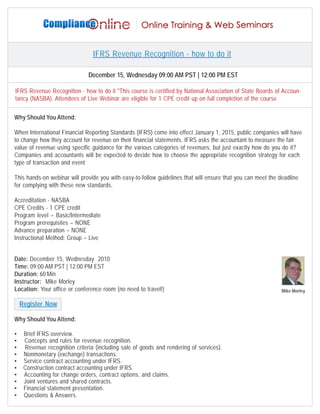

The document details a webinar on IFRS revenue recognition scheduled for December 15, 2010, aimed at public companies needing to comply with new accounting standards effective January 1, 2015. The session will cover guidelines for recognizing various types of revenue, including specific accounting for service and construction contracts, and is geared toward financial professionals. Attendees can earn 1 CPE credit upon completion, and registration information is also provided.