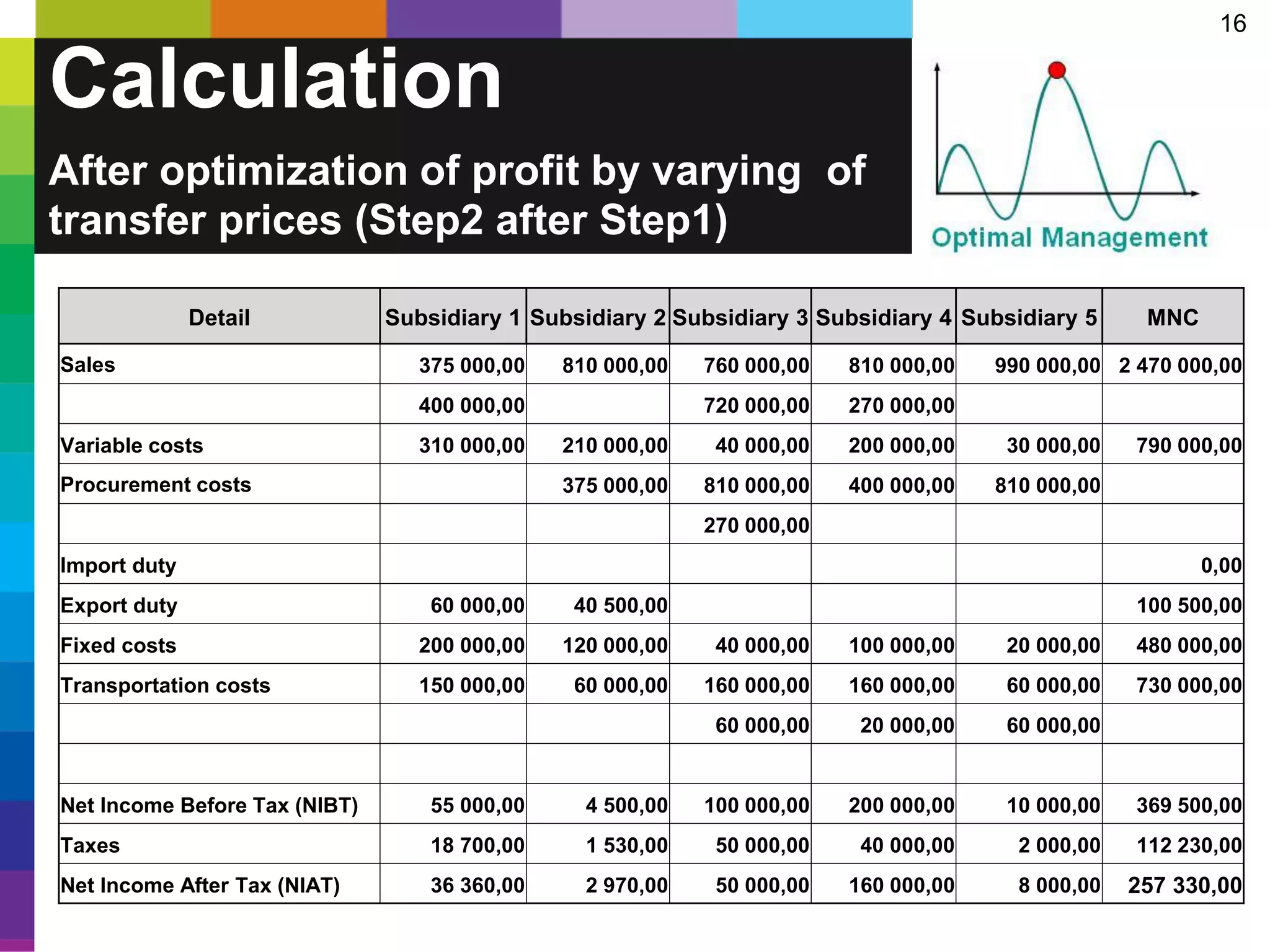

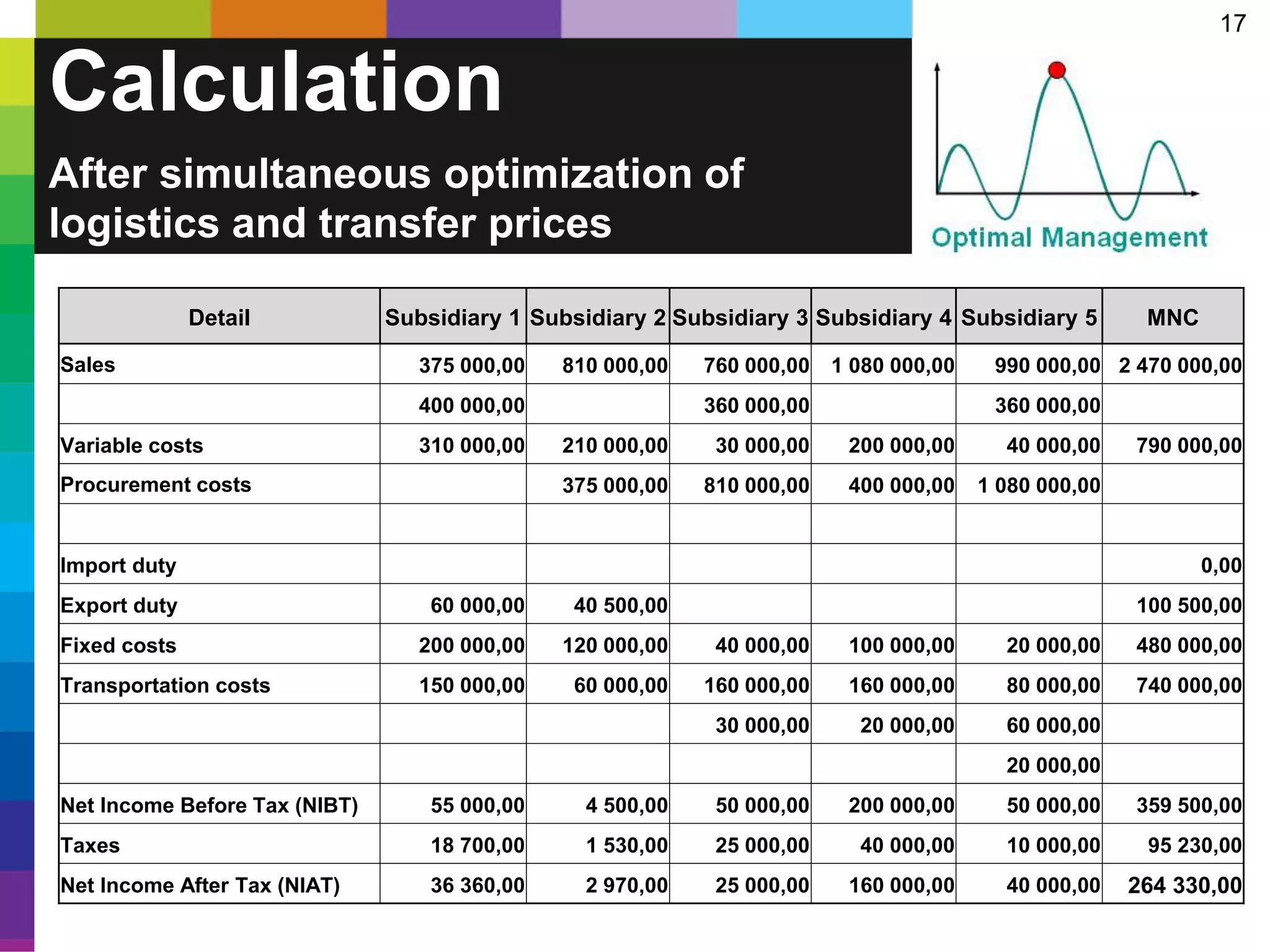

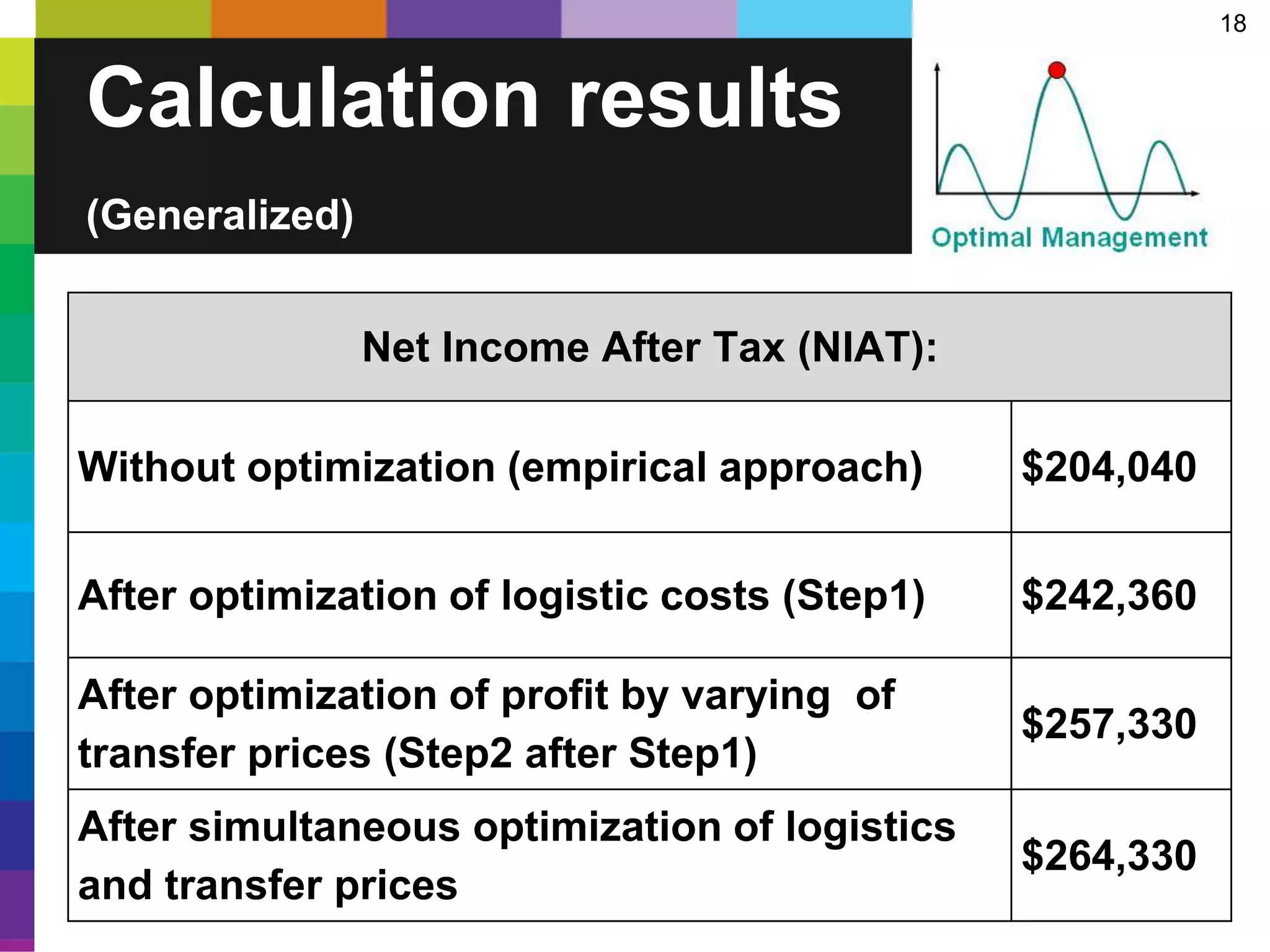

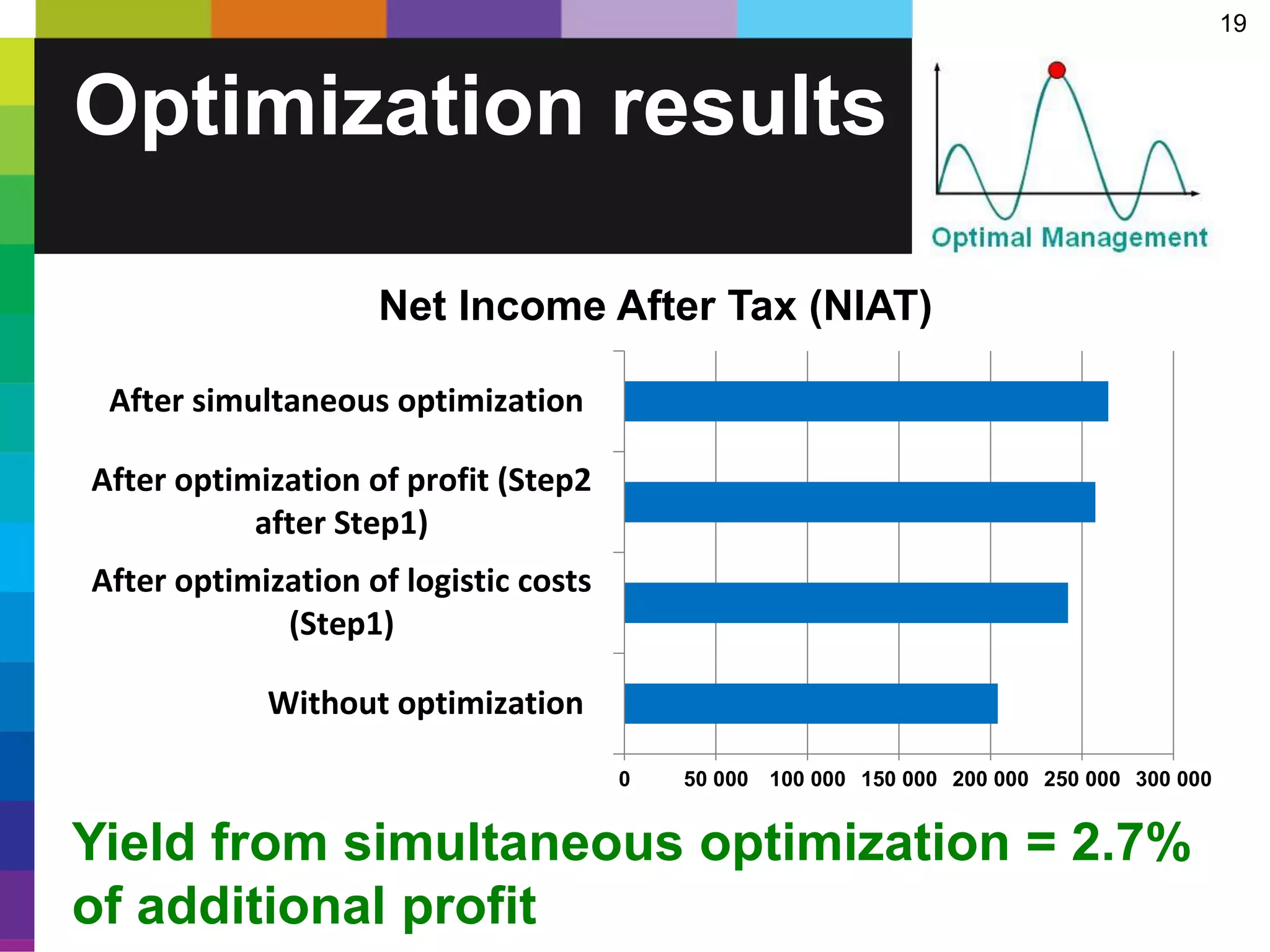

The document discusses a demonstration calculation for optimizing a simplified supply chain in a multinational enterprise by comparing two-step and one-step optimization processes. It details the structure, data, and costs associated with subsidiaries in different countries, as well as various market demands and transfer pricing strategies. The results indicate that simultaneous optimization yields a higher net income after tax compared to the empirical approach, with specific recommendations for enhancing the optimization process.