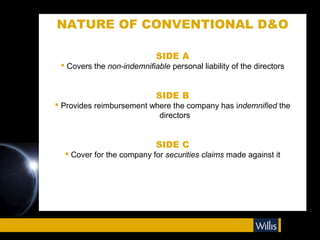

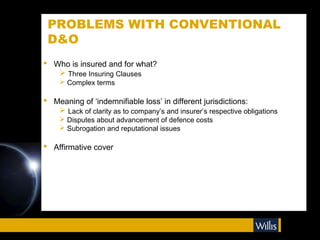

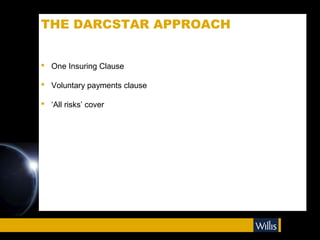

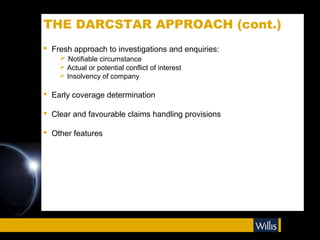

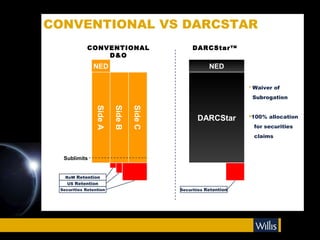

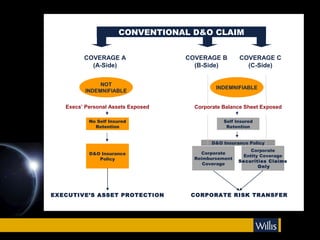

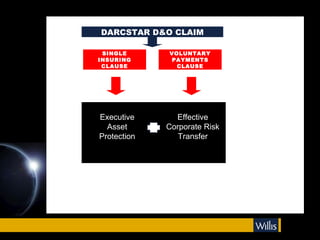

The document describes DARCSTAR, a new type of directors' and officers' (D&O) insurance. It has one insuring clause rather than the conventional three sides (A, B, C). This provides clearer coverage for who and what is insured. DARCSTAR also features a voluntary payments clause, "all risks" coverage, favorable claims handling, and covers investigations and insolvency situations. It aims to provide simpler coverage than conventional D&O policies which can be complex with unclear terms.