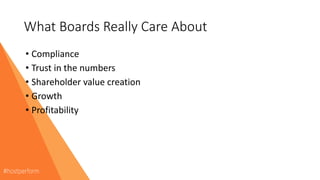

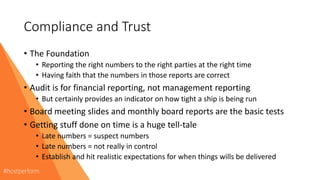

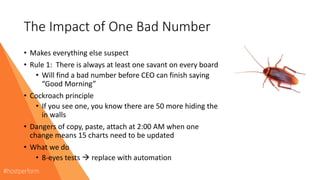

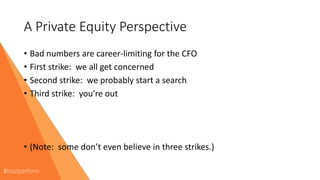

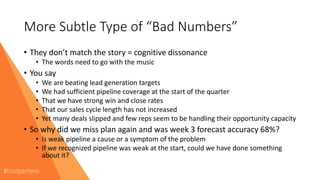

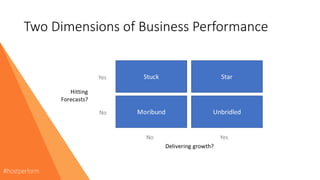

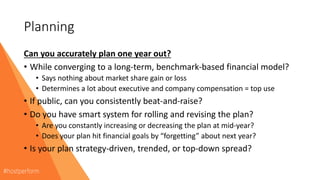

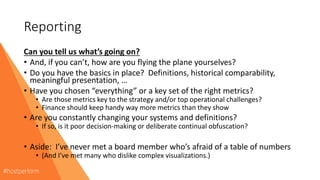

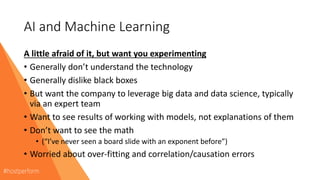

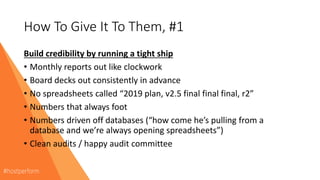

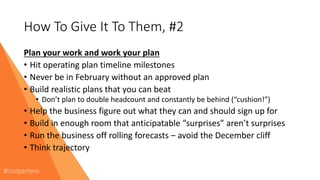

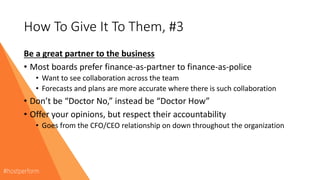

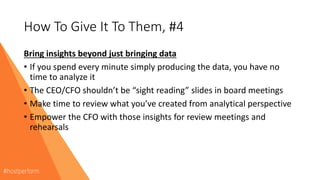

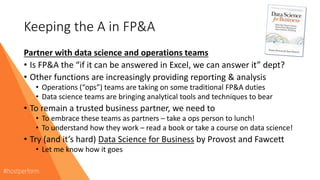

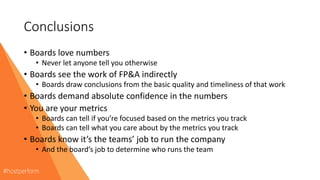

The document discusses how boards view enterprise performance management (EPM) from their perspective, emphasizing the importance of compliance, trust in accurate reporting, shareholder value creation, and maintaining realistic expectations. It highlights key board priorities such as timely reporting, growth, profitability, and a transparent narrative that aligns with the company's performance. Additionally, it outlines strategies for effectively communicating with boards, building credibility, and fostering collaboration across teams.