Deferred Tax.pptx

•Download as PPTX, PDF•

0 likes•5 views

Deferred tax arises from temporary differences between accounting profit and taxable profit. Temporary differences occur when income or expenses are recognized in different periods for accounting and tax purposes. Deferred tax assets arise when accounting profit is less than taxable profit, and deferred tax liabilities arise when accounting profit is greater than taxable profit. The document provides an example to illustrate deferred tax calculations over 6 years for an office equipment asset with different depreciation methods between accounting (straight line) and tax (reducing balance). It shows the annual temporary differences, deferred tax impact, and accounting entries for deferred tax and income tax.

Report

Share

Report

Share

Recommended

69 Prepared by Miranda Dyason Workshop 5 Ac.docx

/ 69

Prepared by Miranda Dyason

Workshop 5:

Accounting for income tax

/ 69

Calculate taxable profit, and account for current taxation expense;

Explain that some transactions have both current and future tax consequences;

Account for movements in deferred taxation accounts, and changes in tax rates; and

A

B

C

D

Learning Outcomes

1

E Specify the disclosures required by AASB 112.

Explain differences between accounting treatments and taxation treatments for a

range of transactions;

/ 69

Accounting profit v Taxable profit

2

ACCOUNTING TAX

Basis of

accounting

Accruals basis

Principally cash basis (some

exceptions – eg. sales)

Equations Revenue – Expenses

= Accounting profit

Taxable income (TI) – tax

deductions (TD) = Taxable

profit

AASBs and the

Corporations Act are key

sources that determine

the appropriate

accounting treatment of

transactions

The Income Tax Assessment Act

determines the tax treatment of

transactions

/ 69

▸ Permanent differences:

• Arise when amounts recognised as part of accounting profit are not

recognised as part of taxable profit (or vice versa).

▸ Temporary differences:

• Arise when the period in which revenues and expenses are

recognised for accounting purposes is different from the period in

which such revenues and expenses are treated as taxable income

and allowable deductions for tax purposes.

Permanent & temporary differences

3

/ 69

Review questions:

4

Loftus et al (Chapter 12):

• Comprehension question 1:

What is the main principle of tax-effect accounting as

outlined in AASB 112?

/ 69

▸ The tax consequences of transactions that occur for accounting purposes

during a period should be recognised as income or expense during the

current period, regardless of when the tax effects will occur.

▸ This requires identifying the current and future tax consequences of

items recognised in the statement of financial position.

▸ To determine current tax consequences of transactions, we need to

determine the entity’s taxable profit for the year, and associated income

tax payable.

▸ To determine future tax consequences of transactions, we need to look

at the differences between an entity’s Statement of Financial Position

(prepared in accordance with the accounting standards) and its tax-

based Balance Sheet prepared in accordance with income tax

legislation.

The requirements of AASB 112

5

/ 69

Review Question –

Current and future tax consequences

6

Loftus et al (Chapter 12):

• Application and analysis exercise 12.6.

/ 69

Company A: DR CR

Interest revenue

(passive)

100

Cash

101

Share capital

1

Example:

Consider the following draft trial balances...

7

Company B: DR CR

Interest revenue

(passive)

100

Cash

1

Interest receivable

100

Share capital

1

Company C: DR CR

In.

Recommended

69 Prepared by Miranda Dyason Workshop 5 Ac.docx

/ 69

Prepared by Miranda Dyason

Workshop 5:

Accounting for income tax

/ 69

Calculate taxable profit, and account for current taxation expense;

Explain that some transactions have both current and future tax consequences;

Account for movements in deferred taxation accounts, and changes in tax rates; and

A

B

C

D

Learning Outcomes

1

E Specify the disclosures required by AASB 112.

Explain differences between accounting treatments and taxation treatments for a

range of transactions;

/ 69

Accounting profit v Taxable profit

2

ACCOUNTING TAX

Basis of

accounting

Accruals basis

Principally cash basis (some

exceptions – eg. sales)

Equations Revenue – Expenses

= Accounting profit

Taxable income (TI) – tax

deductions (TD) = Taxable

profit

AASBs and the

Corporations Act are key

sources that determine

the appropriate

accounting treatment of

transactions

The Income Tax Assessment Act

determines the tax treatment of

transactions

/ 69

▸ Permanent differences:

• Arise when amounts recognised as part of accounting profit are not

recognised as part of taxable profit (or vice versa).

▸ Temporary differences:

• Arise when the period in which revenues and expenses are

recognised for accounting purposes is different from the period in

which such revenues and expenses are treated as taxable income

and allowable deductions for tax purposes.

Permanent & temporary differences

3

/ 69

Review questions:

4

Loftus et al (Chapter 12):

• Comprehension question 1:

What is the main principle of tax-effect accounting as

outlined in AASB 112?

/ 69

▸ The tax consequences of transactions that occur for accounting purposes

during a period should be recognised as income or expense during the

current period, regardless of when the tax effects will occur.

▸ This requires identifying the current and future tax consequences of

items recognised in the statement of financial position.

▸ To determine current tax consequences of transactions, we need to

determine the entity’s taxable profit for the year, and associated income

tax payable.

▸ To determine future tax consequences of transactions, we need to look

at the differences between an entity’s Statement of Financial Position

(prepared in accordance with the accounting standards) and its tax-

based Balance Sheet prepared in accordance with income tax

legislation.

The requirements of AASB 112

5

/ 69

Review Question –

Current and future tax consequences

6

Loftus et al (Chapter 12):

• Application and analysis exercise 12.6.

/ 69

Company A: DR CR

Interest revenue

(passive)

100

Cash

101

Share capital

1

Example:

Consider the following draft trial balances...

7

Company B: DR CR

Interest revenue

(passive)

100

Cash

1

Interest receivable

100

Share capital

1

Company C: DR CR

In.

DEFERRED TAX

Deferred Tax,

By: Mahima Pahwa (IBS Gurgaon)

Differences between Accounting Income and Taxable Income

TYPES OF DEFERRED TAX

DEFERRED TAX LIABILITY

FINANCIAL STATEMENTS PRESENTATION

FINANCIAL STATEMENTS

The Chapter four Financial Statements of my book named "The System of Accounting" Volume II is uploaded with a view to have reward as appreciation with comments and likes enables writer to think more and work.

GROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...

GROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...IFG Network marcus evans

Presentation by Tina Davis Milligan, CPA, Managing Director, Family Office Services, CTC | myCFO - Speaker at the IFG Wealth Management Forum Oct 2015 at the Trump Doral in FLWassim Zhani Federal Taxation Chapter 9 Capital Recovery Depreciation, Amorti...

Wassim Zhani Federal Taxation Chapter 9 Capital Recovery Depreciation, Amortization and Depletion.pdf

Tax Cuts and Jobs Act: Impact on Your Business

Christopher G. Sivak, CPA

Event: Tax Changes, Family Succession Planning & Your Business (August 20, 2018)

Premium MEAN Stack Development Solutions for Modern Businesses

Stay ahead of the curve with our premium MEAN Stack Development Solutions. Our expert developers utilize MongoDB, Express.js, AngularJS, and Node.js to create modern and responsive web applications. Trust us for cutting-edge solutions that drive your business growth and success.

Know more: https://www.synapseindia.com/technology/mean-stack-development-company.html

More Related Content

Similar to Deferred Tax.pptx

DEFERRED TAX

Deferred Tax,

By: Mahima Pahwa (IBS Gurgaon)

Differences between Accounting Income and Taxable Income

TYPES OF DEFERRED TAX

DEFERRED TAX LIABILITY

FINANCIAL STATEMENTS PRESENTATION

FINANCIAL STATEMENTS

The Chapter four Financial Statements of my book named "The System of Accounting" Volume II is uploaded with a view to have reward as appreciation with comments and likes enables writer to think more and work.

GROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...

GROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...IFG Network marcus evans

Presentation by Tina Davis Milligan, CPA, Managing Director, Family Office Services, CTC | myCFO - Speaker at the IFG Wealth Management Forum Oct 2015 at the Trump Doral in FLWassim Zhani Federal Taxation Chapter 9 Capital Recovery Depreciation, Amorti...

Wassim Zhani Federal Taxation Chapter 9 Capital Recovery Depreciation, Amortization and Depletion.pdf

Tax Cuts and Jobs Act: Impact on Your Business

Christopher G. Sivak, CPA

Event: Tax Changes, Family Succession Planning & Your Business (August 20, 2018)

Similar to Deferred Tax.pptx (20)

GROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...

GROWING AND PRESERVING ASSETS THROUGH TAX AND ESTATE PLANNING - Tina Davis, C...

Wassim Zhani Federal Taxation Chapter 9 Capital Recovery Depreciation, Amorti...

Wassim Zhani Federal Taxation Chapter 9 Capital Recovery Depreciation, Amorti...

Fm11 ch 03 financial statements, cash flow, and taxes

Fm11 ch 03 financial statements, cash flow, and taxes

Recently uploaded

Premium MEAN Stack Development Solutions for Modern Businesses

Stay ahead of the curve with our premium MEAN Stack Development Solutions. Our expert developers utilize MongoDB, Express.js, AngularJS, and Node.js to create modern and responsive web applications. Trust us for cutting-edge solutions that drive your business growth and success.

Know more: https://www.synapseindia.com/technology/mean-stack-development-company.html

Maksym Vyshnivetskyi: PMO Quality Management (UA)

Maksym Vyshnivetskyi: PMO Quality Management (UA)

Lemberg PMO School 2024

Website – https://lembs.com/pmoschool

Youtube – https://www.youtube.com/startuplviv

FB – https://www.facebook.com/pmdayconference

3.0 Project 2_ Developing My Brand Identity Kit.pptx

A personal brand exploration presentation summarizes an individual's unique qualities and goals, covering strengths, values, passions, and target audience. It helps individuals understand what makes them stand out, their desired image, and how they aim to achieve it.

Authentically Social by Corey Perlman - EO Puerto Rico

Authentically Social by Corey Perlman - EO Puerto RicoCorey Perlman, Social Media Speaker and Consultant

Social media for business LA HUG - Video Testimonials with Chynna Morgan - June 2024

Have you ever heard that user-generated content or video testimonials can take your brand to the next level? We will explore how you can effectively use video testimonials to leverage and boost your sales, content strategy, and increase your CRM data.🤯

We will dig deeper into:

1. How to capture video testimonials that convert from your audience 🎥

2. How to leverage your testimonials to boost your sales 💲

3. How you can capture more CRM data to understand your audience better through video testimonials. 📊

Discover the innovative and creative projects that highlight my journey throu...

Discover the innovative and creative projects that highlight my journey through Full Sail University. Below, you’ll find a collection of my work showcasing my skills and expertise in digital marketing, event planning, and media production.

Meas_Dylan_DMBS_PB1_2024-05XX_Revised.pdf

Personal Brand Statement:

As an Army veteran dedicated to lifelong learning, I bring a disciplined, strategic mindset to my pursuits. I am constantly expanding my knowledge to innovate and lead effectively. My journey is driven by a commitment to excellence, and to make a meaningful impact in the world.

ModelingMarketingStrategiesMKS.CollumbiaUniversitypdf

Implicitly or explicitly all competing businesses employ a strategy to select a mix

of marketing resources. Formulating such competitive strategies fundamentally

involves recognizing relationships between elements of the marketing mix (e.g.,

price and product quality), as well as assessing competitive and market conditions

(i.e., industry structure in the language of economics).

An introduction to the cryptocurrency investment platform Binance Savings.

Learn how to use Binance Savings to expand your bitcoin holdings. Discover how to maximize your earnings on one of the most reliable cryptocurrency exchange platforms, as well as how to earn interest on your cryptocurrency holdings and the various savings choices available.

-- June 2024 is National Volunteer Month --

Check out our June display of books on voluntary organisations

Kseniya Leshchenko: Shared development support service model as the way to ma...

Kseniya Leshchenko: Shared development support service model as the way to make small projects with small budgets profitable for the company (UA)

Kyiv PMDay 2024 Summer

Website – www.pmday.org

Youtube – https://www.youtube.com/startuplviv

FB – https://www.facebook.com/pmdayconference

Buy Verified PayPal Account | Buy Google 5 Star Reviews

Buy Verified PayPal Account

Looking to buy verified PayPal accounts? Discover 7 expert tips for safely purchasing a verified PayPal account in 2024. Ensure security and reliability for your transactions.

PayPal Services Features-

🟢 Email Access

🟢 Bank Added

🟢 Card Verified

🟢 Full SSN Provided

🟢 Phone Number Access

🟢 Driving License Copy

🟢 Fasted Delivery

Client Satisfaction is Our First priority. Our services is very appropriate to buy. We assume that the first-rate way to purchase our offerings is to order on the website. If you have any worry in our cooperation usually You can order us on Skype or Telegram.

24/7 Hours Reply/Please Contact

usawebmarketEmail: support@usawebmarket.com

Skype: usawebmarket

Telegram: @usawebmarket

WhatsApp: +1(218) 203-5951

USA WEB MARKET is the Best Verified PayPal, Payoneer, Cash App, Skrill, Neteller, Stripe Account and SEO, SMM Service provider.100%Satisfection granted.100% replacement Granted.

Helen Lubchak: Тренди в управлінні проєктами та miltech (UA)

Helen Lubchak: Тренди в управлінні проєктами та miltech (UA)

Kyiv PMDay 2024 Summer

Website – www.pmday.org

Youtube – https://www.youtube.com/startuplviv

FB – https://www.facebook.com/pmdayconference

Recently uploaded (20)

Premium MEAN Stack Development Solutions for Modern Businesses

Premium MEAN Stack Development Solutions for Modern Businesses

Set off and carry forward of losses and assessment of individuals.pptx

Set off and carry forward of losses and assessment of individuals.pptx

3.0 Project 2_ Developing My Brand Identity Kit.pptx

3.0 Project 2_ Developing My Brand Identity Kit.pptx

Authentically Social by Corey Perlman - EO Puerto Rico

Authentically Social by Corey Perlman - EO Puerto Rico

LA HUG - Video Testimonials with Chynna Morgan - June 2024

LA HUG - Video Testimonials with Chynna Morgan - June 2024

Discover the innovative and creative projects that highlight my journey throu...

Discover the innovative and creative projects that highlight my journey throu...

ModelingMarketingStrategiesMKS.CollumbiaUniversitypdf

ModelingMarketingStrategiesMKS.CollumbiaUniversitypdf

An introduction to the cryptocurrency investment platform Binance Savings.

An introduction to the cryptocurrency investment platform Binance Savings.

Kseniya Leshchenko: Shared development support service model as the way to ma...

Kseniya Leshchenko: Shared development support service model as the way to ma...

Training my puppy and implementation in this story

Training my puppy and implementation in this story

Buy Verified PayPal Account | Buy Google 5 Star Reviews

Buy Verified PayPal Account | Buy Google 5 Star Reviews

Auditing study material for b.com final year students

Auditing study material for b.com final year students

Helen Lubchak: Тренди в управлінні проєктами та miltech (UA)

Helen Lubchak: Тренди в управлінні проєктами та miltech (UA)

Deferred Tax.pptx

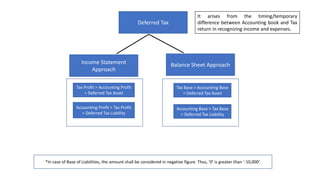

- 1. Deferred Tax Income Statement Approach Balance Sheet Approach It arises from the timing/temporary difference between Accounting book and Tax return in recognizing income and expenses. Tax Profit > Accounting Profit = Deferred Tax Asset Accounting Profit > Tax Profit = Deferred Tax Liability Tax Base > Accounting Base = Deferred Tax Asset Accounting Base > Tax Base = Deferred Tax Liability *In case of Base of Liabilities, the amount shall be considered in negative figure. Thus, ‘0’ is greater than ‘-10,000’.

- 2. Example: Depreciation An Office Equipment has been Purchased at cost of 100,000 and depreciated in straight line basis. Suppose, For Tax purpose, reducing Balance method depreciation of 10% is used. Consider Profit Before tax and Depreciation is 50,000. Year Depreciation (Accounting) Depreciation (Tax) Difference Deferred Tax Entry Income Tax Entry 1 20,000 10,000 10,000 (Tax profit > Accounting Profit) Deferred Tax Asset Dr----- 3,000 Deferred Tax Income Cr ---------3,000 Income Tax Expense – Dr 12,000 Provision for Tax----------Cr 12,000 2 20,000 9,000 11,000 (Tax profit > Accounting Profit) Deferred Tax Asset Dr----- 3,300 Deferred Tax Income Cr ---------3,300 Income Tax Expense – Dr 12,300 Provision for Tax----------Cr 12,300 3 20,000 8,100 11,900 (Tax profit > Accounting Profit) Deferred Tax Asset Dr----- 3,000 Deferred Tax Income Cr ---------3,000 Income Tax Expense – Dr 12,570 Provision for Tax----------Cr 12,570 4 20,000 7,290 12,710 (Tax profit > Accounting Profit) Deferred Tax Asset Dr----- 3,813 Deferred Tax Income Cr ---------3,813 Income Tax Expense – Dr 12,813 Provision for Tax----------Cr 12,813 5 20,000 6,561 13,439 (Tax profit > Accounting Profit) Deferred Tax Asset Dr----- 4,031 Deferred Tax Income Cr ---------4,031 Income Tax Expense – Dr 13,031 Provision for Tax----------Cr 13,031 6 0 5,905 5,905 (Accounting Profit > Tax Profit) Deferred Tax Expense – Dr----1,771 Deferred Tax Asset - Cr----------1,771 Income Tax Expense – Dr 13,228 Provision for Tax----------Cr 13,228

- 3. Yea r Accounti ng Base Tax Base Temporary Difference Deferred Tax Deferred Tax Entry Income Tax Entry 1 80,000 90,000 10,000 (Tax base > Accounting base) 3000 (Asset) Deferred Tax Asset Dr----- 3,000 Deferred Tax Income Cr ---------3,000 Income Tax Expense – Dr 12,000 Provision for Tax----------Cr 12,000 2 60,000 81,000 21,000 (Tax base > Accounting base) 6,300 (Asset) Deferred Tax Asset Dr----- 3,300 Deferred Tax Income Cr ---------3,300 Income Tax Expense – Dr 12,300 Provision for Tax----------Cr 12,300 3 40,000 72,900 32,900 (Tax base > Accounting base) 9,870 (Asset) Deferred Tax Asset Dr----- 3,000 Deferred Tax Income Cr ---------3,000 Income Tax Expense – Dr 12,570 Provision for Tax----------Cr 12,570 4 20,000 65,610 45,610 (Tax base > Accounting base) 13,683 (Asset) Deferred Tax Asset Dr----- 3,813 Deferred Tax Income Cr ---------3,813 Income Tax Expense – Dr 12,813 Provision for Tax----------Cr 12,813 5 0 59,049 59,049 (Tax base > Accounting base) 17,714 (Asset) Deferred Tax Asset Dr----- 4,031 Deferred Tax Income Cr ---------4,031 Income Tax Expense – Dr 13,031 Provision for Tax----------Cr 13,031 6 0 53,144 53,144 (Tax base > Accounting base) 15,943 (Asset) Deferred Tax Expense – Dr----1,771 Deferred Tax Asset - Cr----------1,771 Income Tax Expense – Dr 13,228 Provision for Tax----------Cr 13,228