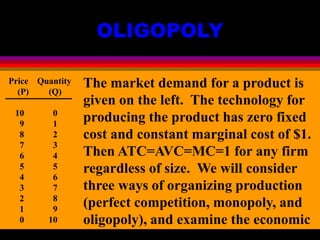

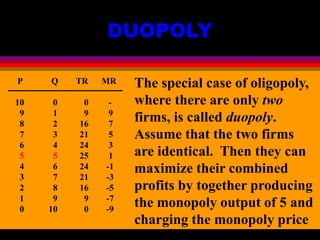

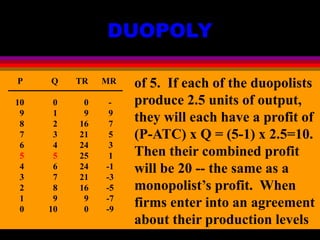

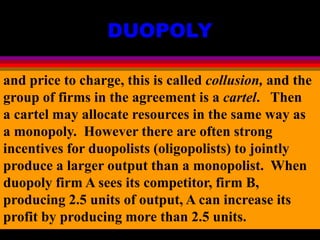

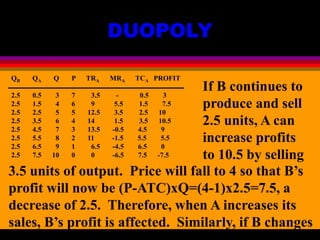

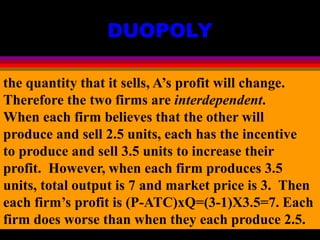

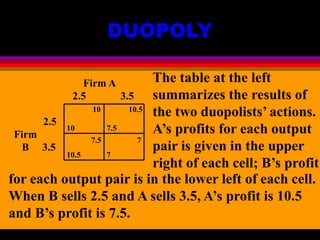

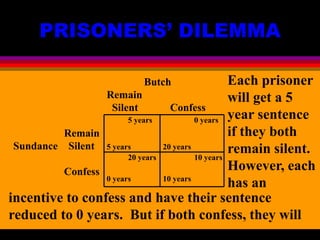

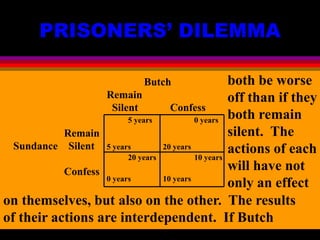

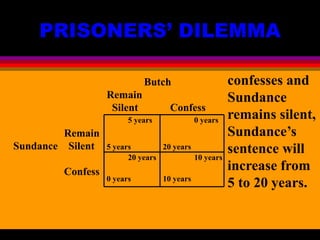

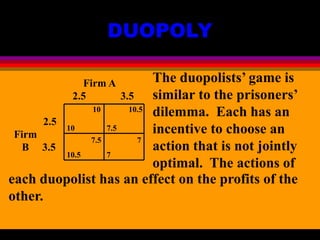

Oligopoly is a market structure with few sellers influencing market price. Firms in an oligopoly are interdependent since the actions of one firm affect others' profits. This interdependence can be modeled as a prisoner's dilemma game where each firm is incentivized to increase output for higher profits, but overall profits decrease if all firms do so. Cartels like OPEC aim to coordinate production quotas to influence price but members often cheat for greater individual profits, requiring enforcement to maintain cooperation.