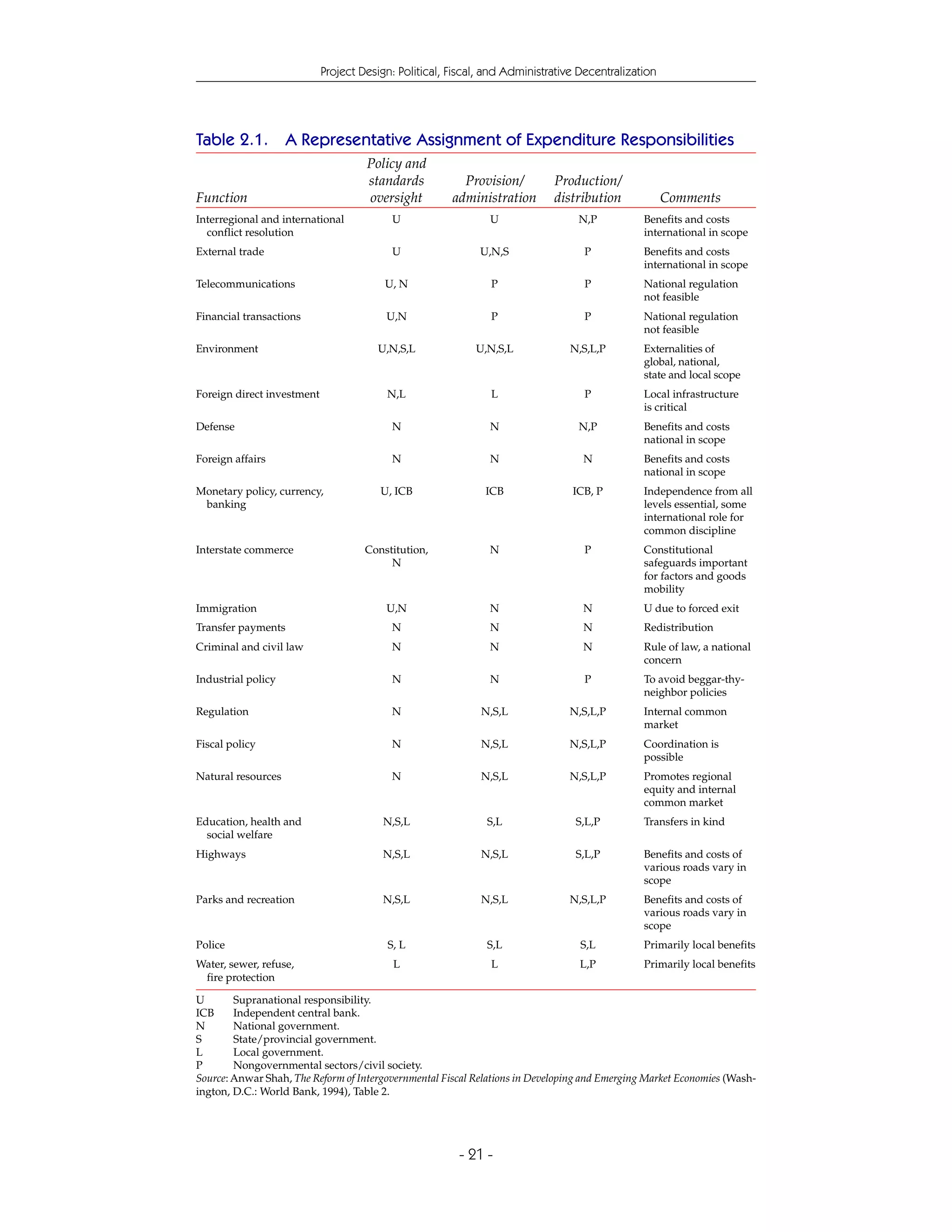

This document provides briefing notes on decentralization from the World Bank. It is divided into four chapters that cover: 1) definitions and rationales for decentralization, 2) issues in designing political, fiscal, and administrative decentralization systems, 3) impacts of decentralization on specific sectors and services, and 4) potential cross-cutting impacts of decentralization related to equity, macroeconomics, growth, and accountability. The notes are intended to highlight the broad range of issues that must be considered regarding decentralization and summarize key topics for practitioners.

![Project Design: Political, Fiscal, and Administrative Decentralization

Local Technical and Managerial Capacity

The recent international trend toward decentralization has provoked a lively de-

bate about the capacity of local governments and communities to plan, finance,

and manage their new responsibilities. Assessing, improving, and accommodating

varying degrees of local capacity have become more and more important as decen-

tralization policies transfer larger responsibilities, as well as budgets, from national

governments to local governments and communities.

While a common rationale for decentralization is that local governments’ prox-

imity to their constituents enables them to better manage resources and match their

constituents’ preferences, it is not clear that local governments and communities have

the capacity to translate this information advantage into an efficiency advantage.

Small, inexperienced, local governments may not have the technical capacity to imple-

ment and maintain projects or the training to effectively manage larger budgets.

This section discusses two main issues in the local capacity debate: what local

capacity is and what to do about varying degrees of local capacity once it has

been identified. “Local government” is taken to mean the level of government at

which some degree of everyday face-to-face interaction between citizens and

government is possible.

Assessing Local Capacity

Decentralization planners have used the general guideline that central agencies

should focus on creating and sustaining the enabling environment and strategic

priorities, while local organizations should concentrate on tailoring the specific

mechanisms of service delivery and public expenditure packages to fit local needs

and circumstances. In reality, however, the varying degrees of local capacity—both

in local government and in civil society and the private sector—obviously affect

decisions about which levels of government can best perform which tasks. In most

cases decentralization of basic services does not mean the wholesale transfer to

local agencies of all tasks associated with those services. An assessment of local

capacity is an integral part of designing decentralization.

What Is Capacity?

Measuring local capacity can be difficult, and the debate over quantifying it has

often been motivated by political concerns as well as technical considerations about

the local government’s ability to provide services. Central governments have used

the “lack of capacity” excuse for refusing to transfer their authority, financial re-

sources, and accompanying privileges to local units. For example, Fiszbein found

in Colombia that “what was being characterized [by national agencies] as poor

planning in municipios was in fact a genuine disagreement between local and na-

tional priorities.”28 The municipios were actually demonstrating considerable local

28. Ariel Fiszbein, “Emergence of Local Capacity: Lessons from Colombia,” World De-

velopment 25:7(1997):1029–43.

- 45 -](https://image.slidesharecdn.com/decentralizationbriefingnotes-wb-130131214739-phpapp02/75/Decentralization-briefing-notes-wb-55-2048.jpg)